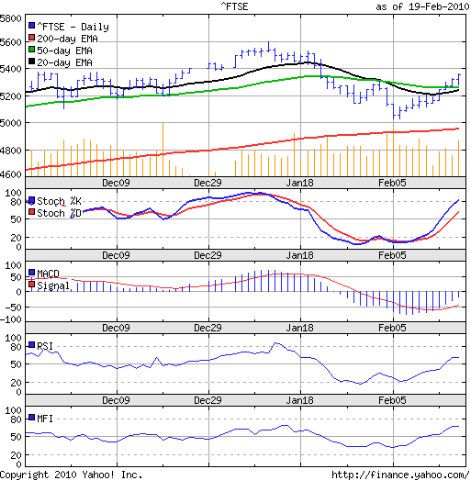

FTSE 100 index chart

In last week's analysis of the FTSE 100 index chart pattern, I had made the following observation about the pull back rally:-

'There is likely resistance around the 5370 level, where several tops were made in late Nov and early Dec '09.

Friday's high of 5366 was the highest for the month, but one can expect the bears to put up a fight next week to stall the bull recovery.'

On Monday and Tuesday, the index reached intra-day highs of 5387 and 5395, only to close below the 5370 level. During the rest of the week, the 5370 level could not be crossed at all.

The 61.8% Fibonacci retracement level of the recent fall from the top of 5600 in Jan 11 '10 to the low of 5033 on Feb 8 '10 is at 5383. No wonder the bears are putting up a fight. Before 5600 can be attacked, the bulls will need to cross the 5400 hurdle.

The index stayed on or above the 50 day EMA throughout the week. The 20 day EMA has moved up to merge with the 50 day EMA. The technical indicators are signalling a move higher next week.

The slow stochastic is in the overbought zone. The MACD is above the signal line and has turned positive after almost a month. The RSI and MFI are both above their 50% levels and heading towards the overbought zones.

But have a look at the volume bars. Thursday's down day had the highest volumes of the week. That isn't a good sign. All in all, the bulls scored a few more points, but the fight is far from over.

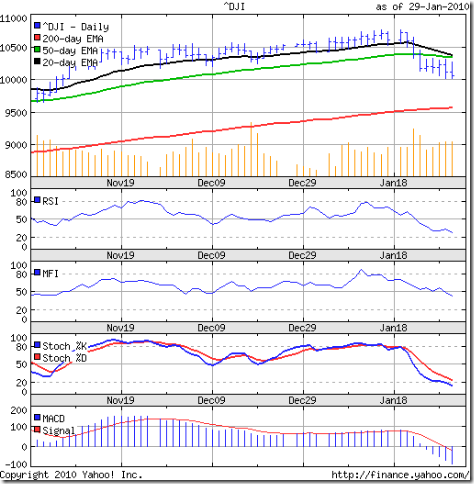

DAX index chart

The pull back rally in the German DAX index chart seems to have fizzled out before it could gather strength. A brief sojourn of the index above the 50 day EMA was quickly resisted by the bears. The index closed just below the 5600 level, and more importantly, below both the 20 day and 50 day EMAs that have resumed their down ward moves.

The MACD is above the signal line but remains in negative territory. The RSI and MFI are both above their 50% levels but their upward momentum is slowing. The slow stochastic retraced sharply after venturing up to the overbought zone and is resting at the 50% level.

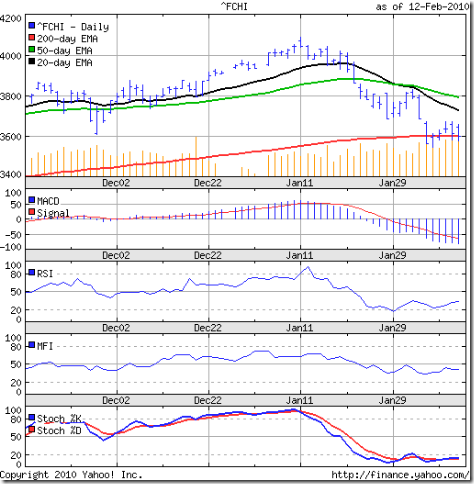

CAC 40 index chart

Expectedly, the CAC 40 index chart pattern continues to be the weakest. The French index barely crossed the 50 day EMA on an intra-day basis but failed to close above it even once. In fact, it has closed below the medium-term moving average 5 weeks in a row.

The technical indicators are reflecting the weakness in the index - which is just 100 points above the 200 day EMA.

Bottomline? The chart patterns of the European indices are still showing the effects of a bear mauling. The bulls in the German and French indices have fared much worse than those in the British index. As long as the indices remain above their 200 day EMAs, the bears would not gain total control. Investors should buy only if they can identify under-valued stocks.