FIIs were net buyers of equity on Mon. and Thu. (Sep 23 and 26), but were net sellers on Tue., Wed. and Fri. (Sep. 24, 25 and 27). Their total net buying was worth Rs 20.4 Billion. DIIs were net sellers of equity on Wed., but were net buyers during the other four days of the week. Their total net buying was worth Rs 8.0 Billion, as per provisional figures.

As on Sep 26, countrywide rainfall figure is 107% of its long period average, as per the India Meteorological Dept. With more than 2 weeks to go before monsoon recedes, the figure could touch 110% (putting it in the 'excess' category after staying 'below normal' for five straight years).

According to a recent UNCTAD report, India's GDP growth will moderate to 6% in 2019 from 7.4% in 2018 due to lower than targetted tax collections and limited public spending.

BSE Sensex index chart pattern

The daily bar chart pattern of Sensex formed a 300 points upward 'gap' on Mon. Sep 23 and touched an intra-day high of 39441. It was the highest level touched by the index since the post-budget sell-off began on Jul 8 '19. In the process, 'death cross' of the 50 day EMA below the 200 day EMA was prevented.

On Wed. Sep 25, the index dropped inside the 'gap' zone - partly filling it - before bouncing up the next day. The 'gap' should act as a floor on the down side. It may take a couple of weeks for the index to 'digest' the sharp two-day rally before it resumes its quest to touch a new high.

Daily technical indicators are in bullish zones, but only MACD is showing upward momentum by rising above its signal line. ROC (not shown) is hovering above the edge of its overbought zone. RSI is moving sideways above its 50% level. Slow stochastic is sliding down inside its overbought zone. Some more consolidation above the 'Gap' is likely.

Small investors should suppress the 'left out' feeling after missing the unexpectedly sharp rally. This is not the right time to jump into the market feet first - despite entreatments by brokers and experts on business TV channels.

Cutting out the 'noise', keeping cool, and following an investment plan is what generates wealth over the long-term. Do your homework, choose fundamentally strong stocks, and hold on to them for many years. Getting in and out of the market willy-nilly due to news headlines is a recipe for financial disaster.

NSE Nifty index chart pattern

The weekly bar chart pattern of Nifty had spent seven straight weeks below its 50 day EMA, and the (purple) up trend line drawn through its Dec '16 and Oct '18 lows. Just when it seemed that the bears were getting the upper hand, a corporate tax cut announced on Sep 20 sent short sellers scurrying for cover.

The index rose above the up trend line, tested resistance from the 11700 level, closed above 11500 after ten weeks, and is back above its three weekly EMAs in a long-term bull market. A new high by Diwali won't be a surprise.

Weekly technical indicators are turning bullish. MACD has formed a bullish 'rounding bottom' pattern below its signal line in bearish zone. ROC (not shown) is rising towards its neutral zone. RSI has crossed above its 50% level. Slow stochastic has risen to its 50% level. Some more near-term index upside is possible.

Nifty's TTM P/E has moved down to 26.52 - which remains well above its long-term average in overbought zone. The breadth indicator NSE TRIN (not shown) is oscillating near the edge of its oversold zone, hinting at near-term index consolidation.

Bottomline? Sensex and Nifty charts are consolidating after sharp upward breakouts following seven weeks of sideways consolidation. A cut in corporate taxes boosted bullish sentiment, but will it boost consumer demand? Both indices are within 5% of their lifetime highs. It is a time for cautious optimism - not euphoria.

FIIs were huge net buyers of equity on Mon. Sep 23, but were net sellers on the next two trading days this week. Their total net buying was worth Rs 15.1 Billion. DIIs were net sellers of equity on Wed. Sep 25, but were net buyers on the first two trading days. Their total net buying was worth only Rs 22.8 Million, as per provisional figures.

The government is expecting a Rs 400 Billion shortfall in GST collections during FY 2019-20 due to the economic slowdown. That could put pressure on the compensation that state governments are liable to receive in case tax growth falls below 14% for the year.

