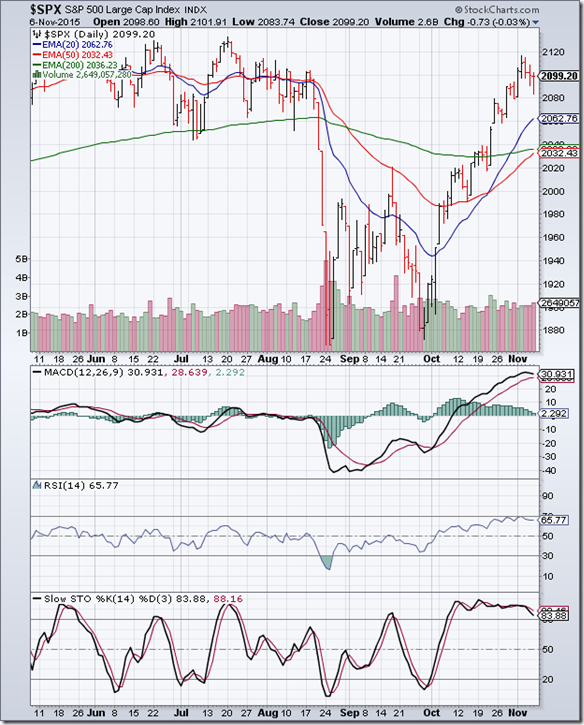

S&P 500 Index Chart

In a trading week truncated by Thanksgiving holiday, the daily bar chart pattern of S&P 500 consolidated sideways and closed flat for the week.

The index is trading above all three EMAs, but needs to climb above the Nov 3 top of 2116 to maintain a bullish pattern of ‘higher tops and higher bottoms’.

A drop below the Nov 16 low of 2019 – which may seem unlikely at this stage - will bring bears back to the fore.

Daily technical indicators are in bullish zones. MACD and RSI are moving sideways. Slow stochastic has entered its overbought zone.

Volumes tapered off in the week gone by. But that is often the case during Thanksgiving week.

On longer term weekly chart (not shown), the index closed flat for the week, but above its three weekly EMAs in a long-term bull market. Weekly technical indicators are in bullish zones.

FTSE 100 Index Chart

The daily bar chart pattern of FTSE 100 climbed above its 20 day and 50 day EMAs after a brief fall during the first two days of the week, but faced resistance from the 6400 level.

The index closed 40 points higher for the week but remains 120 points below its sliding 200 day EMA in a bear market.

Daily technical indicators are in bullish zones, but MACD and RSI are not showing any upward momentum. However, Slow stochastic has climbed sharply inside its overbought zone.

On longer term weekly chart (not shown), the index continued its pullback towards its 200 week EMA, but failed to close above it. The 20 week EMA is about to cross below the 200 week EMA. The ‘death cross’ of the 50 week EMA below the 200 week EMA is still awaited. Weekly MACD and RSI are in bearish zones but showing upward momentum. Slow stochastic has bounced up after receiving support from its 50% level.