Three weeks back, chart patterns of the Jakarta Composite, Singapore Straits Times and Malaysia KLCI indices were hesitating near important resistance levels but looked poised to reach new highs.

There has been quite a turnaround in sentiments since then. Bear selling has pushed the STI back into a bear market. The Jakarta Composite and the KLCI indices are desperately seeking support from their 200 day EMAs.

Jakarta Composite Index Chart

The Jakarta Composite failed to breach its Aug ‘11 top of 4196 convincingly, formed a double-top reversal pattern and started correcting. After dropping below its 20 day EMA, it halted a while near its 50 day EMA before crashing through the blue up trend line to its rising 200 day EMA.

The index pulled back towards the up trend line, found resistance, resumed its down move and closed below the 200 day EMA for the first time since Dec ‘11. Such pullbacks provide selling opportunities. Note that the index had touched a 52 week high of 4235 on May 4 ‘12, but all four technical indicators touched lower tops. The combined negative divergences had warned of a correction or consolidation (as mentioned in the previous post) – but it is looking more like a trend reversal.

The 20 day EMA has crossed below the 50 day EMA, which is bearish. But the 50 day EMA is still well above the 200 day EMA. Technically, the bull market is intact and will remain so till the 50 day EMA crosses below the 200 day EMA. The correction from the May peak is less than 10% so far.

The technical indicators are looking bearish and oversold. The MACD is negative and falling below its signal line. The ROC is also negative, and falling below its 10 day MA. The RSI and the slow stochastic are both in their oversold zones. Any upward bounce is likely to face combined resistances from the up trend line and the falling 20 day and 50 day EMAs.

Book part profits and/or hold with a stop-loss at 3720.

Singapore Straits Times Index Chart

The resistance at the 3030 level, which coincides with the lower edge of the big gap formed in Aug ‘11 on the STI chart, proved to be too strong for the bulls. What had looked like a bullish ‘ascending triangle’ pattern failed as the index dropped below the triangle with a gap and went into a free fall.

The 20 day EMA has crossed below the 200 day EMA, and the 50 day EMA is about to follow suit. The ‘death cross’ will confirm a return to a bear market after a brief foray into bull territory.

The technical indicators are bearish and looking oversold. The MACD is falling below its signal line in negative territory. The ROC has managed to cross above its 10 day MA, but remains negative. The slow stochastic and the RSI are both inside their oversold zones.

Any upward bounce should be used to sell. The STI is likely to test its Dec ‘11 low.

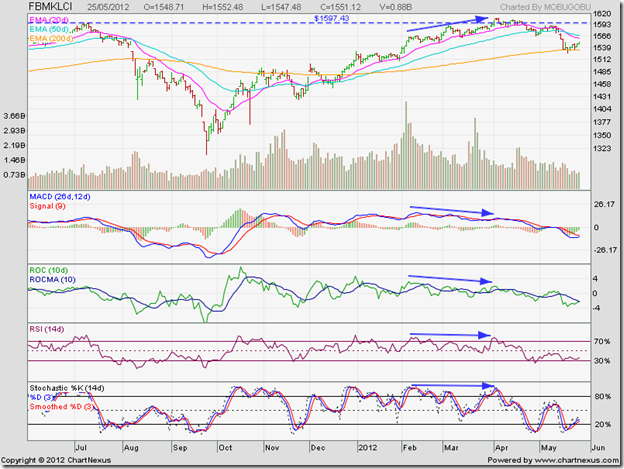

Malaysia KLCI Index Chart

Malaysia’s KLCI index had briefly breached its Jul ‘11 top of 1597 to touch a 52 week high of 1609 in Apr ‘12, but it wasn’t a convincing breach of its previous top. Note that the four technical indicators touched lower or flat tops as the index rose higher (marked by blue arrows).

The combined negative divergences led to a sideways consolidation for a few days, followed by a drop to the 50 day EMA and some more sideways consolidation, and finally a sharp drop to the 200 day EMA. The index is trying to rally by using the long-term moving average as a support.

The low volumes may not be able to sustain the rally. The technical indicators are bearish but showing signs of turning around. The RSI and the slow stochastic touched slightly higher bottoms as the index touched a lower bottom. If the rally continues, it may not be able to get far beyond the falling 20 day and 50 day EMAs.

Book part profits and/or hold with a stop-loss at 1510.

Bottomline? The Asian index chart patterns are in bear grips and may slip into bear markets. The STI seems to have done so already. Time to preserve cash. Corrections are ongoing in global stock markets, and Asia can’t be immune from its ripple effects.

No comments:

Post a Comment