Shanghai Composite index chart

The bar chart pattern of the Shanghai Composite index is trying to engineer a turnaround from the 2300 level. Today's higher close of 2471 meant a 3.5% gain on a weekly basis. The index just about reached its falling 20 day EMA, and continues to remain in a strong bear grip.

Note the positive divergences in the MACD and RSI - both of which made higher bottoms as the Shanghai Composite made a lower one. That could lead to the rally continuing next week.

But the bulls should not get too excited. The 20 day EMA is below the 50 day EMA and both moving averages are falling. Till the index moves above its previous high of 2600 and the 50 day EMA, buying should remain low-key.

All three technical indicators have started moving up but have not turned bullish yet. The MACD is negative and touching the signal line. The RSI and slow stochastic are both below their 50% levels.

Hang Seng index chart

The chart pattern of the Hang Seng index seems to be playing hide-and-seek with the bears - alternately spending a few days above and below the 200 day EMA. Today's 328 points rise has taken it to the long-term moving average (not updated on the chart).

The global indices are rallying, and the Hang Seng is trying not to be left behind. Till it clears the previous high around the 21000 level, the advantage stays with the bears. The Apr '10 top of 22389 will remain the longer-term hurdle for the bulls.

The MACD is at the '0' level but below the signal line. The RSI is at the 50% level and exhibiting positive divergence - making a higher top while the index made a lower one. The slow stochastic is in the oversold zone, but the %K line has just crossed above the %D.

Any buying should be very selective.

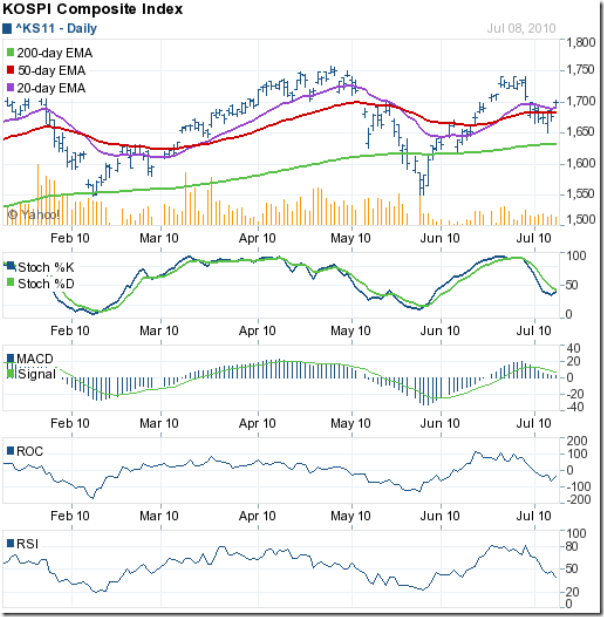

KOSPI (Korea) index chart

The chart pattern of the KOSPI (Korea) index hadn't quite shaken the bears off when I last looked at it a month back. It did so shortly thereafter and soared up to test the Apr '10 top of 1758, but fell short of the 1750 mark.

The bears attacked and pushed the index below the 20 day and 50 day EMAs. The KOSPI got support from the 1650 level, and stayed above the 200 day EMA. Today's close at 1723 may lead to a test of the Jun '10 high of 1741 next week.

The technical indicators are giving bearish signals. The slow stochastic is below the 50% level. The MACD is barely positive and below the signal line. The ROC is in negative territory. The RSI is below the 50% level and falling.

Bottomline? The chart patterns of the Asian indices are trying to display varying signs of strength. The Shanghai Composite remains in a bear market. The Hang Seng is on the border between bull and bear country. The KOSPI is in bull territory, but things could change in a hurry. Investors should wait and watch till a clearer trend emerges.

No comments:

Post a Comment