FTSE 100 index chart

In last week's analysis of the FTSE 100 index chart pattern, I had made the following observations:-

'Looks like the bulls managed to trap the bears into covering their shorts. All three EMAs are moving up, so this rally on weak fundamentals and weaker volumes looks set to continue for a while longer.'

As if on cue, the bulls managed to push the index up to a new high of 5445 on Dec 29 '09. But with low volumes indicating lack of follow-up buying, the index drifted down a bit to close the year at 5413 - a gain of 22% over the close of 4434 on Dec 31 '08.

On the longer term charts, the FTSE 100 had made a 'double top' bearish pattern - 6754 on Jul 13 '07 and 6724 on Nov 1 '07 before crashing to a low of 3461 on Mar 9 '09. The recent high of 5445 has retraced 60% of the entire bear market fall. Resistance can be expected at the 61.8% Fibonacci retracement level of 5500.

All three EMAs continue to move up with the index above them. The technical indicators are looking stronger. The RSI and MFI are both above their 50% levels. The slow stochastic is in the overbought zone. The MACD is above the signal line and rising in the positive zone.

Bears may use the negative divergences - the technical indicators failed to make new tops - to put up a fight.

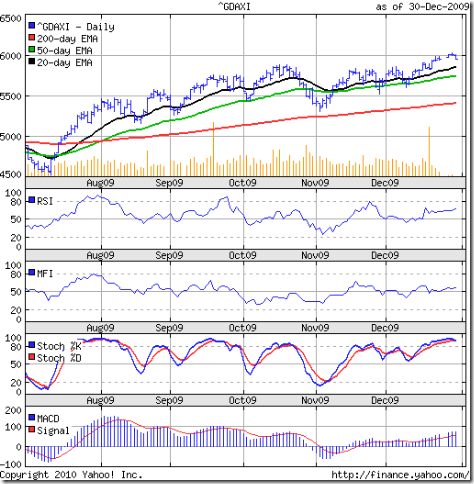

DAX index chart

Like the FTSE 100, the DAX index made a new high of 6027 on Dec 29 '09 on very low volumes before dropping down below the 6000 level. It closed the year at 5957 - a gain of almost 24% over the close of 4810 on Dec 30 '08. The German index has retraced 53% of its entire bear market fall from a high of 8152 in Jul 13 '07 to a low of 3589 on Mar 9 '09.

All three EMAs are moving up with the index above them. That means the bulls continue to rule. The technical indicators are similar to those of the FTSE 100 index. The DAX index can move up to the 6400-6500 zone, which is also around the 61.8% Fibonacci retracement level of the bear market fall.

CAC 40 index chart

The CAC 40 index chart also made a new high of 3977 on Dec 29 '09 on low volumes. The year end saw the index close at 3936, a year-on-year gain of 22%. The French index has retraced only about 40% of the entire bear market fall from a high of 6156 on Jul 13 '07 to a low of 2553 on Mar 9 '09.

The three EMAs are moving up, the index is above them and the technical indicators are all looking bullish. The index may move up further before facing resistance in the 4300-4500 zone, which is around the 61.8% Fibonacci retracement level of the bear market fall.

Bottomline? The bulls are holding sway at the European indices. Keep trailing stop-losses and enjoy the bull rally in spite of the weak fundamentals. At some point in the near future, the economic stimuli may need to be curtailed. 2010 could be a year of consolidation, as the economies recover gradually.

2 comments:

Hopefully it will be a good year for the FTSE, I started spread betting on it towards the end of last year, now I’m hooked!

The FTSE has started off the new year on a positive note. Well begun is half done.

Post a Comment