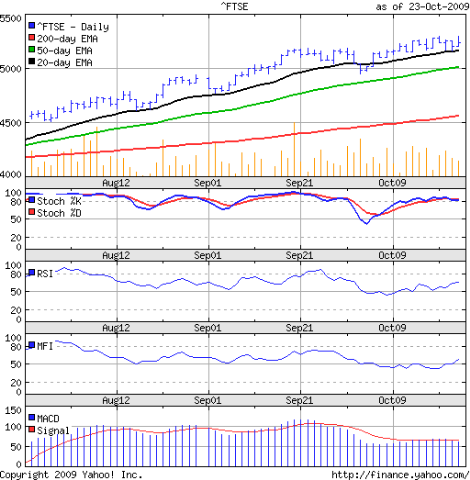

FTSE 100 index chart

The FTSE 100 index managed to close marginally higher - unlike its neighbours across the channel - during a sideways week of trading. There was resistance at the 5300 level and support from the 20 day EMA.

The volumes remain a concern - two of the up days on Oct 19 and 23 had lower volumes than down days on Oct 20 and 22. Bull markets require strong volumes to survive. The negative divergences in the technical indicators is also a worry.

All three EMAs are moving up. The slow stochastic remains in overbought zone. The RSI and MFI are both above the 50% level. Only the MACD has slipped a bit below the signal line.

The FTSE 100 has been making higher tops and bottoms, but of late the upward momentum is slowing. In the past one month, the index has barely gained 2%.

DAX index chart

The DAX index made a new high of 5888 on Oct 20 but could not sustain the up ward momentum and had a 'reversal day' on Oct 23 to close 3 points lower for the week. The 20 day EMA, which has flattened, provided good support.

The volumes have been so-so. The technical indicators look a little weaker than those of the FTSE, and the negative divergences are worrisome. The slow stochastic has dropped from the overbought zone. The RSI is above the 50% level, but the MFI could not move above the mid-point. The MACD is touching the signal line.

The DAX index has gained less than 1% in the past one month.

CAC 40 index chart

The CAC 40 index made a new high of 3914 on Oct 20, but could not sustain the upward momentum either, and closed 19 points lower for the week. Another 'reversal day' at the end of the week on good volumes - just like the previous week - doesn't augur well for the bulls.

Both the 20 day and 50 day EMAs are beginning to flatten, though the 200 day EMA is still moving up. The slow stochastic has dropped below the overbought zone. Both the RSI and MFI are above the 50% levels. The MACD has slipped below the signal line.

Negative divergences in the technical indicators put a question mark on the sustainability of the bull rally. Note that the CAC 40 index is 14 points below its closing level a month ago.

Bottomline? The chart patterns of the European indices show that the momentum of the bull rallies are slowing, with negligible gains in the past one month. Keep trailing stop losses and take partial profits.

No comments:

Post a Comment