FIIs were net sellers of equity on all three trading days this week. Their total net selling was worth Rs 40.2 Billion. DIIs were net buyers on all three days. Their total net buying was worth Rs 50.5 Billion, as per provisional figures.

Traditional bellwethers of rural consumption – two-wheeler and tractor sales – have moderated to 5% YoY in Q3 from 16-25% in Q2. Higher fuel prices are also starting to hurt urban demand – September witnessed a 3.6% YoY contraction in passenger vehicle sales.

The daily bar chart pattern of Nifty touched an intra-day low of 10005 on Fri. Oct 26 - its lowest level in 7 months - but all three technical indicators touched slightly higher lows. The positive divergences triggered a sharp counter-trend rally that is facing resistance from the falling 20 day EMA.

The 50 day EMA is on the verge of crossing below the 200 day EMA. The 'death cross' will technically confirm a bear market. From its Aug 28 top of 11760, the index has corrected almost 15% by touching last Friday's low of 10005. A 20% correction is another technical confirmation of a bear market.

Daily technical indicators are turning bullish. MACD has crossed above its signal line inside oversold zone. RSI is rising towards its 50% level. Slow stochastic has emerged from its oversold zone, and is rising towards its 50% level.

Some more near-term upside is possible. Use the rally to get rid of under-performers in your portfolios. Expect bears to start selling at any time.

Nifty's TTM P/E has moved up to 25.0, which is much higher than its long-term average. The breadth indicator NSE TRIN (not shown) is moving down in neutral zone, suggesting some consolidation.

Oil's price is rising again. Rupee depreciated against the US Dollar today. Tata Motors declared disappointing numbers. Liquidity problems of NBFCs may get worse before they get better. Government's public spat with RBI could have been handled better. The sordid CBI saga continues.

The stock market may take more time to find a proper bottom. The 10000 level is likely to get breached sooner than later.

WTI Crude Oil chart

The daily bar chart pattern of WTI Crude Oil started correcting after touching a 52 week high of 76.90 on Oct 3. After receiving some support from its 50 day EMA, oil's price dropped sharply below its 50 day EMA on Oct 17.

Three days of sideways consolidation was followed by another sharp fall below its 200 day EMA on Oct 23. Since then, oil's price has been consolidating within a bearish 'flag' pattern. Some more consolidation/correction is likely.

Daily technical indicators are looking bearish and oversold. MACD is falling below its signal line and entered its oversold zone. RSI is hovering just above its oversold zone. Slow stochastic is trying to emerge from its oversold zone.

The falling 20 day EMA has crossed below the falling 50 day EMA - like it did in Jun & Aug '18 - indicating near term bearishness. However, oil's price is trading just above its 200 day EMA, keeping bullish hopes alive.

On longer term weekly chart (not shown), oil's price bounced up after receiving support from its 50 week EMA, and closed above its 50 & 200 week EMAs in long-term bull territory. Weekly technical indicators are showing downward momentum. MACD is falling below its signal line in bullish zone. RSI and Slow stochastic are falling below their respective 50% levels.

Brent Crude Oil chart

Since touching a 52 week high of 86.74 on Oct 3, the daily bar chart pattern of Brent Crude Oil has undergone a sharp 13% correction. The 50 day EMA had provided some support on the downside.

However, on Oct 23, oil's price dropped below 76 followed by a further drop to 75.11 the next day. Since then, there has been a bit of a price recovery. On Oct 29, oil's price formed a 'reversal day' bar (higher high, lower close) that can lead to a correction towards the rising 200 day EMA.

Daily technical indicators are looking bearish and a bit oversold. MACD is falling below its signal line, and looks poised to enter its oversold zone. RSI is below its 50% level. Slow stochastic is trying to emerge from its oversold zone.

Oil's price is trading below its falling 20 day and 50 day EMAs - showing near term bearishness - but closed above its 200 day EMA in a bull market.

Rising global supply despite impending sanctions on Iran's oil exports, and weakness in global stock markets are contributing to bearish sentiments in the oil market.

