Hang Seng index chart

The extended vacation at the Shanghai market enabled the bulls to regroup. After receiving strong support at the 50 day EMA, the Hang Seng index jumped back above the 20 day EMA in a determined effort to attempt a new high. The bears managed to stop the bull charge, as the index closed almost flat on Fri, Oct 9 '09.

Nevertheless, the Hang Seng closed more than 5.5% higher for the week. The up trend line joining the bottoms made in Apr '09 and Jul '09 provided support to the recent correction. All three EMAs are moving up again, and the bull market is intact after a healthy correction.

The volumes haven't picked up much, which puts a question mark on the sustainability of the rise. The technical indicators are giving mixed signals. The slow stochastic has bounced off nicely from the oversold zone, but hasn't crossed the 50% level yet. Both the RSI and MFI are below their 50% levels. The MACD has moved up but remains below the signal line.

Watch out for the previous top of 21930 made on Sept 17 '09. That needs to be cleared by the bulls.

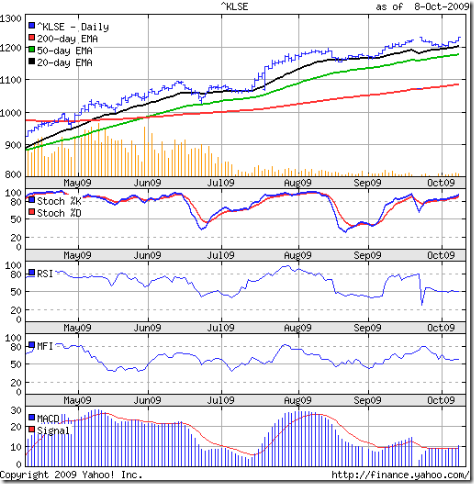

Malaysia (KLCI) index chart

The Malaysia KLCI index was looking stronger than the Hang Seng four week's back. Let us see if there has been any change in sentiments since then.

The KLCI index continues to look stronger than the Hang Seng. The minor correction received support from the 20 day EMA as the bulls renewed their charge. Today (Oct 9 '09) the index made a new high of 1237 before closing at 1234 - but has managed to gain only 2% in the past four weeks.

Volumes continue to disappoint. The slow stochastic is in the overbought zone. The RSI is at the 50% level. The MFI is just above the 50% level. The MACD has moved above the signal line.

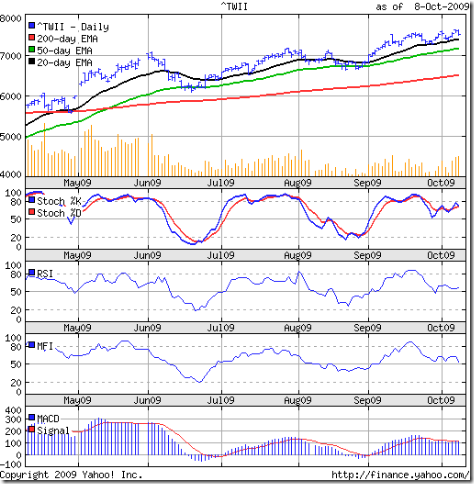

Taiwan (TSEC) index chart

The bulls are in control of the Taiwan TSEC index, which made a new closing high of 7609 on Wed, Oct 7 '09. After making a higher high of 7636 on Oct 8 '09 the index fell back and closed at 7503 - a 'reversal day' pattern. It jumped back up and closed at 7572 today - but made an 'inside day' pattern (higher low but lower high), which suggests indecision.

The technical indicators made lower highs - showing negative divergences. The slow stochastic is just below the overbought zone. The RSI is above the 50% level. So is the MFI. The MACD is touching its signal line.

Bottomline: The Asian index chart patterns continue to look bullish, but the upward momentum has slowed down. The Shanghai Composite rose nearly 5% today after a long holiday break. The Chinese index is still in a correction mode, and holds the key to further up moves of the Asian indices. Keep tight stop losses.

No comments:

Post a Comment