India's apparel exports have revived by 4% YoY during the Apr-Jul '19 period after two consecutive years of de-growth of 3-4% per year. However, ICRA has reported a likely slowdown in growth during the rest of FY 2019-20.

The daily bar chart pattern of Nifty shows how the Finance Minister's fourth 'booster' dose - a cut in corporate taxes announced on Fri. Sep 20 morning - has turned around the bearish sentiment prevailing in the market.

A short-covering frenzy erupted, and the index soared like a rocket past its 200 day EMA and the upper Bollinger Band. Nifty gained more than 550 points (5.3%) in one day.

There was more fun and games on Mon. Sep 23. Huge FII buying propelled the index higher with an upward 'gap' of 90 points. Nifty tested the 11700 level intra-day and closed with a gain of more than 300 points.

Sanity prevailed on Tue. Sep 24. The index formed an indecisive 'doji' and closed just 12 points lower but still traded above the upper Bollinger Band.

Both FIIs and DIIs were in profit booking mode today (Wed. Sep 25). Nifty fell sharply below the upper Bollinger Band and partly filled the 90 points upward 'gap' formed on Mon. Sep 23.

Daily technical indicators are in bullish zones. MACD is rising above its signal line. RSI has made a U-turn before it could reach its overbought zone. Slow stochastic is inside its overbought zone, but has turned down. Some more correction or consolidation is possible.

Nifty's TTM P/E has slipped down to 25.92, but remains inside its overbought zone and higher than its long-term average. The breadth indicator NSE TRIN (not shown) is hovering near the edge of its oversold zone, hinting at some near-term index consolidation.

The post-budget downward 'gap' of 26 points can provide resistance on the upside, in case bulls get adventurous again. The corporate tax cut has come as a sentiment booster to the stock market, but is unlikely to stimulate consumer demand in the near term.

A silver lining is that the festive season is almost upon us. Urban consumers may be able to open their purse strings - thanks to their Diwali bonuses. It is doubtful that rural consumers will be able to do likewise.

Small investors should avoid falling into the trap of 'buy' calls and big upside targets being suggested by experts on TV and pink sheets. An index barely 5-6% below its lifetime high is not providing a 'great buying opportunity'.

Stay invested, continue with your SIPs, get rid of non-performers in your portfolios, and be very selective in what you buy.

FIIs were net sellers of equity during the first four trading days of the week, but were net buyers on Fri. (Sep. 20). Their total net selling was worth Rs 33.7 Billion. DIIs were net buyers of equity on all five days of the week. Their total net buying was worth Rs 48.2 Billion, as per provisional figures.

After three disappointing 'booster' packages, the Finance Minister hit the ball out of the park by announcing a significant cut in corporate taxes on Fri. Sep 20. Sensex and Nifty soared - trapping unwary short sellers - and business leaders sang 'Hallelujah'.

The GST council announced reduction in rates for hotels, outdoor caterers, precious/semi-precious stones but hiked rates for caffeinated drinks and railway wagons. No major relief was provided to auto and cement sectors.

BSE Sensex index chart pattern

The daily bar chart pattern of Sensex fell steadily on the back of sustained FII selling, and dropped to test support from the lower edge of the 'support zone' (between 35900 and 37100) on Thu. Sep 19.

There was a sea change in market sentiment after the FM announced corporate tax rate cut on Fri. Sep 20. The index did a sharp U-turn as traders rushed to cover their shorts. Sensex closed above its three EMAs in bull territory for the first time in nearly three months.

Daily technical indicators are turning bullish. MACD has crossed above its rising signal line in bearish zone. ROC has risen sharply to the edge of its overbought zone. RSI has moved above its 50% level. Slow stochastic has emerged from its oversold zone. Some more near-term upside is possible.

Small investors should avoid getting caught in the sudden euphoria. The devil is in the details. How many companies actually pay more than 25% tax? If they do, will they be willing to forego existing tax incentives? Will tax benefits be passed on to consumers, or used to pare debt? Will rural consumers rush out to buy two-wheelers, tractors and cars? Will MSMEs start opening new factories just because tax has been reduced by 3.5%?

