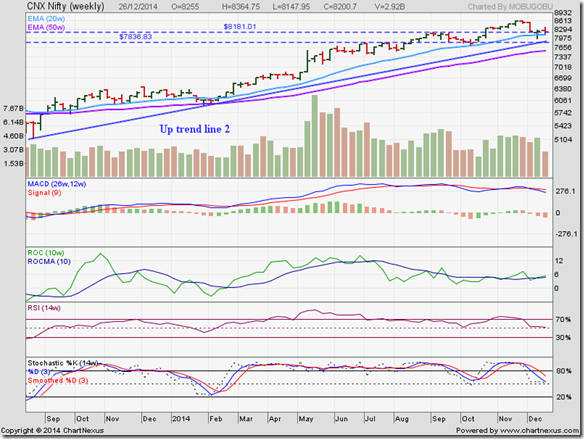

Nifty ended the previous year at 6304. It gained 1978.70 points to end the current year at 8282.70 – a fairly substantial inflation-beating return of 31.4% – despite a sharp correction during Dec ‘14.

An investor who regularly invested in an index fund or Nifty BeES (1 yr return: 30.94%) would have made similar returns. If your portfolio return was less than 30% during the year, you may reconsider/relearn your stock picking skills (or, take the help of a market expert).

What kind of returns can be expected in 2015? Expecting another 30% year on a higher base may be too optimistic. But with inflation and oil prices moving down, and a majority government - which is not averse to taking tough decisions - in place, a 15-20% gain is in the realm of possibilities.

That would mean a Nifty level in the range between 9500-9900 on Dec 31, 2015.

The zone between 7840 and 8180 (corresponding to Nifty’s Jul ‘14 and Sep ‘14 tops) – marked by blue dotted lines – provided good support to the index during its recent correction.

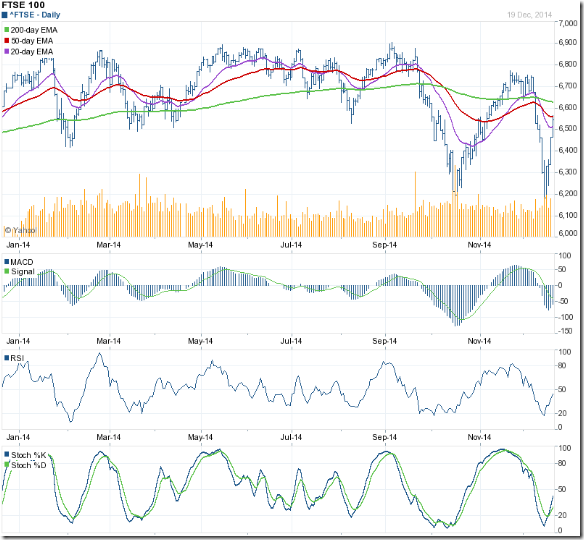

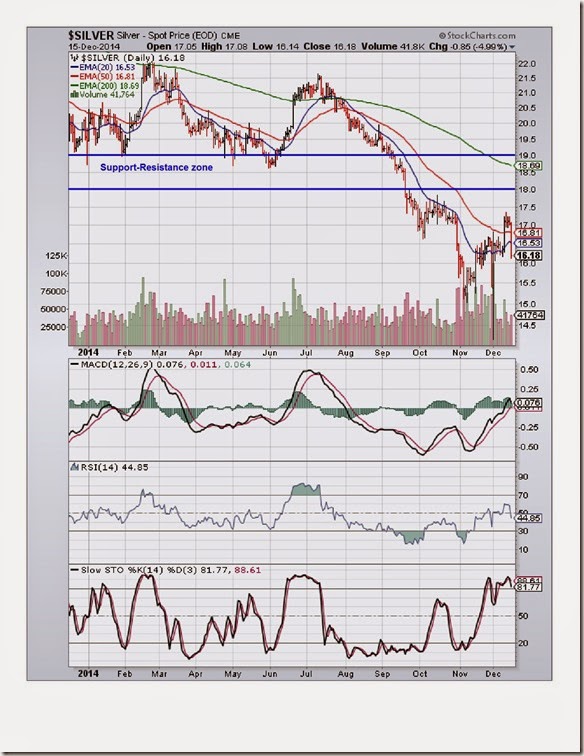

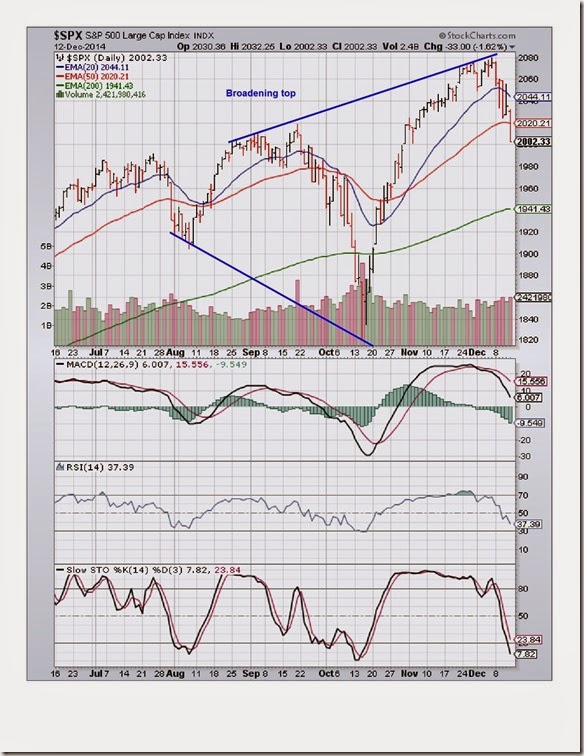

A rising US Dollar index, and indications of slow growth in China and Europe caused FIIs to book profits – their net selling in equities touching Rs 4400 Crores during Dec ‘14. DII net buying of close to Rs 6000 Crores during the month failed to propel Nifty to a new high.

Daily technical indicators are turning bullish. MACD has moved up to touch its sliding signal line in negative territory. ROC is rising sharply in positive territory above its 10 day MA, which has formed a bullish ‘rounding bottom’ pattern. RSI is moving up towards its 50% level. Slow stochastic has crossed above its 50% level.

Volumes have been on the lower side during this week, but it is gradually rising. Many FIIs are on their year-end break, which may be the reason for low volumes.

Trading activity should pick up from next week – allowing Nifty to resume its upward march. The correction during the month has not deterred the 200 day EMA from continuing its gradual rise. The long-term bull market is alive and well.

(Wishing all blog visitors, blog followers, blog subscribers, newsletter subscribers and twitter followers a peaceful and prosperous 2015.)