Last week, I had mentioned that the bulls may find it difficult to extricate themselves from the bear grip, but may attempt a pull back. The mild attempt to move up during the first three days of the week didn't succeed. By the end of the week, the Dow lost more than 100 points.

The GDP number at 5.7% was quite a bit above expectations. Consumer spending is picking up. Bernanke got re-appointed. Q4 '09 results of companies have been better.

So, why did the index drop? A closer look at the GDP figure revealed that the rise was caused mainly by inventory re-stocking. The trauma of unemployment is permeating into the psyche of investors. The economy will need to get a lot better before it can be considered to be in good health.

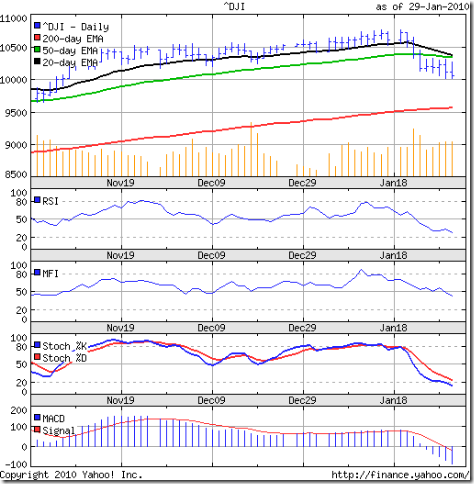

Let us take a look at the 3 months bar chart pattern of the Dow Jones (DJIA) index:-

The bear onslaught has caused the 20 day EMA to drop down to the falling 50 day EMA. The index struggled through the week to move higher, but the medium-term moving average provided strong resistance. The 200 day EMA is still moving up - the long-term up trend remains in tact.

The effort by the bears to push the index below the Nov '09 low of 9647 was well supported at the 10000 level. The higher volumes on the last two down days of the week indicate that the bears may mount a renewed attack.

Both the RSI and MFI are below the 50% level and moving down. The slow stochastic has entered the oversold zone. The MACD is falling in negative territory and is below the signal line.

Bottomline? The Dow Jones (DJIA) index chart pattern is still in a bear grip. The bulls managed to avert a bigger sell-off, and may make another attempt to regain control. Investors can sit on the side lines till a clearer trend emerges.

No comments:

Post a Comment