Since the beginning of this month, the US government has been in partial shutdown. That means all government services and activities barring a few emergency and security services have come to a halt and government employees have been asked to proceed on unpaid leave. Why?

Because the government has run out of funds. Oct 1 being the first day of a new fiscal year, budget appropriations for different departments and activities need to be finalised before that date. But the Congress with a Republican majority is playing a game of ‘dare’ with the Democrat US President – withholding appropriations till the President bows down to their demands for budget cuts.

With both sides refusing to budge from their respective positions, there was no alternative to a partial shutdown. The debt-ceiling will be reached on Oct 17. Unless a deal is worked out before that date, the US government may default on its debt. In this months guest post, Nishit explains the current fiscal impasse, and how it may affect global stock markets.

---------------------------------------------------------------------------------------------------------------------------------------

The current hot topic of discussion is the expiry of US Debt ceiling. What is this all about and how does it affect Indian markets? Let us try and simplify things.

Right now, the Government shutdown, in American politics, refers to a temporary halt in government services when lawmakers cannot pass the necessary funding measures in time.

Reference: http://en.wikipedia.org/wiki/Government_shutdown

In 1939, the US government was authorized to borrow money up to a particular limit. This was to make sure that the debt did not go completely out of control. The various arms of the US democracy have to work together to keep raising the limit as time passes by - coming to an agreement over the amount by which it has to be raised.

Thanks to petty politicking between the Democrats and Republicans, things are at a stand-off. The debt ceiling will be reached by Oct 17th and the government will be unable to borrow more money. If that happens, then US may default on its debt. US government issues Treasury bills of various maturities ranging from 30 day to 30 years. Some of these will come up for payment and due to technical reasons, the payment will be missed.

USA is no ordinary country. It is the leading superpower. Its debt is considered to be safest in the world. Many governments including ours have invested in US Treasury bills. We hold about US $59 Billion worth of debt in US Government Securities.

The fall-out of US debt default will be that gold’s price will rise and world economy may get a shock. The world economy is already in a fragile state and can do without such needless technical defaults over petty politics.

The sentiments of the US people are pretty strong against this standoff and about 70% don’t approve of it. Already due to shutdown, many National parks and monuments have been closed to visitors and people sent home on leave without pay. This is already hurting US consumer sentiment.

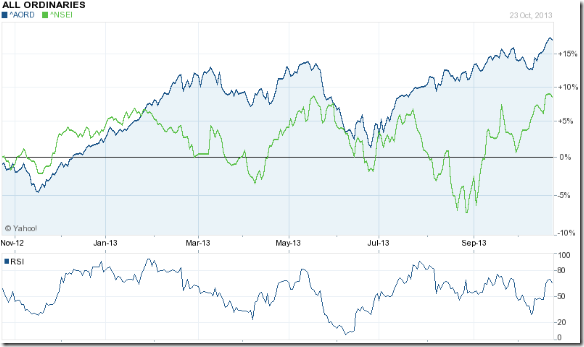

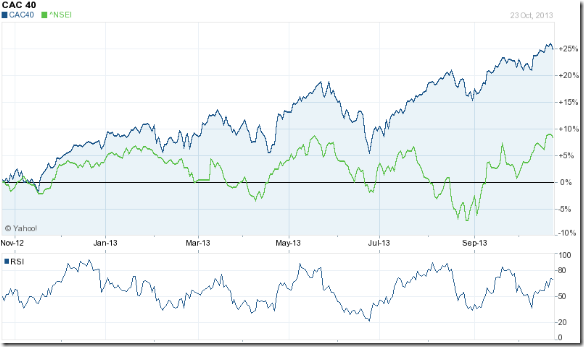

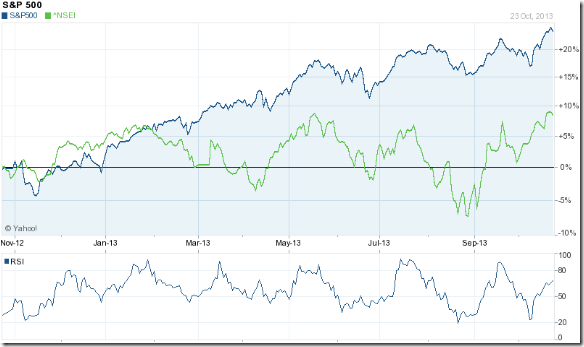

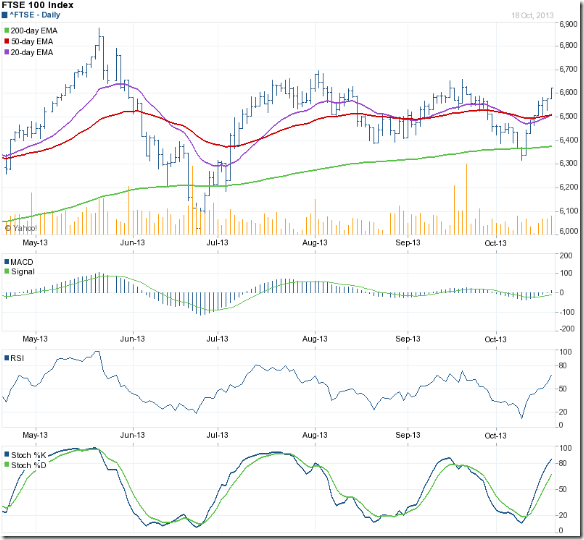

Important US economic data are not being released and this will lead to tapering of US bond buying being postponed. For this reason, our markets have gone up.

After Oct 17th, if there is no resolution, then there may be crisis in global equity markets. In my opinion, things will not come to such a pass. The politicians will find some way out at the last possible minute. Even if a resolution is not reached by Oct 17th, the US government will have enough funds to meet its debt obligations for another 30 days.

This was a good chance for speculators to make some money by betting on a non-event. Expect a big gap up in markets when this fiscal impasse is resolved. The game right now is all about kicking the ball further down the road. With a month wasted here and a dovish new Fed Chairman, quantitative easing will continue for some more time. New highs here we come.

After highs, a correction has to take place which is the law of markets. If you have equities in place, slowly book profits at higher levels. Markets always give a chance to buy back at lower levels. Remember 5118 almost 45 days back?

---------------------------------------------------------------------------------------------------------------------------------------

(Nishit Vadhavkar is a Quality Manager working at an IT MNC. Deciphering economics, equity markets and piercing the jargon to make it understandable to all is his passion. "We work hard for our money, our money should work even harder for us" is his motto.

Nishit blogs at Money Manthan.)