On longer term weekly chart (not shown), oil's price dropped below its 20 week EMA after more than 2 months but manged to close above it, and well above its 50 week and 200 week EMAs in long-term bull territory. Weekly technical indicators are showing downward momentum. MACD is falling below its signal line in bullish zone. RSI and Slow stochastic are seeking support from their respective 50% levels.

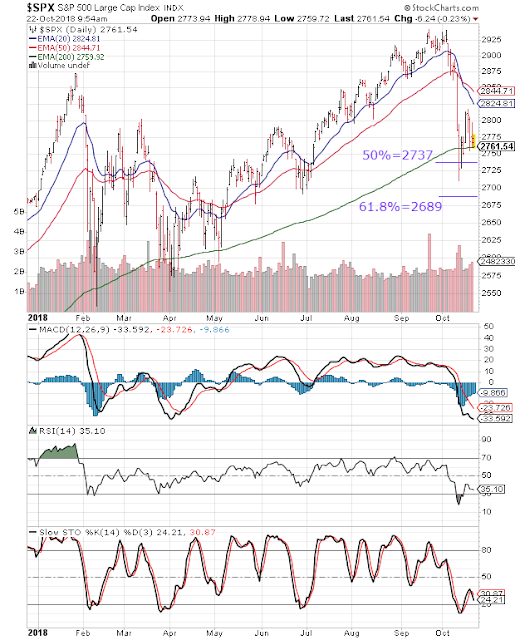

S&P 500 index chart pattern

The following remark was made in last week's post on the daily bar chart pattern of S&P 500: "Another likely breach of the 200 day EMA can lead to a fall towards the lower edge of the support zone."

The fall below the 200 day EMA was steeper than expected. On Fri. Oct 26, the index touched an intra-day low of 2628 and closed 30 points below the 61.8% Fibonacci retracement level of 2689. The strong volumes indicate that the index may fall lower.

The index is trading well below its three falling EMAs in bear territory. It seems that the entire 'Trump rally' - from the small 'double bottom' reversal pattern formed during Jan-Feb '16 to the 'double top' reversal pattern formed during Sep-Oct '18 - is facing correction, with a possible drop to the zone between 2400 and 2500.

Daily technical indicators are looking bearish and oversold. MACD is falling deeper inside its oversold zone. RSI is about to re-enter its oversold zone. Slow stochastic has re-entered its oversold zone. RSI and Slow stochastic are showing positive divergences by not falling lower with the index. A likely technical bounce may face more selling by bears.

On longer term weekly chart (not shown), the index closed below its 20 week and 50 week EMAs but well above its 200 week EMA in a long-term bull market. Weekly technical indicators are showing downward momentum. MACD is falling below its signal line in bullish zone. RSI is falling below its 50% level. Slow stochastic is about to enter its oversold zone.

FTSE 100 index chart pattern

The following comment appeared in last week's post on the daily bar chart pattern of FTSE 100: "Bulls needn't get too excited, as the index appears to be forming a bearish 'flag' pattern."

The index faced resistance from its falling 20 day EMA and then broke out below the bearish 'flag' (shaded) to touch an intra-day low of 6852 on Fri. Oct 26 - breaching its Mar 26 low - before recovering to close at 6940.

Daily technical indicators are correcting oversold conditions. MACD has crossed above its falling signal line in bearish zone, and seems to be forming a bullish 'rounding bottom' pattern. RSI and Stochastic have emerged from their respective oversold zones. A technical bounce is likely. (At the time of writing this post, the index is trading 90 points higher.)

On longer term weekly chart (not shown), the index closed below its three weekly EMAs in long-term bear territory. Weekly technical indicators are looking bearish. MACD is falling below its signal line in bearish zone. RSI has emerged from its oversold zone. Stochastic is trying to do the same.

FIIs intensified their net selling of equity shares during the week. Their total net selling was worth Rs 57.5 Billion. DIIs were net buyers of equity on all five trading days. Their total net buying was worth Rs 45.1 Billion, as per provisional figures.

