In last week's discussion of the Dow Jones (DJIA) index chart pattern, a 'reversal day' bar was observed on Fri, Sep 11 '09. It had bearish implications, and some correction was expected.

On Mon, Sep 14 '09, the Dow did make a lower top and a lower bottom but closed higher. The rest of the week, the bull charge continued with higher tops and higher bottoms - supported by higher volumes. There seems to be no hurdle high enough to trip the bulls.

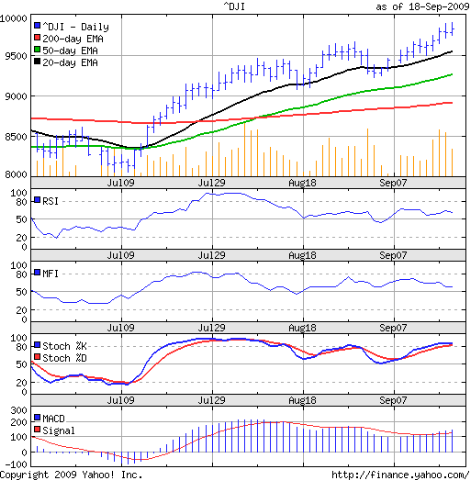

Let us have a look at the 3 months bar chart pattern of the Dow Jones (DJIA) index:-

Once again, a 'reversal day' pattern formed on Thu, Sep 17 '09 - but it was ignored by the Dow as it made a higher top and a higher close. All three EMAs are also moving up, leaving no doubt that the bulls are in charge.

Note the negative divergences in the RSI and MFI, which are moving lower - though they remain above their 50% levels. The slow stochastic has moved into the overbought zone. The MACD has inched above its signal line, but is also showing negative divergence. The technical indicators are not as bullish as the index.

The economy appears to be improving and the worst seems to be over. Just don't mention that to your friend or neighbour who may have lost his job recently. For him, the worst is beginning.

Consumers are saving more and spending less. As per this article, stock funds are showing net outflows and bond funds are showing net inflows. Corporate insiders are merrily selling. Corporate share buy-backs are down more than 70% year-on-year. That leaves short-covering and programmed trading as the buying support for the market. How long can the bull rally sustain on such weak underpinnings? (Not to forget about the bearish 'rising wedge'!)

Bottomline? The Dow Jones (DJIA) index chart pattern seems determined to enter a new bull market by climbing a wall of worry. The European indices are correcting today (Mon, Sep 21 '09) and its effect may be felt across the Atlantic. On two recent occasions, the Dow had sought support from its 20 day EMA, and may do so again. Time is ripe for some profit booking.

No comments:

Post a Comment