This is Kiran’s first-hand, ground-zero view of the state of the US economy. If you like what you read, or would like to ask him a question, please leave a comment using the link beneath this post.

-------------------------------------------------------------------------------------

Economics of the USA from Ground Zero

Lets do some detailed macro economics here, and then bring it home to how things are unfolding in the US.

The US Govt says that the increase in real GDP in the second quarter primarily reflected positive contributions from non-residential fixed investment, exports, personal consumption expenditures, private inventory investment, federal government spending, and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, also increased.

If you see the graph below it shows a slow-down. The US Govt says that the deceleration in real GDP in the 2nd quarter primarily reflected an acceleration in imports and a slow-down in private inventory investment. This is not good.

What makes the situation even more convincing is that a few days ago, the Q2 ’10 GDP was revised down to 1.6% (instead of the earlier estimate of 2.4%). So, the slowdown has already begun and we are just finding out. Inventory buildup was the real reason for the jump in growth, in addition to the stimulus to housing and autos, but that is fading away. This is not good at all!

The reality of what is happening can be seen in the following chart which I follow closely to track the future of the US economy. The newly reported Consumer Metrics Institute’s Daily Growth Index (CMI) annualized growth rate is 1.6%, down from a 2.4% rate published just 28 days earlier -- a 33% downward revision of the growth rate in four weeks. It overlays well on the GDP chart, portraying what is about to happen to the US GDP.

Views from Ground Zero

My view of the US economy from ground zero is that we are definitely slowing down, and the slowdown is more rapid than most people are ‘feeling’ and obviously more than what the government is telling us. The revision and the overlay chart above proves this point even more.

Of course, do not forget that the US Govt created an artificial demand for housing sales in Q1 and Q2 ‘10. If you were a first time home buyer you got a $8000 tax subsidy from the government, and if you were a 2nd time home buyer, you got $6500. Contracts needed to be done by Apr 30, 2010 and the purchase has to conclude by Sep 30, 2010. Now, the sales of new homes in the US fell to an all-time record low in July ‘10, as demand from consumers dried up after the tax breaks were withdrawn. So, we may see a positive GDP number in Q3 ’10, but we should be close to zero (0%) in Q4 ’10!

The worry that the global economies, and in particular people in China or India should have is the likely slow-down in US spending in Q1 & Q2 ’11. If the GDP is negative for 2 quarters in a row, then US Govt. calls that a recession, and if we get to a recession, then the global markets are going to get affected.

Employment Situation

All of this stems from a simple rule of economics. We have approximately 140 Million people employed today in the US. If there is more unemployment in this pool, then spending gets curtailed. If spending is curtailed, the discretionary spending (flavored coffee, ice-cream, gambling, cosmetics, nice clothing, cool electronics, jewelry, luxury items, vacation/resorts, upgrades to anything/everything, outsourcing home-chores etc) gets cut back, which then spirals into affecting the GDP and the global employment further.

On the other hand, the US is still considered to be the land of opportunity with the lowest cost of food and clothing. On top of it, the average hourly earnings of all employees on private nonfarm payrolls increased to $22.59 in July ’10. Over the past 12 months this has increased by 1.8%. In July ‘10, average hourly earnings of private-sector production and nonsupervisory employees increased to $19.04. Wouldn’t you say that this is enough for a money-conscious family to live decently? The problem is due to the personal debt habits of many people in the US - the spend-thrift patterns, utilizing most goods as disposables, tendency to spend money before it is earned. When things slow down, trouble is right around the corner for this large subset of people in the US. This is precisely why we are in this situation.

Life Style of Majority

You might ask, what do the streets of the US look and feel like at ground zero? Well, I get around in my city/suburb and see two sides of the coin. If households have a job, life is 90% as merry as it always was, and spending continues, albeit at a slower pace. If one of the jobs in the family has been affected by downsizing (layoffs), then there is budgeting going on, and everyone in the family spends less. If no one in the family is working full time, then life is tough and spending is completely curtailed. The latter is the situation for lower and lower-middle America (housing, construction, manufacturing and related industry workers).

Case in point……we just got invited by two of our American friends to the usual neighborhood parties of Fall 2010, to say our last hurray to the summer. One of them is a Wine-Tasting-Party. We open nearly 40-50 bottles of wine over a period of 6 hours and taste it, as part of the annual ritual at our friends’ house. In both of these households, one of the jobs in the family is gone, and yet, the lifestyle continues to be the same! A good guesstimate would be that they both have huge borrowings on their homes (mortgage) and credit cards. Both have kids in colleges, and are making their kids study on ‘college loans’. Hunkering down into a ‘savings’ mode is not yet an acceptable practice for the lavish life-styles of middle and upper-middle America.

Now, 80%-90% people who were employed earlier are still employed with similar or slightly lower pay. Hence, if one goes around in the ‘good’ suburbs, you will see less people in stores, buying less ‘stuff’, and yet, the businesses continue to operate. There are ‘high end’ stores that are affected and are closing ‘under 10%’ of their corporate/franchised locations, but majority of them still survive. The Christmas shopping season between Nov 1st, 2010 and Jan 5th, 2011 will be the biggest proof, although I project that it will prove the ‘slow-down’, and a ‘recession’ scenario for sure.

Reality of Indians/Asians

If you are wondering how all this affects Indians/Asians, then I can tell you that it affects less than 1% of Indians/Asians in America. Why? Because, the 1st and 2nd generation Indians/Asians are highly conservative, money conscious, big savers, and leverage the land of opportunity to the hilt. Many Indians/Asians work two jobs if necessary, shop aggressively at every “weekly special sale” in town, and cut corners by in-sourcing everything (cutting grass, cleaning house, cooking foods from scratch, picking up freebies, taking lunch to work). Also, Indians/Asians figure out that buying is better than renting, and driving used cars is good for the pocket book. Such prudence allows savings to grow rapidly, for leveraging during a rain day.

Bottom Line

The US is still a land of opportunity, the land of the simplest processes, and a country with methodical execution of almost 99% of human wants/needs. It is still a country filled with ‘what is in it for me’ and ‘I want it now’ syndrome. My kids are growing up with the same natural instincts and I am fighting to teach them the Indian Values and Common Sense Smartness. I have been a beneficiary of this land of opportunity for decades, and love the simplicity and clarity of everything that America offers.

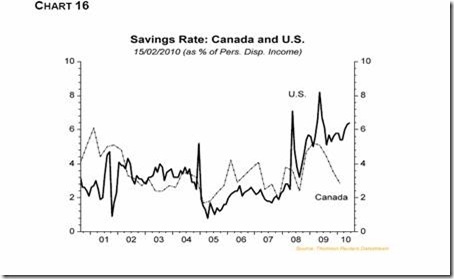

A combination of high debt (personal, professional and country level), high pay scales relative to other countries, open borders to bring anything/everything in, and finally, a fiscal policy where government wants to play in every circle, is the recipe that has created this challenging situation. There is some improvement in the savings rate (as shown above), but all in all, it may take another decade to get back on the original track, although with this shake-down, it may never get on the original track.

What do you think, dear readers?

-------------------------------------------------------------------------------------

KKP (Kiran Patel) is a long time investor in the US, investing in US, Indian and Chinese markets for the last 25 years. Investing is a passion, and most recently he has ventured into real estate in the US and also a bit in India. Running user groups, teaching kids at local high school, moderating a group in the US and running Investment Clubs are his current hobbies. He also works full time for a Fortune 100 corporation.