India's fiscal deficit touched 95.3% of full year budget estimate during Apr-Sep '18, compared with 91% during Apr-Sep '17. Spending touched 53.4% against 53.5% last year, but receipts were 39% against 40.6% of full year budget estimate last year.

Liquidity position of India's financial markets have worsened with cash deficit widening to Rs 1.4 Trillion this week against a small surplus in the first week of Oct '18. RBI's efforts to improve the situation through bond purchases haven't helped much.

BSE Sensex index chart pattern

The following comment was made in last week's post on the daily bar chart pattern of Sensex: "A drop inside the Fibonacci support zone (between 33934 and 32372) is on the cards."

The index dropped and closed inside the support zone on Tue., Thu. and Fri. (Oct 23, 25 and 26). The 20 day EMA has crossed below the 200 day EMA for the first time since Nov '16. The imminent 'death cross' of the 50 day EMA below the 200 day EMA will technically confirm a bear market.

From its Aug 29 top of 38990, Sensex has corrected 14.6% by touching a low of 33349 on Fri. 26th. A 20% correction is technically treated as the start of a bear market. The index is not in a bear market yet, but it sure feels like one - since the index has spent 16 straight trading sessions below its 200 day EMA.

Incidentally, BSE Midcap index and BSE Smallcap index (not shown) have corrected 26% and 33% from their respective Jan '18 tops. 'Death cross' on both indices have technically confirmed bear markets. Sensex is likely to enter a bear market as well.

Daily technical indicators corrected oversold conditions but remain bearish. MACD is facing resistance from its falling signal line inside its oversold zone. ROC and RSI have emerged from their respective oversold zones, but are still inside bearish zones. Slow stochastic has re-entered its oversold zone.

All four indicators are showing positive divergences by touching higher bottoms while Sensex has dropped lower. Another technical bounce is likely. The previous bounce had faced resistance from the falling 20 day EMA.

Sensex may correct/consolidate some more. Large-caps are bearing the brunt of FII selling. It may be worthwhile to start looking at adding fundamentally strong mid-cap and small-cap stocks - particularly if they are already in your portfolios.

NSE Nifty index chart pattern

The following comment was made in last week's post on the weekly bar chart pattern of Nifty: "Formation of a weekly 'reversal' bar (higher high, lower close) is hinting at a further correction towards the lower edge (9827) of the Fibonacci support zone."

As if on cue, the index plunged to a low of 10004.55 - a level not seen during the past 7 months. For the 4th week in a row, the index closed below its 20 week and 50 week EMAs. It hadn't done that since Dec '16.

Weekly technical indicators are looking a bit oversold. MACD is falling below its signal line and has entered bearish zone. ROC is well inside its oversold zone, and is falling further. RSI has dropped to the edge of its oversold zone. Slow stochastic has entered its oversold zone for the first time since Mar '18.

Nifty's TTM P/E has moved down to 24.12, which is still above its long-term average. The breadth indicator NSE TRIN (not shown) is rising towards its oversold zone, suggesting some more near-term downside.

Bottomline? Both Sensex and Nifty charts have closed inside Fibonacci support zones. Macro headwinds like high oil prices, a weak Rupee, widening trade and fiscal deficits, ongoing debt woes of NBFCs have increased bearish sentiment. No signs of a market bottom are visible yet.

FIIs were net sellers of equity on all three trading days this week. Their total net selling was worth Rs 29 Billion. DIIs were net buyers on all three days. Their total net buying was worth Rs 22.9 Billion, as per provisional figures.

The net direct tax collection in India grew by 15.7% to Rs 4.89 Trillion YoY during the period Apr - Oct 3rd week, 2018 - meeting 42.5% of the full fiscal year target of Rs 11.5 Trillion.

Tight monetary conditions for NBFCs may soon begin to hit the economy as funds for consumption and investment are slowly getting squeezed. Sale of motorcycles, tractors, plywood and cement have slowed in the past few weeks.

The daily bar chart pattern of Nifty touched an intra-day low of 10102 on Tue. Oct 23 - its lowest level since Mar 28 '18. All gains made during Apr-Aug '18 got wiped out during Sep-Oct '18. The index is trading well below its three falling EMAs in bear territory.