Only time will provide answers to those questions. In the meantime, follow your asset allocation plan, continue SIPs, use the sentiment boost to get rid of non-performing stocks/funds and stay invested in good companies/funds for the long-term. That is the best way to build wealth - whether Sensex is falling or suddenly jumping northwards.

NSE Nifty index chart pattern

The weekly bar chart pattern of Nifty breached the lower edge of the 'support zone' (between 10700 and 11100) intra-week, but bounced up sharply on Fri. Sep 20 to close above both its 50 week and 20 week EMAs for the first time since early Jul '19.

Reduction in corporate taxes - announced by the Finance Minister on Fri. Sep 20 - triggered a sharp technical bounce due to short-covering. Nifty closed at its highest level in eight weeks.

Weekly technical indicators are in bearish zones, but showing upward momentum. MACD appears to be forming a bullish 'saucer' pattern below its falling signal line. ROC has crossed above its falling 10 week MA. RSI has emerged from its oversold zone. Slow stochastic has started rising towards its 50% level. Expect some more near-term index upside.

Nifty's TTM P/E has moved up to 27.72 - which is well above its long-term average in overbought zone. The breadth indicator NSE TRIN (not shown) is oscillating near the edge of its oversold zone, hinting at near-term index consolidation.

Bottomline? Sensex and Nifty charts have broken out upwards after consolidating sideways for seven weeks. Sharp short-covering bounces were triggered by a cut in corporate taxes, which may not boost consumer demand in the near term. Stay calm, and follow your investment plans.

FIIs were net sellers of equity on all three trading days this week. Their total net selling was worth Rs 25.2 Billion. DIIs were net buyers of equity on all three trading days. Their total net buying was worth Rs 11.7 Billion, as per provisional figures.

India's WPI-based inflation was 1.08% in Aug '19 - the same as in Jul '19 but much lower than 4.62% in Aug '18. Rise in inflation of food items was balanced by deflation in fuel and power.

The Finance Ministry is considering a fourth 'booster' dose to revive a sliding economy, after the first three 'booster' doses failed to generate any significant revival in 'animal spirits'.

For the past seven weeks, the daily bar chart pattern of Nifty has been consolidating sideways with a slight downward bias, touching progressively lower tops. The 'death cross' (marked by grey oval) of the 50 day EMA below the 200 day EMA at the beginning of the month had technically confirmed a bear market.

Bulls are fighting hard, but the resistance zone between 11100 and 11200 has proved to be a tough hurdle. The Aug 23 low of 10637 is in danger of being tested, and breached.

The index had bounced up after testing support from the lower Bollinger Band at the beginning of the month. But the counter-trend rally lost steam after crossing above the middle band (20 day SMA - marked by green dotted line).

Daily technical indicators are in bearish zones. MACD is seeking support from its rising signal line. RSI is below its 50% level. Slow stochastic formed a 'double top' reversal pattern at the edge of its overbought zone, and has dropped sharply below its 50% level.

Nifty's TTM P/E has slipped down to 26.66, but remains inside its overbought zone and much higher than its long-term average. The breadth indicator NSE TRIN (not shown) is oscillating near the edge of its oversold zone, hinting at some near-term index consolidation.

Three 'booster packages' from the Finance Minister have come and gone without making a dent on the bearish sentiment of FIIs. Bulls are hoping for a miracle from our popular leader. But he seems more interested in fiddling around with photo-ops while the economy is sinking.

Q2 (Sep '19) corporate earnings may be worse than Q1 (Jun '19) numbers. The upcoming festive season sales may prevent a total washout. Small investors should be extremely wary about bottom fishing.

During another holiday-shortened trading week, FIIs were net sellers of equity on Mon. and Fri. (Sep. 9 and 13), but were net buyers on Wed. and Thu. (Sep. 11 and 12). Their total net buying was worth Rs 4.6 Billion. DIIs were net sellers of equity on Thu., but were net buyers on the other three trading days. Their total net buying was worth Rs 19.0 Billion, as per provisional figures.

