Last week's analysis of the stock chart patterns of the European indices concluded with the following observations:-

'The stock index chart patterns of the European markets are showing buying exhaustion, which could lead to a correction. Part profit booking is advised. Better entry points may become available.'

All the three indices went through a mild correction during the week.

FTSE 100 index chart

The FTSE was looking the most bullish, and corrected only 1.75% on a closing basis, remaining just above the 20 day EMA. All three EMAs are still moving up, so the bull rally is intact.

The technical indicators are reflecting the correction. The slow stochastic is still in the overbought zone, but the %K line has gone below the %D. The RSI has dipped below the overbought zone. The MFI is moving sideways below the overbought zone. The MACD has moved a bit below the signal line.

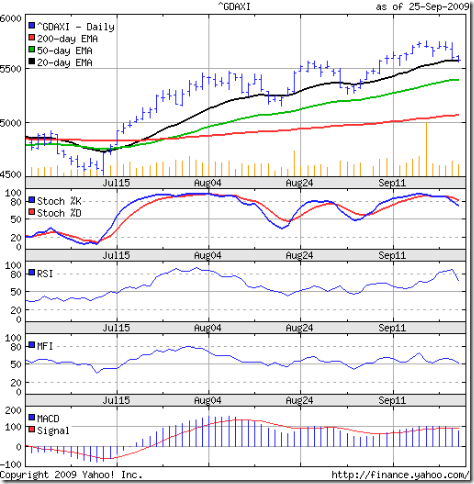

DAX index chart

The German index corrected 2.2% on a closing basis, and got support from the flattening 20 day EMA. The 50 day EMA stopped rising, but the 200 day EMA is still moving up. There is no immediate threat to the bull market.

The technical indicators appear a little weaker than the FTSE's. The slow stochastic has dropped out of the overbought zone. So has the RSI. The MFI is resting on the 50% level. The MACD is positive, but below its signal line.

CAC 40 index chart

The French index corrected 2.3% on a closing basis, and sought support at its short-term moving average. The 20 day EMA has stopped rising, but the 50 day and 200 day EMAs are moving up.

The technical indicators are almost identical to those of the DAX. The French economy has followed its neighbouring country and come out of the recession.

The 20 day EMA has provided good support to the FTSE and CAC since the middle of Jul '09. The DAX went below its 20 day EMA twice, but stopped short of falling to the 50 day EMA.

Bottomline? The stock index chart patterns of the European indices had mild corrections and have reached short-term support levels. The economies are clawing back towards recovery. Chances of a resumption of the bull rally are good. In case of a further correction, the 50 day EMA should provide support.

2 comments:

Hi Subhankarji,

Whenever time permits, request you to write an article on using the Aroon Oscillator

Thanks,

Srikanth

Hi Srikanth

Check out the link on the Aroon indicator and oscillator on the right panel of my blog - under 'Technical Indicators'.

Post a Comment