There are two kinds of investors in the stock market. Those who know, and those who don’t. Those who know what is going on (a minority), use their knowledge to ‘take’ money from those who don’t have a clue about how and when to buy or sell stocks (a majority).

There is no harm in not knowing something – as long as you acknowledge the fact, and don’t put your money in it. The majority of small investors lose money in the stock market because they fail on both counts. They are in denial about their market knowledge (rather, the lack of it), but invest their money any way.

In this month’s guest post, targetted at the majority of investors, Nishit suggests a simple and easy way to make money in the stock market. In fact, it is a ‘no-brainer’. The only drawbacks(?) of this simple strategy are that it is boring, requires discipline and works only over the long-term.

If you are looking for excitement or adrenaline rush while ‘investing’ – visit a casino or a race course. You may enjoy yourself while you lose money!

--------------------------------------------------------------------------------------------------------------------------------------------

The stock market is a complex place and it keeps rising and falling without any apparent logic. Those who are acquainted with the market can make a killing by picking the right stock at the right price and at the right time. A vast majority of the population does not have this skill set. So, what can they do to participate in the gains?

There are various asset classes like fixed deposits, real estate, gold and equities. Equities far outclass the other asset classes as they give significantly high returns over a long period of time. Real estate is illiquid and one needs to have vast sums of money to invest in real estate. Gold also has long periods of time where it moves nowhere and inflation eats away the returns.

For those who have no clue about equities, the first step is to identify 3-4 good Mutual Funds. There are several funds, like HDFC Top 200, which have given compounded returns of 20% for the past 20 years.

Next, they have to invest a fixed amount every month (SIP) - which could be as low as Rs 1000. Over a period of time, the bull phases and bear phases will be taken care of to give smooth annualised returns.

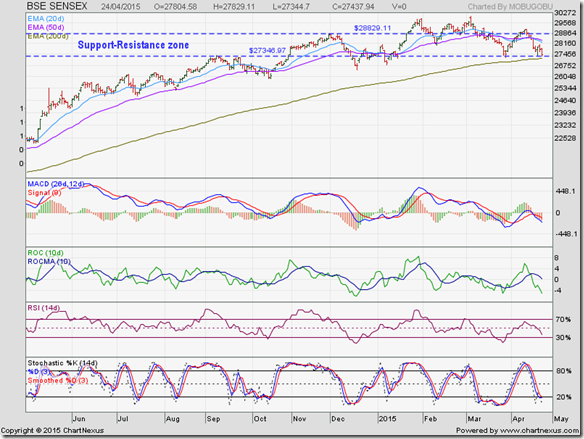

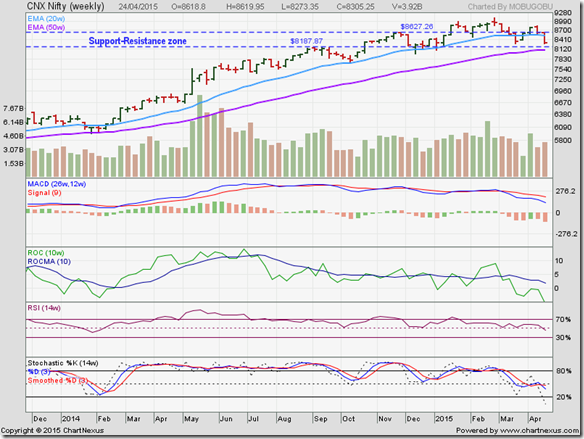

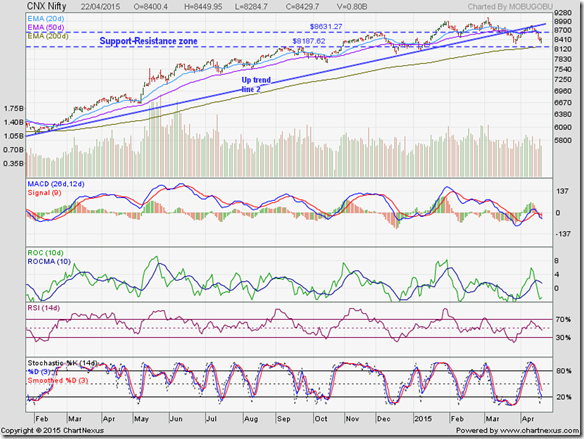

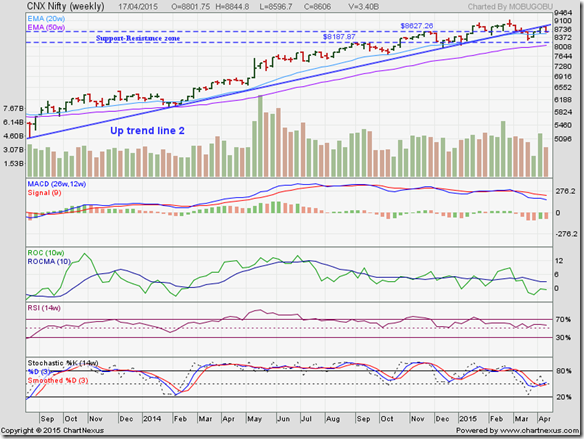

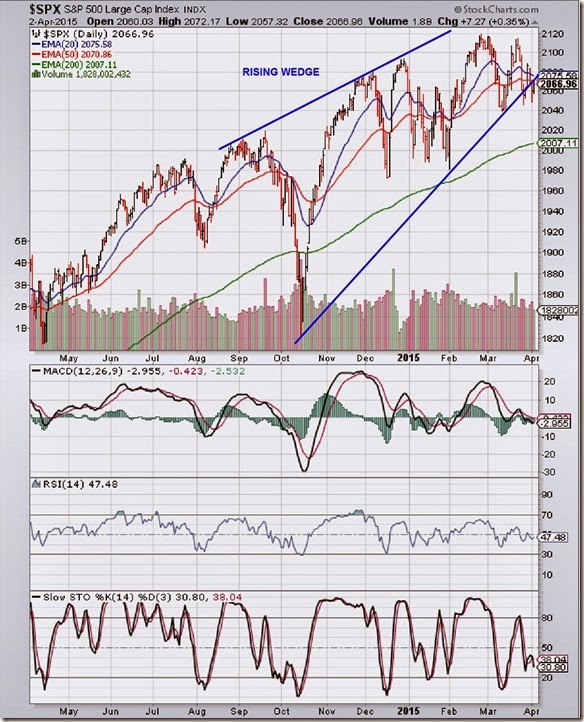

Of course, somewhat alert and savvy investors can tweak this model further by investing more amounts when markets have tanked and booking profits after significant run ups. Nowadays there are many free blogs (like mine and Subhankar’s), which can guide investors about the trend in the market. Also, there are general phenomena - like the market peaking in Feb-March and then correcting 20-30%. The current year is a classic example of this.

Someone may ask the question: How does one identify the right mutual fund? For this one can ask a savvy investor friend, a financial planner or check out the website www.valueresearchonline.com.

This website gives a list of 5 star rated funds in various categories. Based on this, one can shortlist the funds and do a periodic investment in these selected funds. A handful of funds should be more than adequate.

With the advent of the internet, it has become very easy even for those with limited financial knowledge to invest and earn money from the markets.

--------------------------------------------------------------------------------------------------------------------------------------------

(Nishit Vadhavkar is a Quality Manager working at an IT MNC. Deciphering economics, equity markets and piercing the jargon to make it understandable to all is his passion. "We work hard for our money, our money should work even harder for us" is his motto.

Nishit blogs at Money Manthan. You can reach him at nish.stockid@gmail.com)