In last week's analysis, two likely resistance levels to the bull rally of the Dow Jones (DJIA) index was mentioned. One was the previous high of 10158 (made on Oct 21, '09). The other was the 50% Fibonacci retracement level of 10360.

The bears chose not to defend the previous high, but put up a strong fight as the Dow Jones (DJIA) index chart pattern approached the 10360 level.

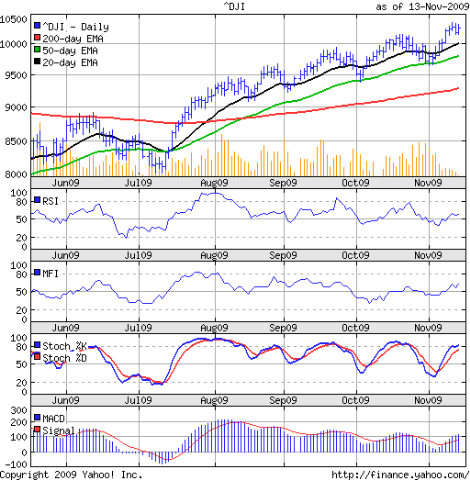

In spite of the falling volumes, the technical indicators had been giving a boost to the bull rally. Will the 10360 level be taken out this week? A look at the 6 months bar chart pattern of the Dow Jones (DJIA) index may provide the answer:-

All the three EMAs are moving up nicely and the index remains above them. Note how the 50 day EMA has provided solid support during recent corrections. The bull charge seems unstoppable.

Both the RSI and MFI are above their 50% levels. The MACD has moved above the signal line. The slow stochastic has entered the overbought level. The technical indicators continue to favour the bulls.

It is not a hopeless situation for the bears. The low volumes and the negative divergences in the RSI and MACD can enable them to fight back.

Unemployment continues to rise. The Consumer Confidence index sank to 47.7 in October. During the recession in 2001, which included the 9/11 attacks, the index was at 84.9 - as per this article.

Bottomline? The Dow Jones (DJIA) index chart pattern is trying to reach higher altitudes without the oxygen tank of volumes. Partial profit booking recommended. This isn't the time for investors to enter.

No comments:

Post a Comment