Daily technical indicators are in bearish zones, and are not showing any upward momentum. MACD is facing resistance from its falling signal line inside its oversold zone. RSI is getting support from the edge of its oversold zone. Slow stochastic has re-entered its oversold zone.

Note that all three indicators showed positive divergences by touching slightly higher bottoms, when the index dropped lower. That may have triggered today's upward bounce. Is it possible that the index has formed a small 'double bottom' reversal pattern?

Technically, such a pattern will get confirmation only if Nifty manages to rally past its Oct 17 top of 10710 (where it had faced strong resistance from its falling 20 day SMA and had dropped towards the lower Bollinger Band). The odds for such a rally doesn't favour bulls.

Nifty's TTM P/E has moved down to 24.60, but still remains higher than its long-term average. The breadth indicator NSE TRIN (not shown) is moving down in neutral zone, suggesting some near-term upside.

Oil's price has come down from lofty levels and Rupee's fall against the US Dollar has temporarily stalled. That has provided brief respite to bulls. But FIIs are still in exit mode - so, more downside is likely.

Gold chart pattern

The daily bar chart pattern of Gold consolidated sideways within a 'rectangle' pattern for almost 8 weeks before breaking out upwards with a strong volume surge on Oct 11.

After a pullback to the top of the 'rectangle' the following day, gold's price rose to test resistance from the zone between 1240 and 1250. It has been consolidating sideways above its 20 day and 50 day EMAs, but remains below its falling 200 day EMA in a bear market.

A dip in the US Dollar index to 94.50 possibly triggered the upward breakout. The Dollar index has since moved above 95.50, putting a lid on gold's price.

Daily technical indicators are in bullish zones but not showing upward momentum. MACD is above its signal line but its up move has stalled. RSI is sliding down. Slow stochastic is about to drop from its overbought zone. Expect some more consolidation in the zone between 1220 and 1240.

On longer term weekly chart (not shown), gold’s price crossed above its 20 week EMA intra-week, but closed just below it, and well below its 50 week and 200 week EMAs in long-term bear territory. Weekly technical indicators are turning bullish. MACD formed a 'rounding bottom' pattern and crossed above its signal line in bearish zone. RSI has moved up towards its 50% level, but is not showing upward momentum. Slow stochastic has risen sharply above its 50% level.

Silver chart pattern

The daily bar chart pattern of Silver moved above its 20 day and 50 day EMAs, but retreated after touching a lower top. Since the beginning of the month, silver's price has been consolidating sideways within a 'triangle' pattern.

Volumes have been stronger on recent down days. In case of an upward breakout from the 'triangle', the zone between 15.0 and 15.2 can provide strong resistance.

Since a 'triangle' is an unreliable pattern, a downward breakout and a test of the Sep '18 low can't be ruled out. It would be prudent to wait for the breakout before taking any buy/sell decision.

Daily technical indicators are in neutral zones and showing downward momentum. MACD is above its signal line and moving sideways. RSI is seeking support from its 50% level. Slow stochastic is moving down towards its 50% level. Expect some more consolidation in the zone between 14.4 and 15.0.

On longer term weekly chart (not shown), silver’s price closed well below its three falling weekly EMAs in a long-term bear market. Weekly technical indicators have remained in their respective bearish zones after correcting oversold conditions.

S&P 500 index chart pattern

The following comments were made about the daily bar chart pattern of S&P 500 in last week's post: "...it formed an 'inside day' as well as a 'hammer' candlestick pattern. Bulls appear to be ready for a fight back."

The index dropped below its 200 day EMA on Mon. Oct 15, but managed to close above the support zone between 2737 and 2689 (the significance of these levels were mentioned in last week's post)

. It bounced up to touch an intra-day high of 2817 on Wed. Oct 17, but formed a bearish 'hanging man' candlestick pattern.

Bears used the opportunity to follow a 'sell on rise' strategy. The index dropped to seek support from its 200 day EMA, and closed flat for the week. (At the time of writing this post, the index is desperately trying to stay above its 200 day EMA - but for how much longer?)

