All pre-election market surveys are pointing to the end of UPA’s 10 year stint at running the central government. General elections are around the corner. If the surveys are to be believed, an NDA-led coalition is most likely to form the next government.

In an election year, it makes no sense for the Finance Minister to present a comprehensive budget. Instead, a ‘Vote on Account’ is presented to Parliament for approval of the present government’s expenditure till the new government takes over. The new Finance Minister will then announce a full budget.

More often than not, the ‘Vote on Account’ is a non-event as the present government’s policies are carried forward for a short period of time. At best, some tinkering with existing policies are done to alleviate problems in a few areas. That is precisely what the Finance Minister did.

In this month’s guest post, Nishit takes a look at some of the measures announced, and the likely effect on the stock market.

------------------------------------------------------------------------------------------------------------------------------------------

The interim Budget has come and gone. So, how does one read into it? First of all, what is the interim budget or vote-on-account? It is merely a permission taken by the Government from the Parliament to continue with its expenses for a limited period of time.

This is because there will be a new Government sworn in by end of May and it would be the prerogative of that Government how they want to decide the economic policies for India. Typically in vote-on-account, no major decisions are taken and it is basically a continuation of the status quo.

A few things do stand out in this year’s vote-on-account. First, excise duty reduction of 4% on the sale of automobiles. Now, this is a major relief to the Automobile sector and also a car buyer’s dream. The last time such an exemption was allowed was in March 2008. Assuming a car is costing about Rs 6 lakhs, there is a straight saving of up to Rs 24000. Also, to be noted is that this exemption is only till June. Whether it continues in the full year budget is the next government’s prerogative.

If anyone is planning to change their vehicle in the next 1 year, next 3 months is the time to do it. During the months of April-May, car companies offer larger discounts since the March-end rush to gain depreciation benefits is out of the way.

There is a further 2% excise duty reduction on white goods like AC, refrigerators and Mobile Phones. Now, these translate into miniscule reductions of say Rs 600 on an AC worth Rs 30000. So, this is purely a sentiment booster.

The Government has done financial jugglery of containing the fiscal deficit to 4.6% by rolling over subsidies worth about Rs 35000 Crores to be paid to Oil Marketing companies to the next year. This helps achieve the target fiscal deficit number and shifts the subsidy headache on to the next Government.

Also, a lower CAD (Current Account deficit), the difference between dollars earned and dollars spent, of US $45 Billion will help the Rupee become stronger.

All in all, a budget that had nothing great to offer but which also did not offer too many populist measures. All eyes would now be on the first budget by the new Government.

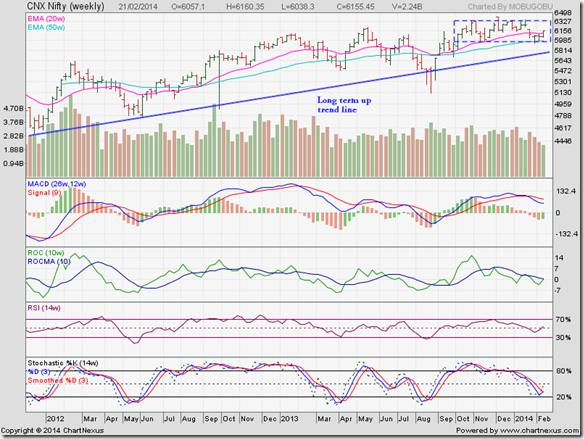

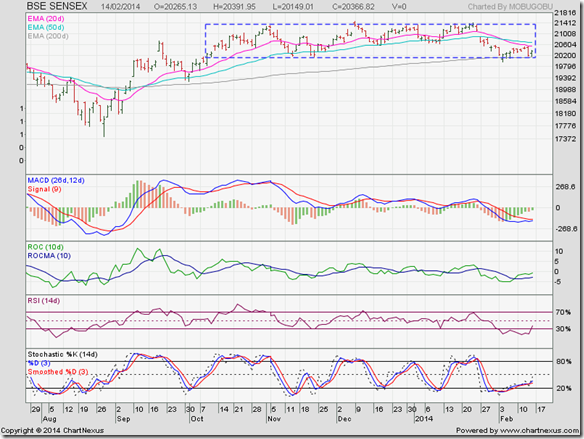

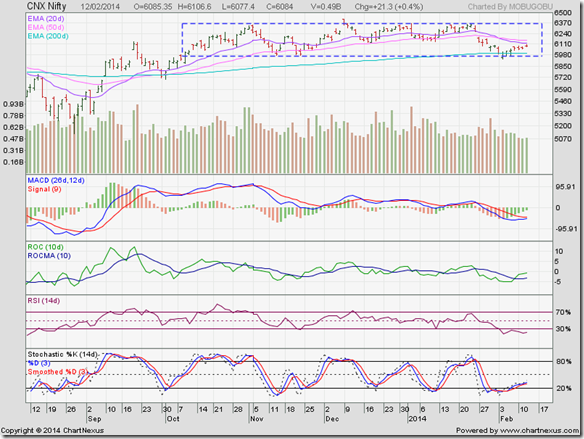

If the Finance Minister had gone in for a populist budget, the market could have tanked. Now, as I see it, the chances of a full fledged market crash before the elections is fading and seems far less likely. The next 3 months could see range bound stock specific moves in the markets.

------------------------------------------------------------------------------------------------------------------------------------------

(Nishit Vadhavkar is a Quality Manager working at an IT MNC. Deciphering economics, equity markets and piercing the jargon to make it understandable to all is his passion. "We work hard for our money, our money should work even harder for us" is his motto.

Nishit blogs at Money Manthan.)