FTSE 100 index chart

In last week's analysis of the FTSE 100 index chart pattern, I had mentioned about the positive divergence in the RSI (which made a higher low as the index made a lower low). Whether because of it, or otherwise, the bulls managed to mount a small rally.

Once again, the resistance from the falling 20 day EMA proved to be a tough barrier. The index made a 'higher high lower close' reversal day pattern on Friday. The battle lines between the bulls and bears are now clearly drawn between the 5000 level and the falling 20 day EMA.

The slow stochastic has just managed to emerge out of the oversold zone. The MACD is still negative and below the signal line. The RSI is moving up but remains below the 50% level. The MFI is touching the 50% mark.

The index is grinding down slowly instead of falling in a heap.

DAX index chart

Not unexpectedly, the DAX index bounced off the 200 day EMA giving the bulls some temporary relief. But the subsequent rally was weak. The index failed to get close to the falling 20 day EMA and oscillated between the 200 day EMA and the 5600 level.

The slow stochastic is inside the oversold zone. The MACD is negative and below the signal line. Both the RSI and MFI are below the 50% levels. The distance between the falling 20 day and 50 day EMAs is increasing.

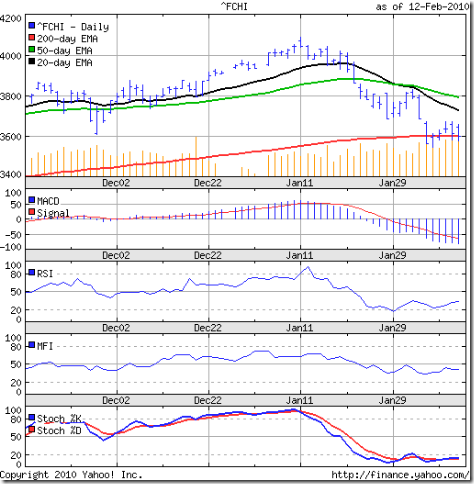

CAC 40 index chart

The CAC 40 index chart continues to be the weakest. The pull back effort by the bulls barely managed to push the index above the 200 day EMA before closing exactly on the long-term moving average on Friday. The index remains well below the falling 20 day EMA, and is a whisker away from dropping into a bear market.

The technical indicators of the CAC 40 index are in much the same bearish state as those of the DAX index.

Bottomline? The chart patterns of the European indices show that the bulls are gradually but reluctantly giving away ground to the bears. Some more correction is likely. Enter only if you see value in individual stocks.

No comments:

Post a Comment