Why did I choose to look at the DAX chart pattern? Two reasons. It has been nearly three weeks since I discussed the CAC (France) chart pattern and the FTSE (UK) chart pattern. It is time to take another look at a European market.

More importantly, I was motivated to look at the DAX chart pattern by this article in the Wall Street Journal that paints a grim picture of the European economy, and Germany happens to be the largest economy of Europe.

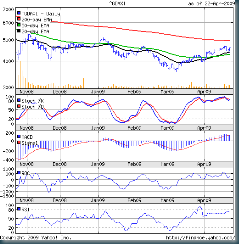

Technical analysis experts say that all fundamentals are reflected in the chart patterns. Let us take a look at the 6 months bar chart of the DAX to find out the veracity of that assertion:-

(Please right-click on the image above and open it in a new tab or window for a better view.)

Readers who have been following my earlier posts on technical analysis of global indices may notice that the DAX chart looks more like the Dow chart than either the Hang Seng or the Sensex charts - both of which reached their respective 200 day EMAs during the recent rally.

The more striking thing to note is the near complete absence of volume confirmation. The up trend during Mar and Apr '09 have been on marginally higher volumes. This is a contra indication - so the rally is likely to terminate sooner rather than later.

The slow stochastics is still in the overbought zone but the %K has gone below the %D line. The MACD, ROC and RSI have all started to turn down. The technical indicators are all showing negative signs.

Is there nothing positive in the DAX chart pattern? Yes, a couple of them. The index is getting some support from the 20 day EMA. Plus the 20 day EMA has got its nose above the 50 day EMA, and both averages have turned up.

Bottomline? The DAX and its short and medium term averages are still below the 200 day EMA. The long term bear market is not over by a long shot. Caution advised to investors. The rally can be used to get rid of non-performing stocks in your portfolio.

2 comments:

Hello Subhankarji,

can you guide me about Axis Bank.

Thanking you in Advance for your efforts...

Titu

Hi Titu

I don't actively track Axis Bank but took a quick look at the charts. From a low of 280 on Mar 9,'09 the stock shot up to a high of 540 on Apr 20,'09 where it faced resistance at its 200 day EMA. I would wait for a proper correction before adding/entering.

It is a fundamentally strong company that has talked about starting a Mutual Fund business. (My first choice in private sector banks is Yes Bank, which is smaller but has a lot of growth potential.)

Post a Comment