The FTSE chart pattern will be discussed in today's post as part of my endeavour to provide a more global perspective to the stock market scenario. (I have a few readers from the UK, and would request them to please give me a feedback on my analysis and let me know if I'm on the right track or not.)

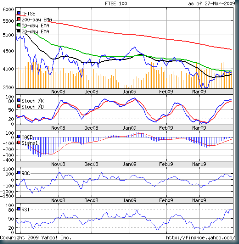

Let us take a look at the 6 months closing chart pattern of FTSE:-

(Please right-click on the image above and open it in a new tab or window for a better view.)

The global rally in world stock markets in the month of Mar '09 has taken both the Hang Seng and the Sensex above the 50 day EMA. Not so for the FTSE, which is still struggling in the region between the 20 day EMA and the 50 day EMA.

The 20 day EMA is gradually moving up, but is still below the 50 day EMA. The FTSE is well below the 200 day EMA, which means the stock market is still in a long term bear grasp.

A rectangular sideways consolidation phase - defined approximately by the 4600 level on the upper side and the 3700-3800 zone on the lower side - began after the Oct '08 lows. The 3700-3800 zone acted as a support during Nov '08, but got penetrated in late Feb '09 and the FTSE made a new closing low at 3500 in Mar '09.

Though it bounced off sharply from the Mar '09 low, the up move is showing signs of fizzling out. Why? Because the FTSE seems to be in the process of making a 'rounding top' chart pattern.

The slow stochastics has entered the over bought zone. MACD is barely positive. ROC is already turning down. RSI has flattened after entering the over bought zone.

Technical analysts often claim that all fundamentals are reflected in the chart patterns. If we take that claim at face value, we may conclude that the fundamentals of the UK economy are in worse shape than those of South East Asia (as represented by the Hang Seng chart pattern) and India (as represented by the Sensex chart pattern).

Bottomline? The FTSE is likely to test the recent low of 3500 and may go even further downwards. Looks like this bear market isn't going to end any time soon.

No comments:

Post a Comment