Daily technical indicators are looking quite bearish. MACD is falling deeper inside its oversold zone. RSI and Slow stochastic emerged from their respective oversold zones but are moving downwards. Another likely breach of the 200 day EMA can lead to a fall towards the lower edge of the support zone.

On longer term weekly chart (not shown), the index remained below its 20 week EMA but closed above its 50 week and 200 week EMAs in a long-term bull market. Weekly technical indicators are showing downward momentum. MACD is falling below its signal line in bullish zone. RSI is sliding down below its 50% level. Slow stochastic is about to enter its oversold zone.

FTSE 100 index chart pattern

The following comment appeared in last week's post on the daily bar chart pattern of FTSE 100: "Stochastic has stopped falling, and can trigger a technical bounce."

It turned out to be a weak bounce. On Mon. Oct 15, the index formed a small 'reversal day' bar (lower low, higher close) by touching an intra-day low of 6961 - its lowest level in 7 months - but closing higher at 7029.

That triggered a small rally, as the index formed a bullish pattern of 'higher tops, higher bottoms'. Bulls needn't get too excited, as the index appears to be forming a bearish 'flag' pattern.

Daily technical indicators are trying to correct oversold conditions. MACD is below its falling signal line in bearish zone, but seems to be forming a bullish 'rounding bottom' pattern. RSI has just emerged from its oversold zone. Stochastic is still inside its oversold zone.

FTSE gained about 0.8% on a weekly closing basis, but is trading below its three EMAs in a bear market. Any further attempt to rally may face resistance from the falling 20 day EMA.

On longer term weekly chart (not shown), the index formed a small 'reversal' bar and just managed to close above its 200 week EMA but well below its 20 week and 50 week EMAs. Weekly technical indicators are looking bearish. MACD is falling below its signal line in bearish zone. RSI has emerged from its oversold zone. Stochastic is still inside its oversold zone.

In a holiday-curtailed trading week, FIIs were net sellers of equity on Tue. & Fri. (Oct 16 & 19) but net buyers on Mon. & Wed. (Oct 15 & 17). Their total net selling was worth Rs 15.8 Billion. DIIs were net buyers of equity on Mon. & Tue. but net sellers on Wed. & Fri. Their total net buying was worth Rs 10.1 Billion, as per provisional figures.

Passenger vehicle sales have declined for three consecutive months due to floods in Kerala and higher ownership costs leading to postponement of purchases.

As per RBI, India's foreign exchange reserves fell by US $5.1 Billion from $399.6 Billion in the week ending Oct 5 to $394.5 Billion in the week ending Oct 12. It was the highest weekly fall in 7 years.

BSE Sensex index chart pattern

The following remark was made in last week's post on the daily bar chart pattern of Sensex: "A pullback to the zone between 35370 and 35736, followed by a corrective move towards 32372 (lower edge of the support zone) seems like a possible outcome."

The index rallied past its 200 day EMA to touch an intra-day high of 35605 on Wed. Oct 17, but faced strong resistance from its falling 20 day EMA and closed 825 points lower. In the process, it formed a large 'reversal day' bar that ended the brief counter-trend rally.

On Fri. Oct 19, the index opened with a downward 'gap' and dropped to an intra-day low of 34140 before recovering to close at 34316 - losing more than 400 points (1.2%) on a weekly closing basis. A drop inside the Fibonacci support zone (between 33934 and 32372) is on the cards.

Daily technical indicators have corrected oversold conditions but remain in bearish zones. MACD is facing resistance from its falling signal line inside its oversold zone. RSI and Slow stochastic have emerged from their oversold zones, but are below their respective 50% levels. Only ROC is showing some upward momentum after crossing above its 10 day MA.

Reliance declared a good set of Q2 (Sep '18) numbers, as did HUL and TCS. But the stocks are facing selling pressure. Bears are in a punishing mood. Sensex may fall towards the lower edge of the support zone at 32372 - where bulls can be expected to put up a fight.

