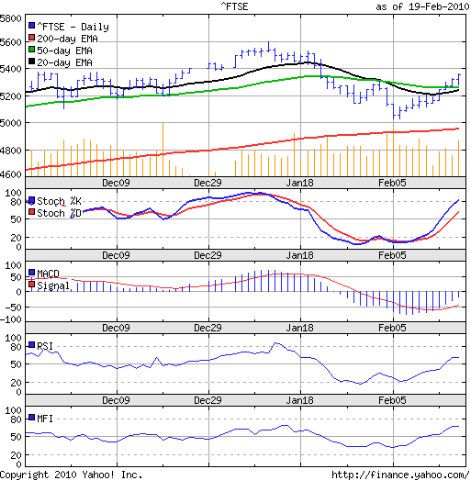

FTSE 100 index chart

Just when all seemed lost for the bulls, they managed a spirited fight back pushing the bears on to the back foot. The index sailed above the 20 day and 50 day EMAs on decent volumes as the fears of sovereign debt default by the PIIGS receded to the background.

The slow stochastic has entered the overbought zone. The RSI and MFI are both above their 50% levels. The MACD is negative but is above the signal line and moving upwards.

The previous high of 5600 is the hurdle that the bulls need to clear to restore the FTSE 100 index chart back to the bull phase. There is likely resistance around the 5370 level, where several tops were made in late Nov and early Dec '09.

Friday's high of 5366 was the highest for the month, but one can expect the bears to put up a fight next week to stall the bull recovery.

DAX index chart

The bull recovery in DAX index chart was a little less spirited. The index managed to move above the 50 day EMA only on the last day of the week, but failed to go past the Feb 3 '10 high of 5734.

The RSI and MFI have moved above their 50% levels. The slow stochastic is rapidly rising towards the overbought zone. The MACD is also rising in the negative zone and is above the signal line.

On the way up, the index may face resistance at the previous tops around the 5850 level.

CAC 40 index chart

The CAC 40 index chart pattern still appears the weakest, with the 50 day EMA providing resistance to the up move. Unlike the FTSE 100 and DAX, the volumes have receded instead of increasing during the week's rally.

The slow stochastic and MFI have moved above their 50% levels. The RSI is resting at the mid-point. The MACD is negative, but rising and is above the signal line.

Bottomline? Despite the strong fight back by the bulls, the worst may not be over for the European indices. The bears are expected to make an effort to regain control. Only a move above the previous tops made on Jan 11 '10 will restore the bull market to its earlier glory.

No comments:

Post a Comment