The stock chart pattern of 3i Infotech Ltd looks a little different from other stocks that have been analysed recently. It made a high of 165 back in May '07 (actually 330, but adjusted for the subsequent 1:1 bonus). The bears attacked almost immediately, and the stock gradually slid down to 115 in Sep '08, before it fell off a cliff.

It finally bottomed at 25 in Mar '09 - dropping 85% from its peak. A swift 3 months rally took the stock to 95 in Jun '09 - an exact 50% Fibonacci retracement of the entire Rs 140 fall over 2 years. Thereafter, the stock has been in a consolidation phase within an 'ascending triangle'.

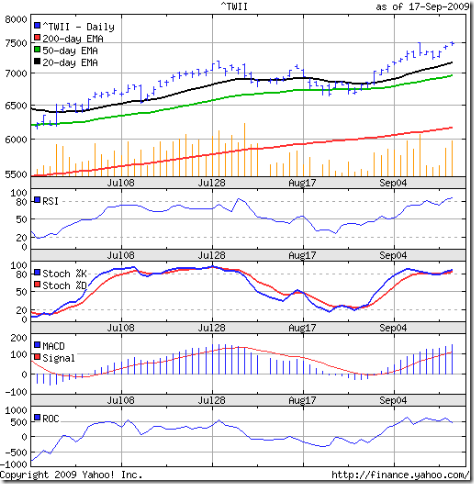

Let us have a look at the 1 year bar chart pattern of 3i Infotech Ltd:-

The RSI has moved above the 50% level. The MACD is positive, but marginally below the signal line. The slow stochastic is below the 50% level but the %K line has just crossed above the %D. All three are indicating mild bullishness. The OBV is providing the real clue to the underlying strength - the gradual rise indicates 'accumulation'.

3i Infotech is part-owned (39.5%) by ICICI Bank, and its revenues are a 50-50 split between software products and services. Its product portfolio - mainly targeted at banks and financial institutions - helps to generate a high net margin of close to 30%.

A low P/E of 6.25 means an earnings yield (E/P) of 16% - which is double the current fixed deposit rates in banks, leaving a good 'margin of safety'. Solid top and bottom line growth and strong cash flows from operations make this an ideal portfolio candidate.

Then why is the stock under-performing the Sensex (which has already retraced 70% of its bear market fall)? The company has been aggressively pursuing growth through the inorganic route. That means, it has been acquiring a number of software companies and businesses in India and overseas.

The danger of such a strategy - when leveraged through debt - is that the interest payments become due sooner than later, whether there is a global economic downturn or not.

3i Infotech is less reliant on clients in US and Europe (where the financial services outsourcing business has been hit the hardest) than most Indian software services companies. But the bears have mauled it just the same. And there lies an opportunity for smart investors.

Bottomline? The stock chart pattern of 3i Infotech is indicating that the smart money has been accumulating the stock, and an upward break from the ascending triangle may be imminent. Enter, or add more, on a close above 95. Keep a stop-loss at 70.

(Some questions: Why is the stop-loss set at 70? If you enter now, should you set a tighter stop-loss? At what price?)