More than three months back, I had analysed the technical chart pattern of the KOSPI (Korea) index. While the BSE Sensex made a new high today, I thought of taking another look at the KOSPI index - not only to see what it has been up to lately, but also to check if it reached any of the levels that the earlier analysis had suggested.

Here is the observation made about the up side:-

'There is no long term resistance below 1500. So another 10% upside is quite likely before any serious correction can happen.'

Today (Friday, July 31, '09), the KOSPI index closed at 1557 - making a new high, just like the Sensex did. On Apr 24, '09, when I had written the earlier article, the KOSPI index had hit a high of 1375. A 10% upside meant a level of 1512. That target has been achieved.

An observation was made about the down side as well:-

'The MACD has stopped moving up for the past few trading sessions. Both the ROC and RSI have made lower highs while the KOSPI continues to make higher tops. This is a 'divergence' that can stop the rally and bring the index down below its 200 day EMA. May be not right away - but the possibility exists.'

The index reacted the following week, and dropped to the 200 day EMA on Apr 28, '09. But it failed to penetrate the long-term average. The rally lost steam and the index consolidated sideways around the 1400 level for almost 10 weeks, before breaking upwards out of the range last week. (On May 25, '09, the KOSPI tested the support of the 200 day EMA on an intra-day basis.)

So, what is the point? Am I trying to prove that I'm an expert at technical analysis? Not quite. This is just to demonstrate that some times, technical analysis can provide remarkably accurate indications about future levels of a stock or an index.

However, since it is not a science but an art (i.e. skill), developed through practice and experience, it can be inaccurate more often than not. While it may be useful to know what the likely up sides and downsides can be, it is better not to rely on technical analysis completely.

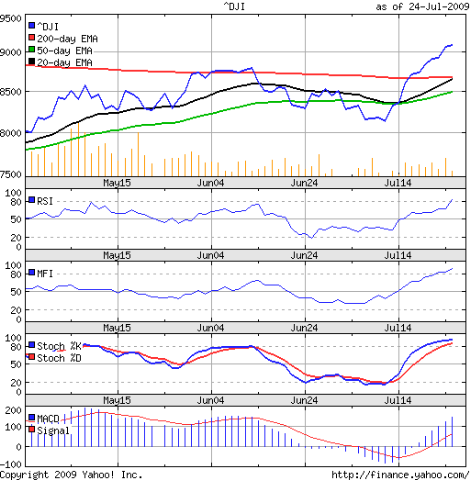

Enough philosophy for one day. Now a look at the 6 months closing chart pattern of the KOSPI (Korea) index (in blue) with the Shanghai Composite index (in red) superimposed for comparison:-

The China index has comfortably outperformed the Korean one, but the one way up move with only minor corrections makes me a little uncomfortable.

The Korean index had a sharp rally followed by a good sideways consolidation. It has now resumed its rally, which can be more sustainable because of the 'base building' at the 1400 level.

The slow stochastic has entered the overbought zone. The RSI is flat and just below the overbought zone. The MFI has moved up and just entered its overbought zone. The MACD is positive and above its signal line. The 20, 50 and 200 day EMAs have all begun to move up along with the index. The bulls seem to have things pretty much under control.

Bottomline? The KOSPI (Korea) index chart pattern has gained less than the Shanghai Composite index or the BSE Sensex index since the rally began in Mar '09. That tells me that some more upside is possible. Investors may adopt a buy-on-dips strategy with a trailing stop-loss and ride the bull.