Shanghai Composite index chart

A full week's trading after a long holiday saw the refreshed bulls lead a new charge, as the Shanghai Composite index managed to inch above its 50 day EMA. The 3000 level proved a strong resistance as the index failed to close above the psychological level.

The technical indicators are showing mild bullishness - an improvement over what was observed 2 weeks back. The slow stochastic has gone above the 50% level. The RSI and ROC are both at the 50% levels. The MACD is negative but is now above the signal line.

The 20 day EMA is below the 50 day EMA, but it seems to be making an effort to move above the medium term average. It failed in its previous attempt last month. Another failure could lead to a deeper correction.

The Shanghai Composite is 500 points below its previous high of 3478, made on Aug 4 '09. Till a higher top is made, the bull market will not resume.

Hang Seng index chart

There was no stopping the bulls as the Hang Seng index made a new high of 22250 on Thu, Oct 15 '09 on good volumes, and closed for the week exactly at its previous top of 21930 made on Sep 17 '09.

There has been a significant improvement in all the technical indicators. The slow stochastic has just entered the overbought zone. The RSI and ROC are both above their 50% levels. The MACD is positive and above its signal line. All three EMAs are moving up together with the index.

The Hang Seng index chart is in much better shape than its mainland big brother. But there are some concerns about the bull market's sustainability. All four technical indicators are exhibiting negative divergences by failing to make new highs.

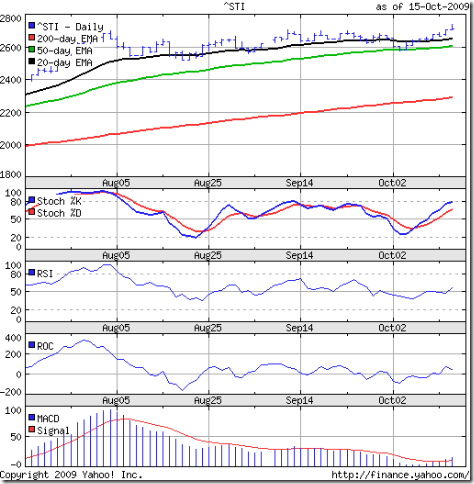

Straits Times (Singapore) index

The Singapore Straits Times index chart was struggling to cross the 2700 level when I had last looked at it 3 weeks back. The index failed to make much progress, and consolidated sideways before finally breaching its previous top of 2707 made on Sep 10 '09 as it made a new high of 2740 on Thu, Oct 15 '09.

The index closed the week at 2708, just a point above its previous top. The technical indicators are all looking bullish, much like its Hong Kong counterpart. The negative divergences are also clearly visible, putting a question mark on the future of the bull market.

Bottomline? The Shanghai Composite index chart hasn't quite shaken off the bears. The Hang Seng and Straits Times charts are looking bullish, but the bears seem to be hiding in the shadows and waiting for a suitable opportunity to pounce. Maintain strict stop losses.

No comments:

Post a Comment