The 50 bps (0.5%) interest rate cut by the RBI Governor came as a positive surprise for the market. The consensus estimate was a 25 bps cut – and as often happens, the consensus estimate was wrong!

SBI immediately announced transmission of 40 bps of the cut to its base rate for borrowers. Other banks have followed with cuts of 30-35 bps to their base rates. The stock market has celebrated the good tidings with a rally.

FIIs remain sceptical. As per provisional figures, their net selling in equities during Sep ‘15 has exceeded Rs 11000 Crores. DIIs were net buyers of equity worth more than Rs 10000 Crores. Interestingly, DIIs were net sellers today for the first time this month, as FIIs turned marginal net buyers.

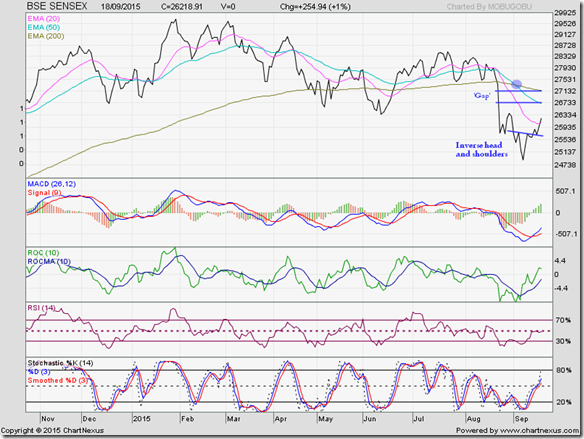

The daily bar chart pattern of Nifty has been trading below the big 165 points ‘gap’ that formed below all three EMAs in bear territory on Aug 24 ‘15. Such ‘gaps’ act as resistance zones during future up moves.

However, the entire trading below the ‘gap’ appear to be forming an ‘inverse head and shoulders’ reversal pattern with the ‘neckline’ at the lower edge of the ‘gap’.

The left shoulder (marked LS) and Head of the pattern have been completed. The right shoulder (marked RS?) is still in the process of formation. If the pattern does play out, the index should fill the ‘gap’ and move above its three EMAs into bull territory.

But will the down trend from the lifetime high touched in Mar ‘15 (marked by blue down trend line) be reversed convincingly? There are two arguments against it and one argument for it.

First, ‘gaps’ formed in bear territory often get filled, but the down trend usually resumes subsequently. Second, FIIs need to turn buyers in a big way. For that to happen, Q2 (Sep ‘15) results need to be a lot better than Q1 results. The odds are low.

However, the ‘inverse head and shoulders’ pattern has measuring implications. The depth of the ‘head’ below the ‘neckline’ should be added to the ‘neckline’ to arrive at an upward target of about 8580. That should carry the index above the down trend line.

Daily technical indicators are beginning to look bullish. MACD is rising above its signal line in negative zone. Note that the signal line has formed a bullish ‘rounding bottom’ pattern. ROC has started rising below its 10 day MA in positive zone. RSI is climbing towards its overbought zone. Slow stochastic reversed direction after facing resistance from the edge of its overbought zone but is trying to move up again.

It will require strong buying support for the index to fill the ‘gap’ and move higher. That may not happen right away.