FTSE 100 index chart

Some times, stock markets start to fall when the load of concerns becomes too heavy. After weeks of rising ever higher by defying technical signals and economic fundamentals, the FTSE 100 index had a decent correction last week. The FTSE dropped about 200 points (3.8%).

The index fall was supported by the 50 day EMA. But bulls have no reason to feel optimistic. The fall has been on increased volumes, which indicates that the correction is likely to continue next week. Rising volume tends to support the index direction.

The 20 day EMA has turned down. The 50 day EMA has flattened. But both remain above a rising 200 day EMA. Technically, the bull rally is not under threat.

The technical indicators have turned quite negative. The RSI and MFI are below the 50% levels. The slow stochastic has dropped sharply below the 50% level and seems headed for the oversold region. The MACD has also fallen steeply and is well below the signal line.

DAX index chart

The 'reversal day' on Oct 23 '09 took a heavier toll on the DAX index, which fell 325 points (more than 5.5%) below the previous week's close. Higher volumes during the week means the correction may not be over yet.

The 20 day EMA is moving down towards the flattened 50 day EMA. The 200 day EMA is still rising. The bulls will be hoping that the DAX index doesn't drop below the long-term average.

The RSI and MFI are both below their 50% levels. The slow stochastic is about to enter the oversold zone. The MACD has dipped into negative territory and is well below the signal line. The technical indicators of the DAX look weaker than those of the FTSE.

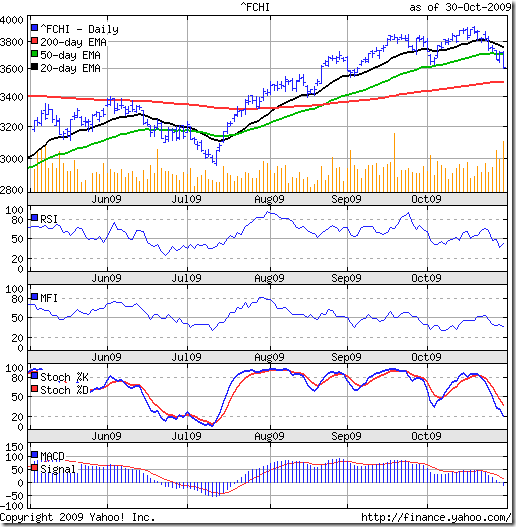

CAC 40 index chart

The CAC 40 index also succumbed to the 'reversal day' pattern made on Oct 23 '09 as it tumbled 200 points (5.3%) below its previous week's close. The fall on increasing volumes is not a good sign for the bulls.

The EMAs and technical indicators all look bearish and very similar to those of the DAX index.

Bottomline? The chart patterns of the European indices have turned quite bearish, and the corrections are likely to continue next week. Use any upward bounce - likely from the 200 day EMA - to reduce holdings. Wait for the correction to play out.

2 comments:

Interesting reading as always!

“Use any upward bounce - likely from the 200 day EMA - to reduce holdings.” In other words the 200 day EMA indicates that – market moving bad news notwithstanding – a bounce back is likely next week? What would constitute a bounce back – clawing back 1-2% - or the indicates suggest even more bounce is probable? Am I interpreting correctly?

With regard booking profit. When moving some investment out of equities and back into cash, is there any recognised approach – e.g. staged withdrawal, moving out say, 20% of your investment at a time?

I’d be interested to hear any thoughts you have.

All traders use the 200 day EMA as a trend decider - so a bounce up is likely from there. Support/bounce could also happen at previous tops (made in Aug '09).

The index can bounce up to the 20 day EMA, and above that, test the previous high.

I always prefer partial profit booking in stocks from the core portfolio. The percentage really depends on an individual's risk tolerance levels.

Post a Comment