India's merchant exports slipped by 6.1% to US $26.13 Billion in Aug '19. Imports dropped by 13.4% to US $39.58 Billion. The trade deficit of $13.45 Billion narrowed from $17.92 Billion in Aug '18, but widened marginally from $13.43 Billion in Jul '19.

In Jul '19, India's Index of Industrial Production (IIP) rose to 4.3% from a downwardly revised 1.2% in Jun '19, but was lower than 6.5% in Jul '18. CPI-based consumer inflation in Aug '19 rose to a 10 month high of 3.2% (due to higher vegetable prices) against 3.1% in Jul '19.

BSE Sensex index chart pattern

The daily bar chart pattern of Sensex gained more than 400 points (1.1%) on a weekly closing basis as FIIs turned net buyers for the week. The index moved above its 20 day EMA, but faced resistance from its 200 day EMA.

The 50 day EMA is about 105 points above the 200 day EMA, and the two together may provide strong resistance on the upside. In case Sensex manages to move above its 50 day EMA, it can quickly reach the 38250-38500 zone. Will it?

Daily technical indicators are looking neutral to bullish. MACD rising above its signal line in bearish zone. RSI is at its neutral zone. Slow stochastic is above its 50% level. Some near-term upside is possible.

The expected third economic 'booster' package was announced by the Finance Minister on Sat. Sep 14 - some sops for exporters and affordable housing - but perhaps not enough to boost bullish sentiment. The market may have rallied in hope of a stronger 'booster' dose.

'Death cross' of the 50 day EMA below the 200 day EMA, which will technically confirm a bear market, is still awaited. Except for two or three sessions, the index has spent most of the past six weeks below its 200 day EMA in bear territory.

Small investors have kept faith in the market by not discontinuing SIPs. However, anecdotal evidence from the hinterland shows that rural economy is in shambles. The periodic 'booster' packages have not shown much effect on the ground.

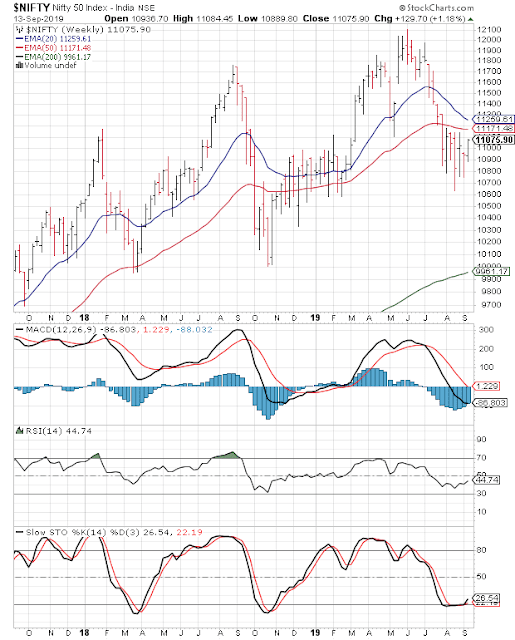

NSE Nifty index chart pattern

The weekly bar chart pattern of Nifty gained 130 points (1.2%) on a weekly closing basis, but closed below its 50 week EMA for the seventh straight week.

Weekly technical indicators are in bearish zones, but not showing any downward momentum. MACD is moving sideways below its falling signal line. RSI is below its 50% level. Slow stochastic has moved up a bit from the edge of its oversold zone. Expect some near-term index upside.

Nifty's TTM P/E has moved up to 27.23 - which is well above its long-term average in overbought zone. The breadth indicator NSE TRIN (not shown) is falling inside its oversold zone, and can limit near-term index upside.

Bottomline? Sensex and Nifty charts have been consolidating sideways for the past seven weeks. A low Q1 (Jun '19) GDP figure and the ongoing US-China trade spat dampened bullish sentiment. Small investors should continue with their SIPs, but avoid any impulsive buying.

During a holiday-shortened trading week, FIIs were net sellers of equity on all four days. Their total net selling was worth Rs 52.7 Billion. DIIs were net buyers of equity on all four trading days. Their total net buying was worth Rs 44.6 Billion, as per provisional figures.

