BSE Sensex index chart

One can’t complain that trading or investing in the Indian stock market is dull! As if the daily and weekly price movements in indices and individual stocks are not challenging enough, one has to contend with a government that works only when pushed to a corner, irresponsible opposition parties, a wide variety of scams and corruption, and creaking infrastructure that is forever on the verge of a collapse.

By any account, last week’s trading had its fair share of thrills. Just as the market was digesting the FDI in retail announcement, came the news of the cabinet passing FDI in insurance and FDI in pension bills. While the latter require to be vetted by Parliament, and are by no means done deals, the very fact that these two bills have gone through the cabinet is a positive for the market.

What happened instead? A ‘flash crash’ in the Nifty (and a sympathetic minor crash in the Sensex) that was being passed off by NSE authorities as an ‘error’ made at a brokerage terminal. If an ‘error’ can cause the Nifty to drop by 900 points within seconds, then NSE authorities should shoulder the blame for having ineffective software systems. The way high-value shares were picked up quickly at much lower prices smells strongly of a well-executed scam.

One of the main reasons for looking at longer-term charts is that daily gyrations and aberrations get smoothened out, revealing the underlying trend. That is precisely what can be observed on the 2 years weekly closing chart of the Sensex. A prolonged bear phase showed the first sign of ending when the index touched a higher bottom in Jun ‘12 (marked by blue uptrend line 1).

Another steeper uptrend (marked by blue uptrend line 2) is in progress. The Sensex rose past its Feb ‘12 top – forming a bullish pattern of higher bottoms and higher tops. The 20 week EMA crossed above the 50 week EMA, technically confirming a return to a bull market.

Bull markets climb ‘a wall of worry’ – and there is plenty to be worried about the Indian and global economies. The more immediate worry is the proximity of a strong resistance zone between 19100 and 20000. This resistance zone has to be overcome if the bulls are to regain control.

Weekly technical indicators are bullish, but looking overbought. MACD is rising above its signal line in positive territory. ROC is also positive and moving up above its rising 10 week MA. RSI and slow stochastic are both inside their overbought zones, but touched lower tops while the index rose higher. The index is trading more than 1500 points above its 50 week EMA.

A correction/consolidation may be around the corner.

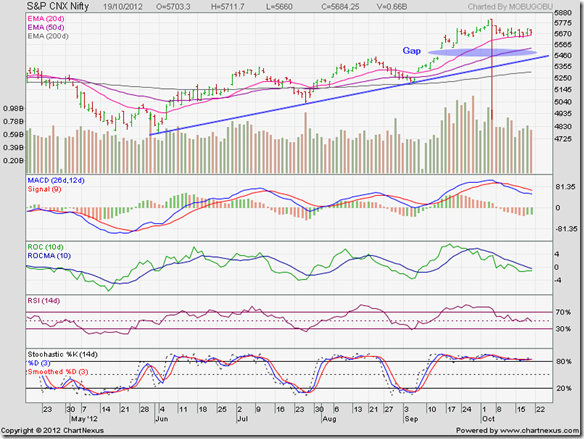

NSE Nifty 50 index chart

Daily movements in an index or a stock are useful in technical analysis, particularly for those who indulge in short-term trading. However, when supports, resistances, trend lines, stop-loss levels are breached, less importance is given to intra-day breaches. More important is whether the breach has been on a closing basis or not.

Large single day movements in an index or a stock are to be noted, but ignored for analysis purposes. Last Friday (Oct 5 ‘12), the Nifty fell a huge 900 points intra-day due to 59 ‘error’ trades, dropping below all three EMAs and the blue uptrend line (not shown in chart below), but closed only 40 points below its previous day’s close.

If you take the ‘flash crash’ into consideration then Nifty’s uptrend has ended – as the index dropped below its Jul ‘12 and Aug ‘12 lows, the uptrend line and all three EMAs. Even the longer-term uptrend line connecting the Dec ‘11 and Jun ‘12 bottoms (not shown in chart) was breached intra-day. But the 2 years daily closing chart of the Nifty is obviously still in an uptrend.

When a stock or an index falls a huge amount within a short time span, whether due to an ‘error’ or a ‘scam’, it is better to remain circumspect. More so in this case, because the Nifty had briefly entered a strong resistance zone between 5750 and 6000. The close just below the resistance zone on Friday may lead to some profit booking in the coming weeks.

Why? Because the Nifty touched a 17 months high, but all four technical indicators are showing negative divergences by failing to touch new highs. However, all four indicators are still bullish, so any correction is unlikely to be steep. Support can be expected from the 20 day EMA (at 5600), 50 day EMA (at 5450) and the blue uptrend line (at 5380).

Bottomline? Chart patterns of BSE Sensex and NSE Nifty 50 indices are in nascent bull markets, but need to cross above strong resistance zones. Both indices are likely to correct or consolidate before bulls can muster enough strength to test the Nov ‘10 tops in both indices. Use dips to enter, but maintain stop-losses. Book partial profits if you entered at lower levels.