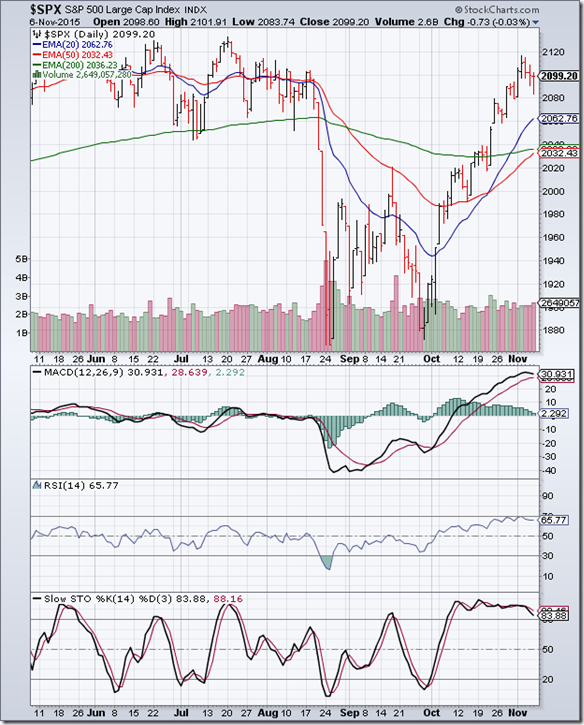

S&P 500 Index Chart

The daily bar chart pattern of S&P 500 continued its rally and crossed above the 2100 level easily, but stopped short of the 2120 level. It closed the week just below the 2100 level with a 1% weekly gain.

All three EMAs are rising and the index is trading above them. The ‘golden cross’ of the 50 day EMA above the 200 day EMA will technically confirm a return to a bull market.

Technical indicators are in bullish zones, and in the process of correcting overbought conditions. MACD and Slow stochastic are ready to drop from their overbought zones. RSI faced resistance from its overbought zone and is trading sideways.

Strong volumes on the three down-days of the week show that bears are not going to throw in the towel without a fight. A bit of correction will improve the technical ‘health’ of the chart and allow the index to rise to a new high.

On longer term weekly chart (not shown), the index closed higher for the 6th week in a row, and is trading well above its three weekly EMA in a long-term bull market. Weekly technical indicators are looking bullish and showing good upward momentum.

FTSE 100 Index Chart

The daily bar chart pattern of FTSE 100 continued its sideways consolidation with a slight upward bias, though it closed marginally lower for the week. The gently rising 50 day EMA provided good downside support.

Technical indicators are giving mixed signals, which is often the case during sideways consolidations. MACD has crossed below its signal line and slipped down from its overbought zone. RSI is sliding down towards its 50% level. Slow stochastic has dropped below its 50% level.

The index is technically in a bear market because it is trading below its gradually descending 200 day EMA. Some more consolidation can be expected.

On longer term weekly chart (not shown), the index again closed below its three weekly EMAs, and is in danger of falling back into a long-term bear market. Weekly MACD and RSI are in bearish zones, but Slow stochastic has managed to stay above its 50% level.

No comments:

Post a Comment