In an effort to kick-start the growth engine of the struggling US economy following a recession, the US Fed (equivalent to India’s RBI) has unleashed a flood of cheap liquidity in a low interest rate regime through its Quantitative Easing programmes.

The hope was that ready availability of money at low interest rate would enable manufacturing and services sectors to expand and create jobs, which in turn would rejuvenate the housing market. Despite three rounds of Quantitative Easing – QE3 is still ongoing – US GDP growth remains in very low single digit.

So, where is all the cheap liquidity going? To global stock markets – boosting stock prices, even as unemployment remains high and the housing market is in doldrums. The patient is ailing but the doctor’s prescription isn’t working. In this months guest post, Nishit explains when to expect QE3 to be wound down and what investors can do to turn a profit in the interim period.

---------------------------------------------------------------------------------------------------------------------------------------

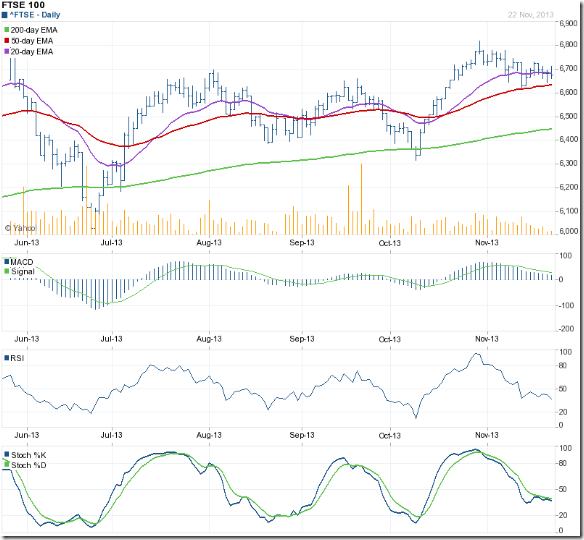

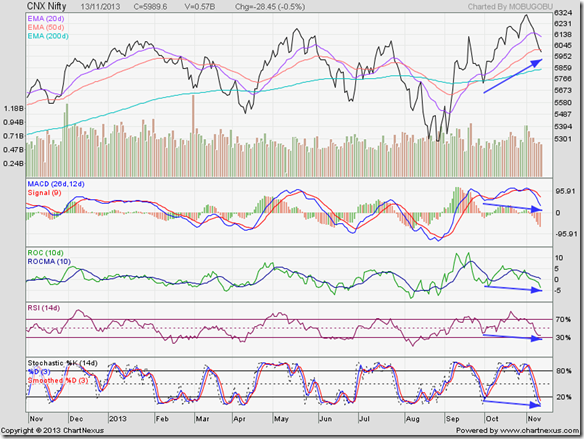

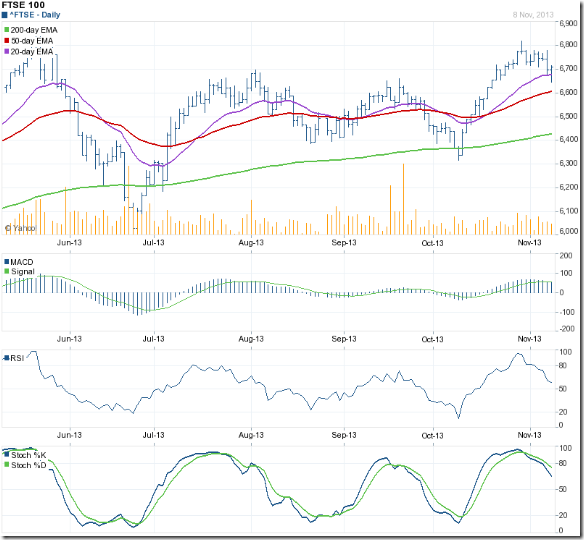

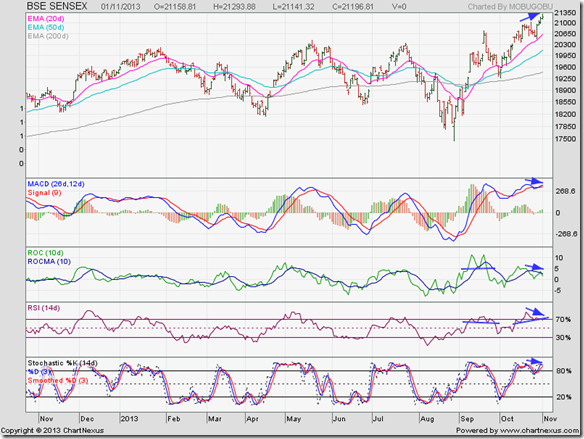

The US Fed has continued with the third round of Quantitative Easing (QE3). This has led to equity markets continuing to rally – boosted by easy and cheap liquidity. Let us try and explore what this QE3 is about and whether it will continue.

The US Fed - to avoid the effects of an economic recession that started in 2008 - keeps buying US Bonds thereby pumping in large sums of money into the economy every month. With prevailing low interest rate, this leads to cheap and easy cash being available to be invested in markets across the world. Interest rates have been artificially kept suppressed near zero.

The Wikipedia definitions are available here:

http://en.wikipedia.org/wiki/Quantitative_easing

Last May, the Fed announced that they were going to go slow on Quantitative Easing. This rang alarm bells across world financial markets as the rally was based more on easy money rather than fundamentals.

The US Debt ceiling crisis due to which the US government locked down for a few days came about in October. Consequently, financial data did not get published for about a month. As the decision to reduce/stop the loose monetary policy was going to be based on financial indicators, it was clear that the decision to reduce/stop buying bonds was going to be pushed back by about 2-3 months.

Ben Bernanke, the US Fed Governor who had taken the call to taper down QE3, is due to retire in January 2014 after about 8 years in the chair. There was speculation about whether he would seek one more term or whether his replacement would be announced. There were multiple names being thrown around and finally Janet Yellen was short listed as the new US Fed Governor to take over from January.

Now, Janet Yellen is a ‘dove’ who is known for not taking aggressive steps. It was widely expected she would be more cautious in stopping the easy monetary policy. At her confirmation hearing, she reiterated that it was necessary to be completely sure that the economy was in very good shape before starting the QE3 taper.

The markets took it as a signal that the loose policy will continue. The emerging markets continued to rally. This sets the base for a November-February rally which will happen if the easing continues.

Of course, a BJP sweep in December State Assembly elections would give the markets a reason to rally. The real underlying reason would be easy money available from the US and elsewhere and reflected in the FII ‘buy’ figures.

So, we should keep an eye on the US Fed, keep booking profits and take the money home. Markets always give a second chance.

---------------------------------------------------------------------------------------------------------------------------------------

(Nishit Vadhavkar is a Quality Manager working at an IT MNC. Deciphering economics, equity markets and piercing the jargon to make it understandable to all is his passion. "We work hard for our money, our money should work even harder for us" is his motto.

Nishit blogs at Money Manthan.)