FTSE 100 index chart

In last week's analysis of the FTSE 100 index chart pattern, I had concluded with the following comment:

'Friday's low of 5303 was higher than the Dec '09 low of 5176. The bulls can use that as a rallying point to fight back quickly, otherwise the bears may regain complete control.'

It was one of those fortuitous occasions that has created such a worldwide following for technical analysis. The index fell further, as expected, and closed at a low of 5146 on Thursday, Jan 28 '10. Technically, that can't be treated as a breach of the Dec '09 low since it was within the 3% 'whipsaw' leeway.

Sure enough, the bulls managed a small pullback and the week's and month's close was at 5189. Does that mean that the bear grip has been loosened? The technical indicators shows otherwise.

The 200 day EMA is still moving up, but the 20 day EMA has dropped to the falling 50 day EMA. The corrective move has been on good volumes, which should be a worrying sign for the bulls.

Both the RSI and slow stochastic are in the oversold zone. The MFI is below the 50% level but managed to stay above the oversold zone. The MACD is falling in the negative zone and is below the signal line.

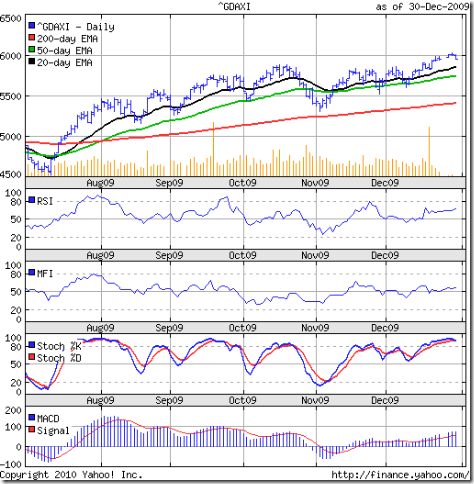

DAX index chart

The DAX index chart behaved similarly to the FTSE 100 chart. Thursday's low of 5540 was below the Dec '09 low of 5605 but within the 3% leeway. Friday's close was at 5609.

Could this be a 'double bottom' leading to a new up move? That seems unlikely as the bears are not going to give up in a hurry. The technical indicators are supporting the bear cause.

The 20 day EMA has fallen and merged with the falling 50 day EMA. The slow stochastic is well inside the oversold zone. The RSI is just above the oversold zone. The MACD is falling in the negative zone and is below the signal line. The MFI is below the 50% level.

CAC 40 index chart

The CAC 40 chart is looking quite similar to its European counter parts, with a low on Thursday and a pull back on Friday. The recent corrective move has been on good volumes.

The 200 day EMA is rising, but the 20 day EMA has dropped to the falling 50 day EMA. The slow stochastic is in the oversold zone. The RSI has entered its oversold zone. The MFI is below the 50% level. The MACD is falling in the negative zone and is below the signal line.

Bottomline? The European indices are still in bear grip and are poised at tantalising support levels. The bulls may attempt a pull back, but bears are unlikely to release their firm grip. Wait for lower levels to enter.