Shanghai Composite index chart

Four days of adventure above the 3000 level and the 50 day EMA proved to be too much for the Shanghai Composite index to handle. Today (Fri, Sep 18 '09), the index made a new high of 3068 but closed lower at 2963 - forming a 'reversal day' pattern.

The 3 months bar chart pattern of the Shanghai Composite index shows more of a sideways consolidation:-

Today's close has taken the index below the 20 day EMA, which rose up to touch the 50 day EMA. The 200 day EMA is still moving up, but the upward momentum is slowing. As long as the index remains well above the long-term average, the bull market remains in place.

The RSI is resting at the 50% level. The slow stochastic has swung up into the overbought zone. The MACD has moved up, but is still in negative territory though above the signal line. The ROC has nicely moved up.

Some more consolidation may be on the cards before the bulls can regain control.

Hang Seng index chart

While big brother is struggling to shrug off the bear attack, the bulls of the Hang Seng index deftly side-stepped the bears. Two days of minor correction was followed by a renewed upward surge, with a new high of 21930 clocked on Thu, Sep 17 '09.

The 3 months bar chart pattern of the Hang Seng index is up and running again on higher volumes, with all three EMAs moving up together:-

The RSI has moved above the 50% level. The slow stochastic is in the overbought zone. The ROC has moved up well. So has the MACD. The technical indicators are supporting the continuation of the bull run.

The negative divergences in the RSI, MACD and ROC - which failed to make new highs - continue to remain a concern.

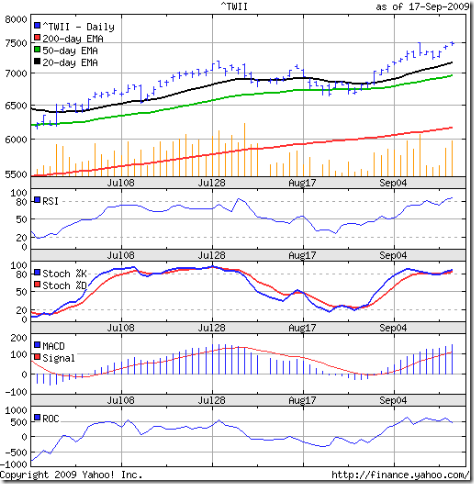

Taiwan (TSEC) index chart

When I last looked at the Taiwan (TSEC) index 4 weeks back, it was undergoing a correction, and the technical indicators were looking weak.

Let's look at the 3 months bar chart pattern of the Taiwan (TSEC) index:-

The TSEC seems to be tracking the Hang Seng as it continues to move up with higher volumes. But unlike its mainland cousins, the Taiwan index closed at a new 52 week high today.

All three EMAs are moving up. Both the RSI and slow stochastic are in overbought zones. The MACD is moving up strongly. Only the ROC is moving sideways, but in the positive zone.

The index is less than 40 points below 7560 (the 61.8% Fibonacci retracement level of the entire bear market fall from 9786 in Nov '07 to 3955 in Nov '08). Some resistance to the up move can be expected next week.

Bottomline? The movement of the Shanghai Composite index may determine which way the other two indices move. Both the Hang Seng and TSEC are looking quite bullish. But the Chinese index can drag them down. Hang on to existing investments with trailing stop losses. If you've missed the rally so far, miss it a little longer.

2 comments:

Dear Sir,

It seems that Chinese central bank had tightened the lending rates during early/mid of July month which led to strong correction in Shanghai Composite index. But now I’m hearing from sources (ING financial) that central bank would like to change their view to easing the lending process which might lead to soft landing...!!!

This might be the reason why Shanghai Composite index doing very well at the same time investors are worried about the lending rates.

And as we know Chinese market is leading the Asia, It’s dragging whole Asian market along with it..

Comment please..!!!

Don't know if the Chinese have figured out what they want to be - communists in thought and capitalist in deeds, or capitalists in thought and communists in deeds.

They have built spanking new infrastructure - specially in and around the cities, to pander to the foreigners who have been pouring in money.

But the world is realising that the country's internal systems and processes remain anti-capitalist.

India's 'middle-path' strategy may win in the longer term. At least, that is my hope.

Post a Comment