Just when everyone started wailing ‘bear, bear’ and speculating about the depths to which the Indian stock market would collapse, the bears turned into bulls. The FIIs bought big on the last day of the week.

Shorts went scurrying to the exit doors. Government’s announcement of an increase in gas prices could not have come at a more opportune time. Suddenly, the dark clouds of gloom and doom parted and the sunshine of higher index levels shone through.

Did the fundamentals change suddenly? It never does. Technically, indices were oversold. That doesn’t always mean a turn around in trend. Is this a relief rally, or a return to a bull market?

Some concluding comments from last week’s analysis are worth repeating: “Both indices should rise to new highs after the corrections are over. Use the dips to add to existing portfolios, but maintain suitable stop-losses.”

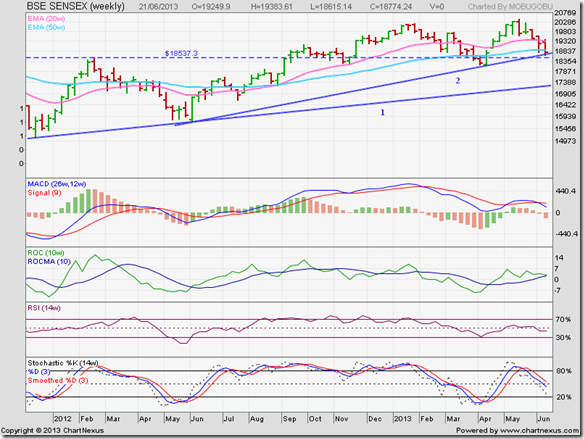

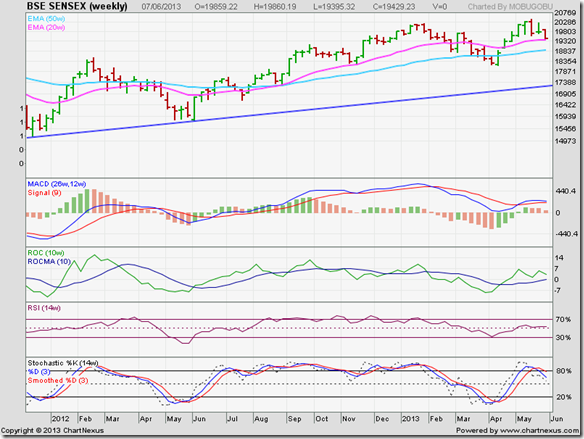

BSE Sensex index chart

The daily bar chart of the Sensex briefly breached the up trend line connecting the Jun ‘12 and Apr ‘13 bottoms. But the breach wasn’t convincing, as the index remained within the 3% ‘whipsaw’ limit. Technically, the support from the trend line held.

The subsequent bounce created an upward ‘gap’ as Sensex moved above its 200 day EMA. A break out with a ‘gap’ is considered a ‘stronger’ break out. Note that the ‘gap’ zone between 18060 and 18290 (formed back in Sep ‘12) again provided support to the Sensex – just as it had done in Nov ‘12 and Apr ‘13.

Daily technical indicators are turning bullish. MACD has turned up from its oversold zone to touch its falling signal line. ROC has climbed above its 10 day MA into positive territory. RSI has moved up to its 50% level. Slow stochastic is also rising towards its 50% level.

Sensex has moved above all its three EMAs, back into bull territory. The up move is likely to resume.

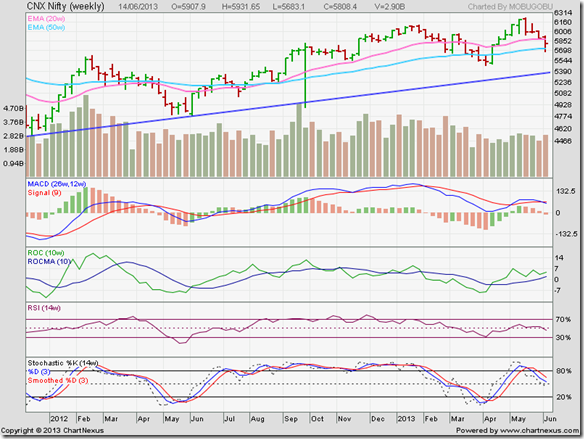

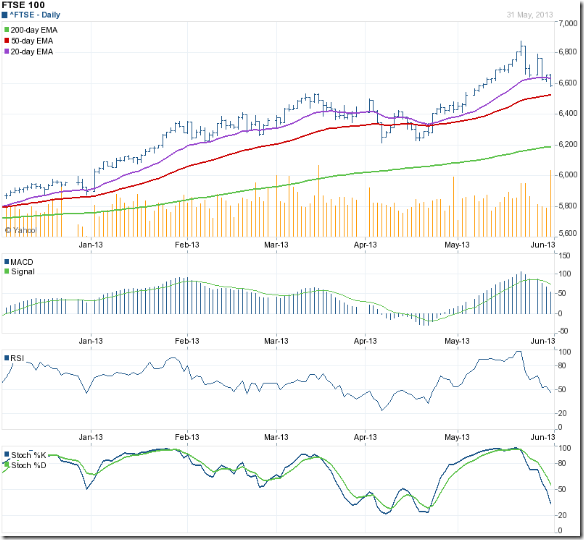

NSE Nifty 50 index chart

The weekly bar chart pattern of Nifty shows two blue up trend lines – the first is a longer-term up trend connecting the Dec ‘11 and Jun ‘12 lows (marked ‘1’) and the second is a shorter-term up trend connecting the Jun ‘12 and Apr ‘13 lows (marked ‘2’).

Ignoring the ‘error trade’ on Oct 5 ‘12 because it isn’t technically significant, up trend line ‘1’ has not yet been breached. Up trend line ‘2’ was breached intra-week during the past two weeks, but the index failed to close below the trend line. Technically, up trend line ‘2’ has not been breached either.

Nifty formed a ‘reversal week’ bar (lower low, higher close) that should end the previous 5 weeks’ corrective move. The index crossed above its 50 week EMA on strong volumes and closed exactly on its 20 week EMA.

Weekly technical indicators are showing some signs of strength. MACD is below its signal line in positive territory, but has stopped falling. ROC has crossed below its 10 week MA, but remains positive. RSI has moved above its 50% level. Slow stochastic has slipped below its 50% level, but its downward momentum is waning.

Nifty is likely to resume its up move and attempt to scale new highs – provided FIIs continue their buying.

Bottomline? Chart patterns of BSE Sensex and NSE Nifty 50 indices received good support from their up trend lines after correcting from 2 year highs. Both indices should rise to new highs on the back of renewed FII buying. This is a good time to accumulate fundamentally strong stocks for the long-term.

(PS: If you are planning to add good mid-cap/small-cap stocks to your portfolio, but are not sure which stocks to pick, book your subscriptions to my Monthly Investment Newsletter. New subscriptions will be offered from July 1-21, ‘13.)