As mentioned in last week's post, a breach of 32372 can lead to a correction down to 30800. Should Sensex get there, it will be a good level to start bottom-fishing.

NSE Nifty index chart pattern

In last week's post on the daily bar chart pattern of Nifty, it was mentioned that a likely pullback rally towards the zone between the 50 week and 20 week EMAs was expected to trigger bear selling. That is precisely what happened.

The index rose above its 50 week EMA to touch an intra-week high of 10710, but bear selling led to a loss of 170 points (1.6%) on a weekly closing basis. The index closed just above the Fibonacci support level of 10283, but below its 20 week and 50 week EMAs in bear territory for the third straight week.

Formation of a weekly 'reversal' bar (higher high, lower close) is hinting at a further correction towards the lower edge (9827) of the Fibonacci support zone. A breach of 9827 can drop Nifty towards 9400.

Weekly technical indicators are looking bearish. MACD is falling below its signal line and is poised to enter bearish zone. ROC is inside its oversold zone, and is falling further. RSI has dropped towards its oversold zone. Slow stochastic has entered its oversold zone for the first time since Mar '18.

Nifty's TTM P/E has moved down to 24.83, which is still above its long-term average. The breadth indicator NSE TRIN (not shown) is rising in neutral zone, suggesting more near-term downside.

Bottomline? The corrections on Sensex and Nifty charts have found support at Fibonacci support zones again. Expected pullbacks towards long-term moving averages faced bear selling. Macro headwinds like high oil prices, a depreciated Rupee, widening trade and fiscal deficits, ongoing debt woes of NBFCs have increased bearish sentiment. Decent Q2 (Sep '18) corporate results announced so far have failed to cheer bulls.

The holy grail of investing is to find the biggest winning stocks in the market. The outliers. The stocks that break all of the records, i.e. the leaders that go up the most.

Studies have been published showing that all of the gains in the market over the decades are from only a handful of stocks. This means that, if your portfolio didn't have some of these leading stocks, it didn't outperform the market.

Read more at:

https://www.investopedia.com/trading/how-find-tomorrows-winning-stocks/

FIIs were net sellers of equity on Tue. Oct 16, but net buyers on the other two trading days this week. Their total net selling was worth Rs 9.6 Billion. DIIs were net buyers on Mon. & Tue. but net sellers on Wed. Oct 17. Their total net buying was worth Rs 10.1 Billion, as per provisional figures.

India's WPI inflation rose to 5.13% in Sep '18 from 4.53% in Aug '18 and an upwardly revised 5.27% in Jul '18. Higher fuel price was the main culprit.

Consumer goods companies are uncertain about the outlook for rural demand as below-normal monsoon rainfall in some states is set to hit income in rural areas.

The daily bar chart pattern of Nifty has reverted back to the control of bears. The counter-trend rally from the lower Bollinger Band came to a screeching halt today.

The index touched an intra-day high of 10710 but faced strong resistances from its 200 day EMA, its 20 day SMA (green dotted line) and the downward 'gap' formed on Oct 4. (The bearish and measuring significance of the 'gap' was discussed in last week's post.)

After an intra-day correction of more than 250 points, the index formed a large 'reversal day' bar and a 'bearish engulfing' candlestick that have put paid to any bullish hopes of a further recovery.

Daily technical indicators have corrected oversold conditions but remain in bearish zones. MACD is facing resistance from its falling signal line. RSI is showing downward momentum. The upward momentum of Slow stochastic has stalled.

Nifty's TTM P/E has moved down to 25.19, but still remains higher than its long-term average. The breadth indicator NSE TRIN (not shown) is moving up in neutral zone, suggesting near-term downside.

All three EMAs are moving down, and the index is trading below them in bear territory. It may be early to call this correction the first leg of a bear market. Technical confirmation will be provided by the 'death cross' of the 50 day EMA below the 200 day EMA, and a 20% fall from the Aug 28 top of 11760 (to 9400).

The correction is far from over. Looks like the index wants to test its downward target of the 'measuring gap' at 9850. A little patience may provide better entry points.

