In last week's discussion about the Sensex chart pattern, I had made the following assertion:

A quick look at indices around the globe reveals that Bovespa (Brazil), Venezuela and Chile in South America and Shanghai, TSEC (Taiwan) and Kospi (Korea) in Asia are the only six that have closed above their 200 day EMA, but the upward rally is slowing. All the other world indices are below their 200 day EMAs.

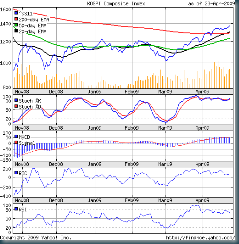

It is logical to have a look at the KOSPI (Korea) 6 months closing chart pattern to ascertain the status of the rally:-

(Please right-click on the image above and open it in a new tab or window for a better view.)

Far from slowing down, the upward rally has resumed with new vigour. Before we look at the technical indicators, let us note the interesting index chart pattern.

The global stock indices, including the Sensex, made a new 52 week closing low on May 9, '09 before the rally started. But look at the KOSPI. It made a low on Mar 2, '09 - but this wasn't a 52 week closing low. That had happened all the way back on Oct 27, '08.

After testing the 52 week closing low in Nov '08, the KOSPI's rally started as the index made gradually higher tops and bottoms while still in a long term bear market. The sharp upward rally from Mar '09 also preceded the global rally by a week.

The index has now spent most of Apr '09 above its 200 day EMA, while global indices (barring the few mentioned) are struggling to reach - let alone cross - their respective 200 day EMAs. Now, have a look at the short and medium term EMAs.

The 20 day EMA moved above the 50 day EMA from below around the middle of Mar '09, and both averages moved steadily up along with the index. But see what happened after the past two days' trade? The 20 day EMA nudged above the flattening 200 day EMA from below - the first confirmation of a bull market.

The stronger confirmation will come if the 50 day EMA also crosses above the 200 day EMA. That seems like a question of 'when?' rather than 'will it'? The volumes in Apr '09 have been considerably higher than in Mar '09.

There is no long term resistance below 1500. So another 10% upside is quite likely before any serious correction can happen. (Coincidentally, the long term resistance for the Sensex is also 10% above its current level of 11300.)

Are there any negatives at all? A few. The MACD has stopped moving up for the past few trading sessions. Both the ROC and RSI have made lower highs while the KOSPI continues to make higher tops. This is a 'divergence' that can stop the rally and bring the index down below its 200 day EMA. May be not right away - but the possibility exists.

Bottomline? It appears that the smart money (read FIIs) have realised that the economies of the USA and Europe are in far worse shape and are betting their stakes on the relatively stronger economies of Brazil, China, India, Taiwan, Korea. The KOSPI chart pattern is reflecting that.

2 comments:

so....

current rally is more than a bear market rally ??????

Yes, Titu - but in Korea.

We are all connected together in a globalised world, but only India has an election overhang and a huge current account deficit.

UPA partners are already jittery about the numbers and have started friendly overtures to the Left (which does not want Manmohan Singh back as PM).

Technically, the Sensex is still struggling at the 200 day EMA. So India is not in a bull market - yet.

Post a Comment