The market started a pullback rally from Wed. Sep 4 expecting announcement of a third set of measures for boosting India's sagging economy. Instead, the Finance Minister promised to consider more measures after consultations.

After strong rallies, prices of gold and silver corrected sharply during Thu. and Fri. (Sep 5 and 6). With global stock markets on recovery paths, some more near-term downside in precious metals is possible.

BSE Sensex index chart pattern

The daily bar chart pattern of Sensex dropped sharply and lost 770 points on Tue. Sep 3 due to heavy selling by FIIs after the long week end. There was some recovery during the rest of the week, but the index closed below its three EMAs inside the 'support zone' (between 35900 and 37100).

Daily technical indicators are looking neutral to mildly bullish. MACD has merged with its rising signal line in bearish zone. ROC has crossed above its 10 day MA to enter bullish zone. RSI and Slow stochastic are just below their respective 50% levels.

The market was hoping for a third economic booster 'package' on Fri. Sep 6, but all it got was a promise. It won't be surprising if FIIs continue to vote with their feet. When an economy is steadily going downhill, throwing a few 'packages' in its path won't stop the slide. The gradient of the road itself needs to be changed.

That means bold reforms and immediate actions. The time for consultation and consideration is long over. More and more companies are laying-off employees and reducing production - making the economy decelerate even more. It is going to be a long and difficult road ahead.

Small investors should concentrate on protecting capital - whatever may be left of it. Ignore the exhortations of those experts who want you to buy now.

NSE Nifty index chart pattern

The weekly bar chart pattern of Nifty tested the lower edge of the 'support zone' (between 10700 and 11100) intra-week before bouncing up to close just below 10950.

The index has been consolidating inside the 'support zone' for the past six weeks, and is trading below its 20 week and 50 week EMAs.

Weekly technical indicators are looking bearish and oversold. MACD is falling below its signal line in bearish zone. ROC and RSI are falling inside their respective oversold zones. Slow stochastic is moving sideways along the edge of its oversold zone. Expect some more consolidation or correction.

Nifty's TTM P/E has moved down to 26.91 - which remains above its long-term average in overbought zone. The breadth indicator NSE TRIN (not shown) has fallen sharply inside its oversold zone. Further index upside may be limited.

Bottomline? Sensex and Nifty charts are consolidating within long-term support zones. A low Q1 (Jun '19) GDP figure and the ongoing US-China trade spat have dampened bullish sentiment. Small investors should stay on the sidelines, but continue with their SIPs.

After Monday's holiday, FIIs were net sellers of equity on both trading days this week. Their total net selling was worth Rs 37.5 Billion. DIIs were net buyers of equity on both trading days. Their total net buying was worth Rs 25.6 Billion, as per provisional figures.

The IHS Markit India Manufacturing PMI slipped to a 15 month low of 51.4 in Aug '19 from 52.5 in Jul '19, but remained above 50 indicating growth. The Services PMI also declined to 52.4 in Aug '19 from 53.8 in Jul '19. The Composite (Manufacturing + Services) PMI moved down to 52.6 in Aug '19 from 53.9 in Jul '19.

GST collection in Aug '19 slipped to Rs 98.2 Billion from Rs 1.02 Trillion in Jul '19, but was 4.5% higher than Rs 93.9 Billion collected in Aug '18.

The weekly line chart of Nifty has breached two up trend lines drawn from the Feb '16 low (also called Fan Lines - marked FL1 and FL2). This is a sign that the long-term up trend is getting weak, but is not yet over.

As per Corrective Fan Principle, downward breach of a third up trend line - that has not yet been drawn on the chart - will technically confirm the reversal of the long-term up trend.

The index is struggling to hold on to the support level of 10800, and may move lower. A test of support from the 200 week EMA appears increasingly likely.

Weekly technical indicators are in bearish zones. MACD is showing downward momentum. RSI and Slow stochastic are moving sideways - hinting at near-term index consolidation.

Nifty's TTM P/E has moved down to 26.61, but remains inside its overbought zone and much higher than its long-term average. The breadth indicator NSE TRIN (not shown) is falling inside its oversold zone. Some near-term index up side is possible.

