S&P 500 Index Chart

The following comments were made in last week’s analysis of the daily bar chart pattern of S&P 500: “All three technical indicators are in bullish zones, but showing negative divergences by touching lower tops. A consolidation or corrective move is likely. Has the index formed a ‘double top’ reversal pattern? Technically, the answer is ‘no’.”

The index corrected down below its 20 day EMA but found good support from its rising 50 day EMA and the 1840 level before bouncing up. By not falling below its previous low of 1840, the possibility of a ‘double top’ reversal has been avoided.

For the past 4 weeks, the index has been consolidating within a rectangular band between 1840 and 1880. Rectangular consolidations tend to be continuation patterns, but can be reversal patterns also – hence are unreliable. In other words, the break out from the rectangle has to be awaited before initiating any buy/sell decision.

Daily technical indicators are turning bullish. MACD is below its signal line in positive territory, but has stopped falling. RSI has bounced up above its 50% level. Slow stochastic is moving up towards its 50% level. Note that during a period of consolidation, indicators often give conflicting signals.

The important thing to remember is that an upward break out above 1880 should be accompanied by a volume surge. A break below 1840 does not require strong volume support.

Stay invested with a stop-loss at 1840.

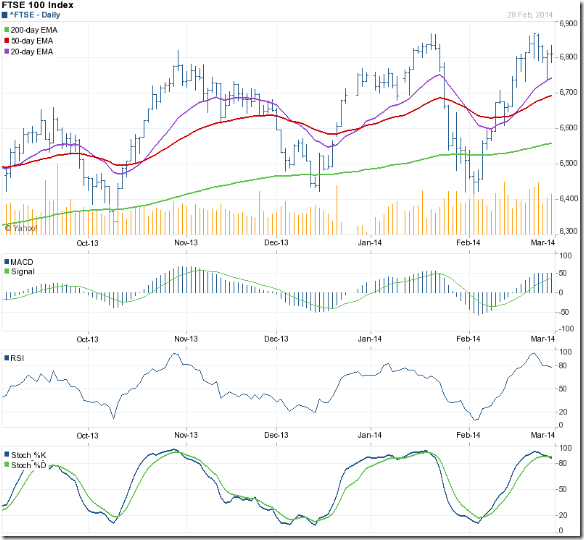

FTSE 100 Index Chart

The 6 months daily bar chart pattern of FTSE 100 managed to temporarily wriggle out of a strong bear grip by closing above its 200 day EMA and the 6600 level, but failed to overcome the resistance from its falling 20 day EMA. The bears will remain in control unless the index convincingly moves above its falling 50 day EMA.

The index is consolidating within a rectangular band between 6500 and 6630. Rectangles tend to be continuation patterns but are unreliable. That means a downward break below 6500 is likely. However, waiting for the eventual break out would be prudent. Stay invested with a stop-loss at 6500.

Technical indicators are in bearish zones, but turning bullish. MACD is about to cross above its falling signal line in negative territory. RSI is gradually moving up towards its 50% level. Slow stochastic has emerged from its oversold zone and rising towards the 50% level. At the time of writing this post, the index is trying to break out above 6630.

Bottomline? Daily bar chart patterns of S&P 500 and FTSE 100 are consolidating sideways within ‘rectangle’ patterns. The eventual break out from the rectangles can be in either direction. Stay invested with suitable stop-losses.