The gravity-defying bull run in gold prices is the dominant story in the investment world - a flight to safety caused by the fall in the value of the US Dollar against global currencies, as the western economies trudge along on the long road to economic recovery.

In his guest post this month, KKP explains the relationship between two of the major forces that drive the global economy – the US Dollar and gold prices. He also gives practical advice about what investors should do if they are contemplating an investment in gold (or precious metals) now.

---------------------------------------------------------------------------------------

Gold, Dollar and Economy

A Brief History of Gold and the Dollar

So, what is puzzling everyone is what is happening with US$, Gold, US Economy, and Global Economy. Well, this is a complex puzzle, but one that should be understood well to know what we are going through, and what is coming at us….

Gold does relate to the dollar…..Up until now it related inversely (mathematically speaking). Gold almost never changes in value under that theorem. It is the dollar that revalues in relationship and valuation of gold. For example, in 1920 a good quality men's suit cost a typical $20 gold piece (I collect some of these coins myself). A similar custom-sown, quality, name-brand suit today can be purchased with about the same amount of gold. So, then why this mad rush into gold, you might say.

Let’s first understand the history lesson of relationship of gold and dollar, and then bring it quickly to the current timeframe. The true relationship is tied to the concept of physical or tangible asset versus a paper-based financial asset. Tangibles like real estate or an antique painting has a real value, while the paper-based dollar is just a representation of the underlying real value (subject to change).

In 1944, the Bretton Woods Agreement launched the first system of convertible currencies and fixed exchange rates, requiring participating countries to maintain the value of their currency within a narrow margin against the US dollar, which was fixed at a rate of $35 per gold ounce. However, in the 1950s and 1960s, the increasing supply of US dollars along with capital outflows aimed at Europe’s postwar recovery put downward pressure on the dollar. Eventually, a series of dollar devaluations in the early 1970s ended the Bretton Woods system, allowing the dollar to be freely traded and freely sold, beginning the long drawn-out period of the falling dollar. And, it is still falling…

![clip_image002[6] clip_image002[6]](http://lh6.ggpht.com/_c85BpwsJIVk/TMlayziV5OI/AAAAAAAABts/_MLki6hKlWM/clip_image002%5B6%5D_thumb%5B1%5D.jpg?imgmax=800)

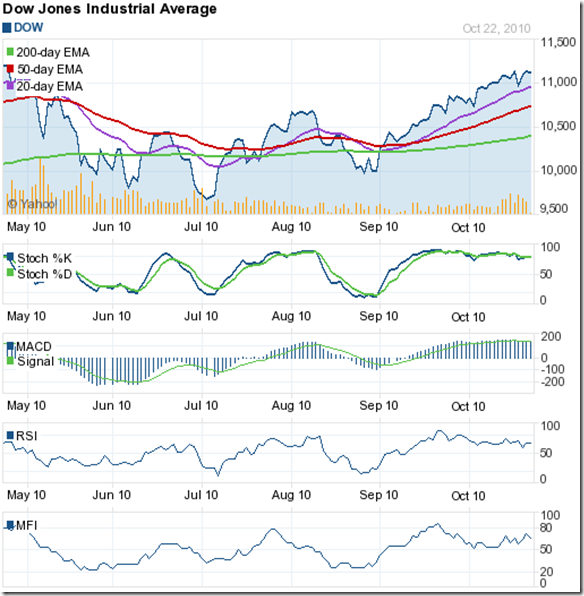

Inverse Relationship of Gold and Dollar

The most recent memory that most investors have in currency/equity/commodity markets is the inverse relationship between the US Dollar Index and the Price of Gold. This relation occurs because gold has for the longest time been used as a hedge against inflation. As the value of the dollar decreases, it will take more dollars to buy a gold coin, and therefore it automatically increases the price of gold. Now, why does the dollar value fluctuate in the first place? It does so, based on Washington’s thought process, comments and shifts in the monetary policies (Federal Reserve). Volcker, Greenspan and now Bernanke have been carefully weighing the movements of rates, inflation as well as valuation of the dollar all of these years. Over the last few decades, Fed has used the fed-funds rate to control inflation and stimulate the economy, and therefore, affected the price of gold. Value of Gold is for the most part determined by the supply and demand, as it should be, without interference from shifts in Washington’s monetary policies. No…no. As we said earlier, they are inversely proportional, and hence it fluctuates based on value of dollar and also the supply/demand (production of gold vs. demand by consumers/industries) characteristics.

If you look between Jan ‘99 and Jun ‘08, the correlation between dollar and gold has been a -0.85 (negative), indicating a very close negative correlation (inverse). Temporary inconsistencies have also occurred as noticed between Apr-Dec ’05. This is when the correlation switched to a +0.68 (both moved in the same direction). All of that was due to the policy shifts affecting the dollar.

![clip_image002[8] clip_image002[8]](http://lh6.ggpht.com/_c85BpwsJIVk/TMla2BV05bI/AAAAAAAABt0/iAW7KOd4X6k/clip_image002%5B8%5D_thumb%5B1%5D.jpg?imgmax=800)

So, when Fed lowers rates, corporate and personal borrowers take out loans and supply of money increases in the system. Demand for dollar decreases, and therefore dollar goes down in value. When they hike the rates, putting the reigns on inflation, it pumps money back out, and strengthens the dollar. When dollar becomes stronger, it naturally devalues gold.

