The European index chart patterns are struggling around the 50% Fibonacci retracement levels of their entire bear market falls. That means, technically, they are still in long-term bear markets. Some are trading above their 200 day EMAs, in an effort to return to a bull market. Here are the 5 year charts of some of the European indices.

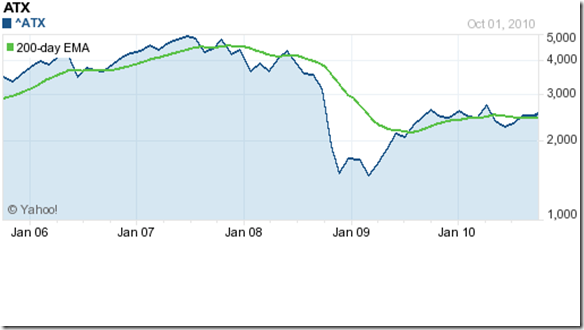

Austria ATX Index Chart

The Austria ATX index is just above the 200 day EMA, but is one of the worst performers of the European indices. It has failed to get close to the 50% retracement level of its bear market fall. The long-term moving average is drifting downwards.

France CAC 40 Index Chart

The CAC 40 index, like the Austria ATX index, has been scraping bottom – failing to regain even 50% of its bear market fall. The 200 day EMA has started to slip down, and the index is likely to follow.

Germany DAX Index Chart

The DAX index chart is moving up above a rising 200 day EMA – sign of a bull market. It has moved past the 50% retracement level of its bear market fall, but is well below its 2007 top. Crossing the 2008 top of 7000 will be the first priority to restore the bullish health of the index.

Netherlands AEX General Index Chart

The Netherlands AEX General index chart is trying hard to reach the 50% retracement level of its bear market fall – trading just above a flat 200 day EMA. The index has been trading in a sideways rectangular band of about 50 points for a year now. Such a long sideways consolidation could lead to a strong break out upwards.

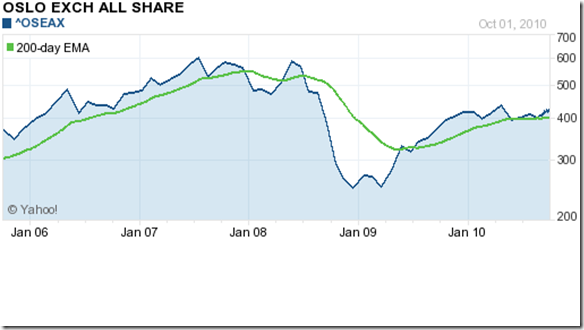

Oslo All Share Index Chart

The Oslo OSEAX index chart has exactly retraced 50% of its bear market fall, and is trading above the 200 day EMA. The index has been trading in a 70 point sideways channel for the past year, and is likely to break out upwards.

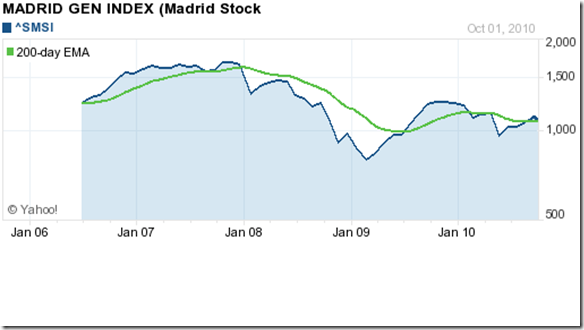

Madrid General Index Chart

The Madrid General index chart is one of the underperformers – along with the Austria ATX and France CAC 40 index charts. The index is about to drop below the flat 200 day EMA and remains in a long-term bear market.

Stockholm General Index Chart

The Stockholm General index chart is back in a bull market – making higher tops and bottoms above a rising 200 day EMA. The Swedish index is one of the better performers, along with the German DAX index.

Swiss Market Index Chart

The Swiss market index chart has slipped below the falling 200 day EMA. It managed to retrace 50% of its bear market fall before dropping down. The index is one of the underperformers among the European indices.

UK FTSE 100 Index Chart

The FTSE 100 index chart is making a determined effort to fend off the bear grasp – but hasn’t been too successful so far. London is still considered by some to be the financial capital of the world. The FTSE 100 chart seems to be singing the Gershwin song: It ain’t necessarily so.

Bottomline? The 5 years European index charts are showing the clear effects of the economic downturn. The quantitative easing programmes haven’t worked very well so far. The Swedish and German markets are showing promise. The Oslo All Share and the Netherlands AEX indices can also be considered for investment. The rest should be avoided till they show signs of recovery.

No comments:

Post a Comment