WTI Crude Oil chart

The following remark was made in the previous post on the daily bar chart pattern of WTI Crude Oil: "Daily technical indicators are looking quite overbought, and can trigger a correction."

Oil's price rose to touch a 52 week high of 76.90 on Oct 3, but started correcting from the next day and dropped to seek support from its 50 day EMA. The subsequent pullback is facing resistance from its 20 day EMA.

Daily technical indicators are showing downward momentum after correcting overbought conditions. MACD is falling below its signal line in bullish zone. RSI has slipped below its 50% level. Slow stochastic has dropped inside its oversold zone, and can trigger a rally.

Oil's price is trading above its 50 day and 200 day EMAs in a bull market. Expect some consolidation before the starting the next leg of the rally.

On longer term weekly chart (not shown), oil's price closed above its three weekly EMAs in long-term bull territory. Weekly technical indicators showed negative divergences by touching lower tops, and are moving down in bullish zones.

Brent Crude Oil chart

The following comments appeared in the previous post on the daily bar chart pattern of Brent Crude Oil: "...vertical rally during the past two weeks is unsustainable. A correction may follow."

Oil's price rose to touch a 52 week high of 86.74 on Oct 3, but started correcting from the very next day. It dropped to seek support from its 50 day EMA before bouncing up to its 20 day EMA.

Daily technical indicators are looking bearish after correcting overbought conditions. MACD is falling below its signal line in bullish zone. RSI has slipped below its 50% level. Slow stochastic has dropped to the edge of its oversold zone, and can trigger a rally.

Oil's price is trading above its 50 day and 200 day EMAs in a bull market. Some consolidation can be expected before the next leg of the rally can begin.

On longer term weekly chart (not shown), oil's price closed above its three rising weekly EMAs in long-term bull territory. Weekly technical indicators are in bullish zones, but not showing any upward momentum.

S&P 500 index chart pattern

Possibility of some more correction was mentioned in last week's post on the daily bar chart pattern of S&P 500. Yet, the vicious bear attack on Wed. & Thu. (Oct 10 & 11) seemed to catch bulls unawares.

The index fell vertically to close below its 200 day EMA for the first time in 6 months. By touching an intra-day low of 2710 on Oct 11, the index dropped into the support zone between 2737 and 2689 (which are the 50% and 61.8% Fibonacci retracement levels respectively of the 408 points rally from the Feb 9 low of 2533 to the Sep 21 top of 2941).

Volume spikes on Wed. & Thu. may be the sign of a 'selling climax'. On Fri. Oct 12, the index bounced up to close above its 200 day EMA in bull territory. In the process, it formed an 'inside day' as well as a 'hammer' candlestick pattern. Bulls appear to be ready for a fight back.

Daily technical indicators are looking oversold. MACD and Slow stochastic are falling deeper inside their respective oversold zones. RSI is trying to emerge from its oversold zone, and can trigger a pullback towards the 2800-2850 zone.

On longer term weekly chart (not shown), the index fell below its 50 week EMA intra-week for the first time since Apr '18, but closed above its 50 week and 200 week EMAs in a long-term bull market. Weekly technical indicators are showing downward momentum. MACD and Slow stochastic are falling in bullish zones. RSI has dropped below its 50% level.

FTSE 100 index chart pattern

The bottom seems to be falling out of the daily bar chart pattern of FTSE 100. Bulls were helpless against aggressive bears, as the index closed more than 320 points (4.4%) lower for the week.

All three EMAs are falling, and the index is trading below them in a bear market. A test of the Mar '18 low is on the cards. (At the time of writing this post, the index is correcting further.)

Daily technical indicators are looking oversold. MACD and RSI are falling deeper inside their oversold zones. Stochastic has stopped falling, and can trigger a technical bounce.

On longer term weekly chart (not shown), the index closed below its three weekly EMAs in long-term bear territory. Weekly technical indicators are looking bearish and showing downward momentum. MACD and RSI are falling towards their respective oversold zones. Stochastic is inside its oversold zone.

