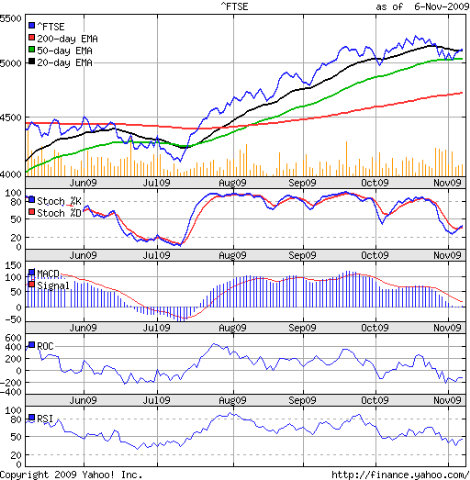

FTSE 100 index chart

The FTSE 100 index chart behaved a lot like the Hang Seng index chart last week, gyrating between the support of the 50 day EMA and the resistance from the 20 day EMA - finally edging above the short-term average, closing less than 2% (98 points) higher for the week.

The down day on Nov 3 '09 had higher volumes than the up days during the rest of the week. That means the bear grasp hasn't been shaken off fully. The 20 day EMA has flattened after falling a little. The 50 day EMA has also flattened after a long rise from Jul '09. But both remain well above a rising 200 day EMA - keeping the bull rally alive.

The top of 5300 made on Oct 23 '09 needs to be crossed convincingly for the bulls to regain complete control. Till then, the bears will harbour hopes of making a fight back.

The slow stochastic turned around from just above the oversold zone and the %K line has crossed above the %D, though both remain below the 50% level. The MACD managed to remain in positive territory, but is below a falling signal line. The ROC is moving sideways in the negative zone. The RSI is below the 50% level.

DAX index chart

The DAX index chart is looking a lot weaker than the the FTSE 100 chart, failing to move above the 50 day EMA and closing only 1.3% (73 points) higher for the week. The 20 day EMA has fallen down to the flattened 50 day EMA. Have a look at a similar pattern made in Jul '09 - when the 20 day EMA fell to the 50 day EMA, only to bounce back up. Will the bulls be able to wrest back control again?

The slow stochastic has moved out of a brief sojourn in the oversold zone, with the %K line crossing above the %D. The MACD remains in negative territory and below the signal line. The ROC is moving sideways well inside the negative zone. The RSI bounced off the oversold zone, but is below the 50% level.

CAC 40 index chart

The CAC 40 index chart pattern is in better shape than the DAX index chart, closing 2.8% (about 100 points) higher for the week and moving above the 50 day EMA, where it met resistance from a falling 20 day EMA. The falling volume bars are a concern for the bulls.

The technical indicators appear similar to those of the DAX, but not as weak.

Bottomline? The chart patterns of the FTSE 100 and CAC 40 indices seem to have survived the bear attack better than the DAX index. The bulls are attempting to regain lost ground and have the edge, but the bears haven't given up the fight. Avoid getting caught in the middle. Wait for the dust to settle before acting.

1 comment:

You are right Subhankar...

When elephants (or for that matter Bulls or Bears)fight, It is the grass (common man) that suffers.....

Post a Comment