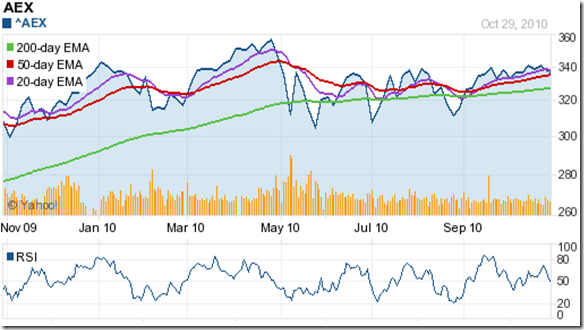

Current Mayhem in Dollar and Boost in Gold

My money market or savings earns 0.01% per annum (compounded), even for amounts over $10,000! With the rates this low the dollar’s widespread sell-off continues with the Euro hitting its highest level against the greenback and the Japanese Yen reaching a 15-year high. The dollar index (DXY is an index of a bunch of western currencies) reached its lowest point of the year, confirming a mass movement-against-dollar with investors chasing higher yields in other currencies. Another sign of US dollar weakness is demonstrated by the number of currencies passing parity (e.g. 1 Canadian dollar buys more than 1 USD). Canadian dollar moved up in 2010 and the Australian dollar recently hit parity having risen to its highest level in over 25 years. This is why I have been moving my money to Australia.

The US dollar’s decline also highlights the sputtering American economy versus many other countries. Bernanke just confirmed a few days ago that the Fed may have to undertake another round of bond-buying which will devalue the dollar further. He is almost copying what other central bankers are doing, which is why all of those currencies are going down also. This is precisely why I started moving US$ to Australia where there has been tightening monetary policy through rate hikes. With family in Australia, I am doing it without much worry.

Gold’s Current Rally

Gold is in the midst of the greatest bull market of all times because interest rates have been at historic lows and dollar is weak. The sputtering global economies have caused major nervousness to the point that the pundits are predicting a complete collapse of certain countries including the US in 2010-2012. In response, gold has enjoyed a run throughout 2009 & 2010 as investors worried about inflation, countries going bankrupt, individual states within the US shutting down, and the mounting US debt (a time-bomb waiting to blow, as some people think). Again, whenever people got spooked by any financial instrument in the past 20-30 years, gold had become the safe-haven to go to. Recently at a party, Gold was the major topic of discussion. Usually, this indicates a sign of too much optimism, which generally leads to a correction down the road. Remember the reverse happens even faster like any other boom, but it is unlikely to happen in the near future for Gold/Silver/Platinum/Diamond based on the circumstances facing Europe and North America today.

So, a Logical Question: Should you Swallow the Gold Pill?

![clip_image002[10] clip_image002[10]](http://lh5.ggpht.com/_c85BpwsJIVk/TMla5KxDfYI/AAAAAAAABt8/15P0NfktHjo/clip_image002%5B10%5D_thumb%5B1%5D.jpg?imgmax=800)

Well, this is always the age old question that gets asked in any Bull Market. It is hard to answer for people who feel left out. Inflation concerns are real, USD issues are real (with the massive printing going on), and future of many countries can be questioned with ease. So, is gold then a good safe-haven?

My feeling is that if there is any recovery in the US and/or Europe, there will be a resting phase for gold that may happen in 2011 and 2012, when the ‘bubble mania’ shifts the attention from commodities to equity or bonds. When media starts ringing the bell on any investment avenue (as published reports in Barrons, Time, Newsweek exemplify), it doesn’t stay up too long. So, my feeling is that new investment funds should wait it out if you are not already invested in gold/precious metals. If you are already invested in gold/silver/platinum/diamond, then hold on for now.

Will gold go to $1400-1500 per ounce and then come back and settle at $1000-1100? Maybe. Q4 ’10 through Q2 ’11 will be a big test for a lot of countries, economies and families. If economies sputter forward in the US/Europe without any major Obama or Federal Reserve or EU interventions, we will have higher rates which will strengthen the dollar and give us that buying opportunity. And, that is all we can hope for since most investors live on optimism…

PS: I am a holder of Gold, Silver, Diamond in various forms, including ETF, and hence may have a biased opinion.

PPS: Click on the hyperlink below or type the URL to get the chronology of what happened between 1792 and 1973:

History of the Dollar's Connection to Gold - An Outline(http://www.coinsite.com/content/faq/dollarvsgold.asp)

--------------------------------------------------------------------------------------

KKP (Kiran Patel) is a long time investor in the US, investing in US, Indian and Chinese markets for the last 25 years. Investing is a passion, and most recently he has ventured into real estate in the US and also a bit in India. Running user groups, teaching kids at local high school, moderating a group in the US and running Investment Clubs are his current hobbies. He also works full time for a Fortune 100 corporation.

![clip_image002[6] clip_image002[6]](http://lh6.ggpht.com/_c85BpwsJIVk/TMlayziV5OI/AAAAAAAABts/_MLki6hKlWM/clip_image002%5B6%5D_thumb%5B1%5D.jpg?imgmax=800)

![clip_image002[8] clip_image002[8]](http://lh6.ggpht.com/_c85BpwsJIVk/TMla2BV05bI/AAAAAAAABt0/iAW7KOd4X6k/clip_image002%5B8%5D_thumb%5B1%5D.jpg?imgmax=800)

![clip_image002[10] clip_image002[10]](http://lh5.ggpht.com/_c85BpwsJIVk/TMla5KxDfYI/AAAAAAAABt8/15P0NfktHjo/clip_image002%5B10%5D_thumb%5B1%5D.jpg?imgmax=800)