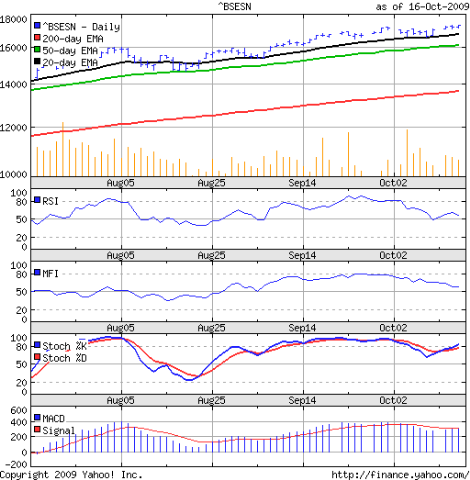

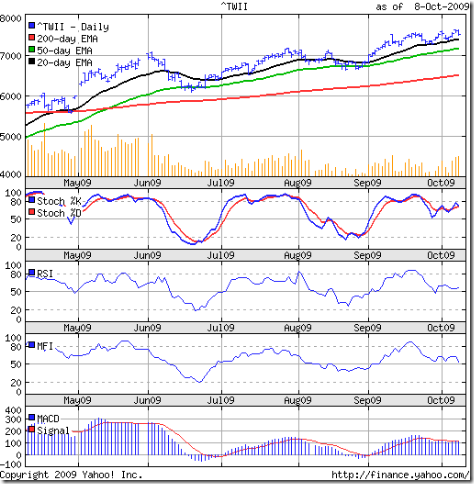

The BSE Sensex index chart pattern is undergoing a much-needed correction. In last week's analysis, I had made the following comment:-

'Looks like the bears have a slight edge, and another 5% fall could be on the cards. That would take the index to the crucial support level of 16000.'

Against expectations, the bulls failed to put up much of a fight. The index lost 915 points (almost 5.5%) for the week, and has so far lost 9% from the 52 week high of 17493 made on 'muhurat' trading on Oct 17 '09. The bears managed to get the upper hand, as the FII selling pressure overwhelmed the buying by domestic institutions.

Likely supports at the 50 day EMA and the 16000 level were broken easily. What are the possible next moves for the Sensex? Since it has been a year since the bear market low of 7700 in Oct '08, let us look at the one year bar chart pattern of the BSE Sensex index:-

Will the correction continue next week, or will there be a good bounce back? What level can the BSE Sensex bounce up to? How low can it fall? Those are tough questions to answer, but let us try and attempt to find out the different levels possible.

The 50 day EMA has flattened a bit but remains well above the rising 200 day EMA. So there is no immediate threat to the bull market, even though the Sensex has dipped below the 50 day EMA. The index had gone below the medium term average back in July '09, only to jump back up.

The top made in Jun '09 was at 15600. The 3% whipsaw lee-way from 16000 gives a level of 15520. The bulls may try to muster support between 15520 and 15600, if the bears continue their rampage. Below that, the 200 day EMA at 14300 can provide support. Beyond that, the gap area between 12300 and 13200 should stem any further fall.

Can the Sensex go down even further? Sure it can, but I wouldn't bet on it at this stage. As of now, the best case scenario looks like a bounce from the 15520-15600 zone. And the worst case looks like a support at the 'gap'.

Can the Sensex bounce up next week itself? That is a possibility, given the oversold nature of the technical indicators. The RSI has almost entered the oversold zone. The MACD is in negative territory and well below the signal line. The slow stochastic is deep in the oversold zone. The Aroon Up has had a bearish cross below the Aroon Down.

An oversold market can stay oversold for a while, but an upward bounce can happen anytime. How high can the Sensex bounce up? The lower trend line of the 'rising wedge' pattern (through which the Sensex broke downwards) is now near the 18000 level. The upward target from my earlier 'gap analysis' was at 17800. So on a bounce up, the maximum target can be the 17800-18000 level.

If the Sensex does get there, don't get in. That would be an excellent selling opportunity. In fact, any rise to the 17000 level can be used for selling. Remember that only an intermediate uptrend has been broken. So what we are witnessing now is possibly an intermediate downtrend, and not a resumption of the bear market.

The other possibility is that the BSE Sensex index continues in a sideways consolidation within a broad range of 13000 to 18000 (like it has done since the election results were declared in May '09) for a few more months. That will be a frustrating period for bulls and bears, but traders will be able to cash in.

Bottomline? The BSE Sensex chart pattern has joined world indices in a long-awaited correction. The strategy should be to 'sell on every rise'. Keep a buy list ready for better buying opportunities. Don't jump in to start buying now - just because a few stocks have dropped a lot.