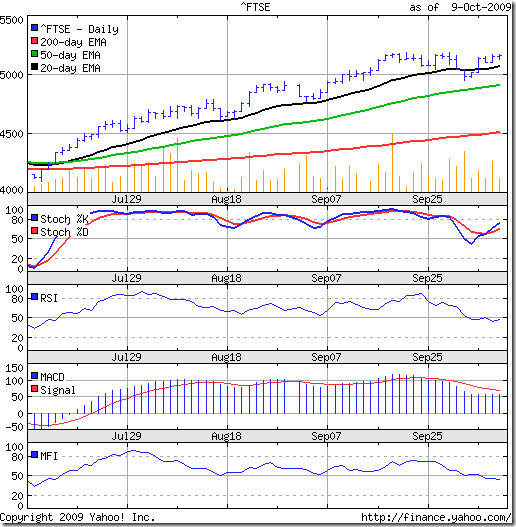

FTSE 100 index chart

In last week's analysis of the FTSE 100 chart pattern it was observed that the up trend line joining the Jul '09 and Sep '09 bottoms was broken and a pullback towards the trend line was expected. That is exactly what the FTSE did - providing good opportunities for selling.

Remember that as per trend analysis theory, a trend remains in place till it is broken. The three EMAs are still moving up, so the bull rally continues. But to gather momentum, the index needs to make new highs.

The slow stochastic has changed direction and moved up sharply, but the other indicators are looking bearish. Both the RSI and MFI are below their 50% levels and the MACD is below the falling signal line. IT should be an interesting tussle between the bulls and bears next week.

DAX index chart

The DAX got good support at the 50 day EMA and also had a pullback towards the trend line connecting the Jul '09 and Sep '09 bottoms. But the volumes haven't been inspiring for the up move to continue much longer.

The technical indicators are looking a lot like those of the FTSE. The RSI is touching the 50% level, but the MFI is way below. The MACD has moved up a bit but remains below the signal line.

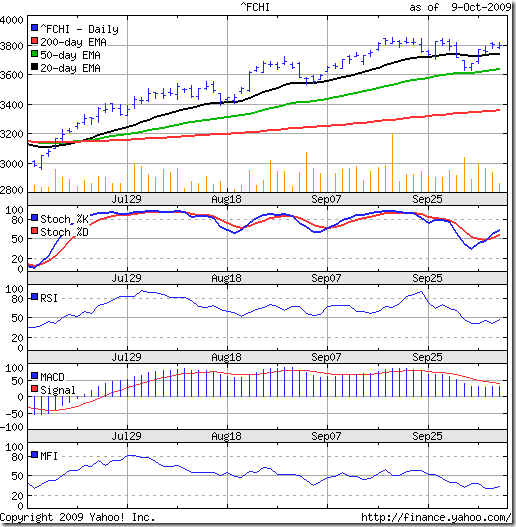

CAC 40 index chart

The CAC 40 chart pattern looks similar to its neighbour's, with the technical indicators looking slightly weaker. The volumes have tapered off. The 20 day EMA has started to flatten out.

Unless the index can move above the prior week's high of 3845 made on Sep 29 '09, the bull rally may be over. A bearish lower top and lower bottom pattern is getting formed.

Bottomline? The stock index chart patterns of the European indices are indicating a desperate fight back by the bulls to regain control. But with every passing day, the rally is getting weaker. Investors should start book profits and save the cash for buying after a proper correction.

No comments:

Post a Comment