FIIs were net sellers on all five days of trading last week. Their total net selling was worth Rs 83.3 Billion. DIIs were net buyers on all five trading days. Their total net buying was worth Rs 85.7 Billion, as per provisional figures.

In Sep '18, India's CPI inflation inched up to 3.77% compared with a 3.69% increase in Aug '18 due to higher food and fuel prices. The figure was less than RBI's medium-term inflation target of 4%.

The IIP number slipped to a 3 months low of 4.3% in Aug '18 from (downward revised) 6.5% in Jul '18 due to a sharp decline in mining sector output and poor offtake of capital goods. However, during Apr-Aug '18, IIP growth was 5.2% - up from 2.3% during Apr-Aug '17.

BSE Sensex index chart pattern

Note the following comments from last week's post on the daily bar chart pattern of Sensex:

"...the index appears to be retracing the 13236 points rally from its Dec 26 '16 low (25754) to its Aug 29 '18 top (38990). The 38.2% and 50% Fibonacci retracement levels of the rally are 33934 and 32372 respectively (marked on chart)."

On Thu. Oct 11, the index dropped inside the support zone between 33934 and 32372 and touched an intra-day low of 33724, but bounced up to close just above 34000. A 700+ points rally on Fri. Oct 12 brought a collective sigh of relief to mauled bulls.

Is the worst over? Can Sensex start a pre-Diwali rally? Bulls would do well to keep their hopes on a tight leash.

By falling to a low of 33724, the index has corrected 5266 points (13.5%) from its Aug 29 '18 top (38990). A 38.2% Fibonacci retracement of the fall will take the index up to 35736, which is the current level of its falling 20 day EMA. To get there, the index needs to overcome resistance from its 200 day EMA (at 35370).

A pullback to the zone between 35370 and 35736, followed by a corrective move towards 32372 (lower edge of the support zone) seems like a possible outcome.

What if the index falls below 32372? It can then correct further to 30800 (which is a Fibonacci 61.8% retracement of the 13236 points rally from the Dec '16 low).

A correction down to 30800 will be more than a 20% correction from the Aug 29 '18 top of 38990 and technically push Sensex into a bear market. It may or may not happen, but forewarned is forearmed.

Incidentally, on Fri. Oct 12, FII net selling (Rs 13.2 Billion) exceeded DII net buying (Rs 12.9 Billion) in equity shares. So, whose buying caused the 700+ points rally in Sensex?

Daily technical indicators are in the process of correcting oversold conditions, but remain in bearish zones. Drop in oil prices and a slight Rupee gain against the US Dollar enthused bulls on Friday. But the stock price of TCS cracked despite declaring decent Q2 (Sep '18) results, which is a bearish sign.

NSE Nifty index chart pattern

The weekly bar chart pattern of Nifty touched an intra-week low of 10139 - inside the Fibonacci support zone between 10283 and 9827 (38.2% and 50% Fibonacci retracement levels of the rally from the Dec '16 low of 7894 to the Aug '18 top of 11760).

The index bounced up to close with a 156 points (1.5%) gain on a weekly closing basis. In the process, it formed a weekly reversal bar (lower low, higher close) that can trigger a rally towards the zone between its sliding 50 week and 20 week EMAs. Expect bears to 'sell on rise'.

Weekly technical indicators are looking bearish. MACD is falling below its signal line in bullish zone. ROC is inside its oversold zone, but has stopped falling. RSI has slipped below its 50% level. Slow stochastic is about to enter its oversold zone for the first time since Mar '18.

Nifty's TTM P/E has moved up to 25.33, which is well above its long-term average. The breadth indicator NSE TRIN (not shown) is falling in neutral zone, hinting at some near-term upside.

Bottomline? The corrections on Sensex and Nifty charts have found temporary support at Fibonacci support zones. Pullbacks towards long-term moving averages are likely. Macro headwinds like rising oil prices, a depreciating Rupee, widening trade and fiscal deficits, ongoing debt woes of IL&FS won't die down in a hurry. Perhaps better than expected Q2 (Sep '18) corporate results can bring some succour to bulls.