The BSE Sensex index chart pattern was looking in fine fettle last week, as the bulls seemed to have negated the bearish technical indicators. But the weaknesses developing in the long term charts led me to warn investors not to make new investments.

The trading details during the week seemed to follow a pattern - FIIs were net sellers and domestic institutions were net buyers. The index gradually drifted down and, in spite of a spirited rally on Fri Sep 4, '09, finished lower week-on-week.

Both FIIs and DIIs were net sellers on Friday. So how did the market move up by 290 points? As per the BSE site, 'clients', 'NRIs' and 'proprietary' were the buyers. Which means retail investors and brokers. Is that an indication that the institutions are 'distributing' the stocks to the weaker hands?

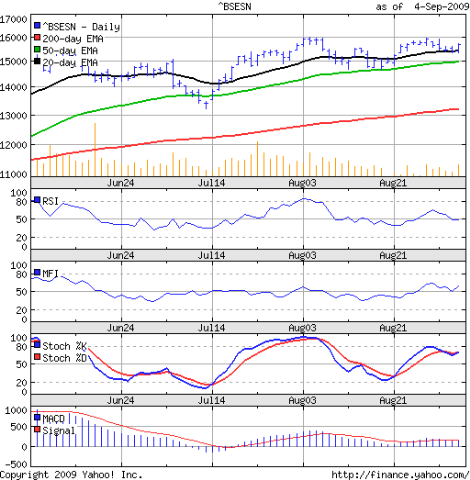

It is time to take a look at the 3 months bar chart pattern of the BSE Sensex index:-

The small correction during the week was well-supported by the 20 day EMA, and all three EMAs continue to move up, confirming that the bulls are still in control. The Oil India IPO at a huge premium opens next week, and the index is expected to remain within a range.

The technical indicators look a little weaker than last week. The RSI has dropped down to the 50% level. The MFI is pretty much where it was last week. The slow stochastic dipped down after touching the overbought region. The MACD has slipped below the signal line.

But the real concern is the volume of transactions. Even a casual glance at the volume bars will show the shrinking volumes from the middle of Aug '09. Bull markets need strong volume support for sustenance.

Bottomline? The BSE Sensex chart pattern shows that an intermediate top is close at hand, if not formed already at 16000. No need to start selling in a panic. But caution should remain the watch word. Your patience and investing acumen will be under test.

2 comments:

I had big complaints against the rally for quite some time.

* The undertone still seems "bullish" especially in small-caps which have started outperforming large cap indices in a significant fashion.

* Tips have started to fly around once more.

* Money making seems easier.

* Continuous upper circuits in small-caps is here once again.

* Volumes remain lower especially on the Up days.

* May be the bear and the sitting on the sidelines camp is tiring out and the missed the bus camp is trying hard to make up for lost time.

However, I've come around to accept the fact that markets can remain irrational longer than we can remain patient. Why should I complain when laggards suddenly find "stories" to move 15-20% in a day, 40% in a week providing a chance to liquidate, if not completely at least partially? :-)

There is no point in fighting a trend, Eswar. Just follow it. If you are feeling uncomfortable, keep trailing stop losses and book partial profits.

This is a great time to get rid of dogs in your portfolio - while they are still in demand.

Post a Comment