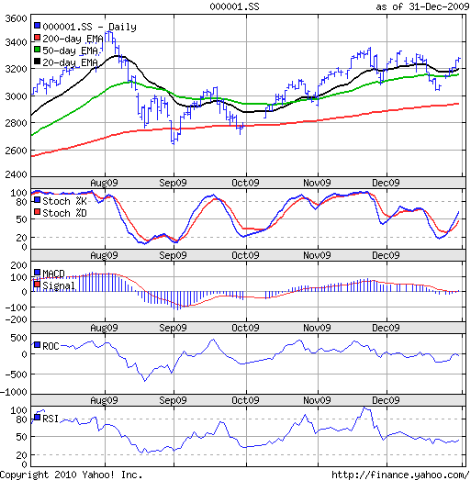

Shanghai Composite index chart

The Shanghai Composite index recovered smartly from the recent low of 3040 on Dec 22 '09 and had 5 straight sessions of higher tops, higher bottoms and higher closes. The index closed at 3277 for the year 2009 - a substantial 80% gain over the close of 1821 on Dec 31 '08.

How will 2010 turn out? I'm not great at market prediction. But another bumper year for the bulls doesn't look very likely. At least the technical picture seems to indicate that. Till the Aug 4 '09 high of 3478 is taken out, the bulls will not be in complete control.

The sharp pull back in the last week of the year has ensured that all three EMAs have resumed their up moves. The slow stochastic has moved above the 50% level after bouncing from the edge of the oversold zone.

The other indicators are not so bullish. The MACD is barely positive. The ROC has turned back into the negative zone after touching the zero line from below. The RSI is moving sideways below the 50% level.

Despite the splendid gains of 2009, the longer term chart shows that the Shanghai Composite index has not been able to retrace even 50% of its entire bear market fall.

Hang Seng index chart

For the first three days of a holiday shortened last week of trade, the Hang Seng index struggled to cross the combined resistance from the 20 day and 50 day EMAs. A strong spurt of 375 points on the last day of the year took the index above the short and medium term EMAs, but fell short of the 22000 level.

The high of 23100 made on Nov 18 '09 remains the barrier to cross if the bulls are to dominate again. The year-end close of 21873 meant a respectable 52% gain for the index over its close of 14387 on Dec 31 '08.

The low volumes on the last week of trade for the year isn't too surprising. Except that the volumes were even lower than those in the last week of Dec '08. The bulls will need to do much better if they want to improve on their performance next year.

The slow stochastic moved up from the oversold zone but remains below the 50% level. The MACD is in negative zone and touching the signal line. The ROC is marginally in the negative zone. The RSI is still below the 50% level.

In the longer term charts, the Hang Seng index managed to retrace 58% of the entire bear market fall at its recent high of 23100 - short of the 61.8% Fibonacci retracement level.

Malaysia (KLCI) index chart

Like the Taiwan (TSEC) index chart we looked at last week, the Malaysia KLCI index is also looking quite bullish. All three EMAs are moving up and the index is above them. But the index has barely gained 1% during all of Dec '09 and remains below the high of 1288 made on Nov 17 '09.

The slow stochastic is about to enter the overbought zone. The MACD is barely positive. So is the ROC. The RSI is just above the 50% level. Volumes have been pretty meager.

The KLCI index gained only 45% for the year, but retraced 65% of its entire bear market fall.

Bottomline? The Asian indices performed quite well in 2009. Expecting stronger performance in 2010 may not be practical. To make money, investors will need to be more stock specific.

No comments:

Post a Comment