The market is hoping that a third round of economic booster 'package' - promised by the Finance Minister - will help stop the slide in the index. But the two earlier 'packages' have failed to revive bullish sentiment.

FIIs have intensified their selling after a weak Q1 GDP number and sliding auto sales. They may not turn buyers in a hurry.

For the month of Aug '19, FIIs were net sellers of equity worth Rs 148.3 Billion. It was their fourth straight month of net selling. DIIs more than matched them. They were net buyers of equity worth Rs 209.3 Billion, as per provisional figures.

India's GDP growth slumped to 5% during Apr-Jun '19 - lowest growth in 6 years; much lower than 8% growth during Apr-Jun '18, and even lower than 5.8% growth during Jan-Mar '19.

India's fiscal deficit during Apr-Jul '19 stood at Rs 5.47 Trillion, which is nearly 78% of the full year (FY 2019-20) deficit target of Rs 7.03 Trillion. Revenue collection is weak due to the economic slowdown.

BSE Sensex index chart pattern

The following comments were made in last week's post on the daily bar chart pattern of Sensex: "All four indicators are showing positive divergences...by rising higher while the index dropped lower. That is a clear signal that precedes a technical bounce."

Finance Minister's first 'booster package' was announced on Fri. Aug 23 after close of day's trading. Bullish fervour was evident on Mon. Aug 26. The index bounced up above the 37100 level and its 20 day EMA before facing resistance at its 200 day EMA.

On Tue. Aug 27, Sensex closed above its 200 day EMA but couldn't move above its falling 50 day EMA. Bear selling resumed on Wed., and the index closed below its 200 day EMA. There was more selling on Thu. Aug 29 (monthly F&O settlement day). The index dropped to close just below 37100.

On Fri. Aug 30, FIIs were net buyers along with DIIs. Sensex formed a 'reversal day' bar (lower low, higher close) and climbed above the 37100 level but closed below its 200 day EMA in bear territory.

The index gained more than 630 points (1.7%) on a weekly closing basis. The 'support zone' (between 37100 and 35900) provided very good support to Sensex during Aug '19. Will the support hold during Sep '19? The poor GDP number can turn out to be the 'joker in the pack'.

Daily technical indicators are looking neutral to bearish. MACD is rising above its signal line in bearish zone. ROC is facing resistance from its 10 day MA in neutral zone. RSI is seeking support from its neutral zone. Slow stochastic has dropped from its overbought zone.

Finance Minister announced a second 'booster package' after close of trade on Fri. Aug 30. This time it was a proposed merger of 10 smaller PSU banks to form four larger banks. Will it positively influence credit off-take in the near-term? Seems very unlikely.

The stock market wants 'big bang' labour reform and land reform plus scrapping of LTCG to revive bullish sentiment. Instead, it is getting peripheral reforms in dribs and drabs and lectures on fitness, holidays within India, and 'all is well' in Kashmir. Be prepared for more listless index performance - if not a crash.

NSE Nifty index chart pattern

The weekly bar chart pattern of Nifty moved above the 11100 level intra-week - as it had done in each of the past three weeks - but failed to move above its 50 week EMA once again.

The index corrected to close inside the 'support zone' (between 11100 and 10700) for the fifth straight week, but gained almost 194 points (1.8%) on a weekly closing basis.

Weekly technical indicators are looking bearish and oversold. MACD is falling below its signal line. ROC is below its falling 10 week MA, and is trying to emerge from its oversold zone. RSI has slipped inside its oversold zone. Slow stochastic is moving sideways along the edge of its oversold zone.

Nifty's TTM P/E has moved up to 27.27 - which is above its long-term average in overbought zone. The breadth indicator NSE TRIN (not shown) is moving up inside its oversold zone. Some near-term index downside or consolidation is possible.

Bottomline? Sensex and Nifty charts are at long-term support zones. A couple of 'booster packages' announced by Finance Minister has failed to revive bullish sentiment. A lower-than-expected Q1 (Jun '19) GDP figure and the ongoing US-China trade spat are not going to help the cause of bulls. Small investors should stay on the sidelines, but not stop their SIPs.