In the previous update 2 months back, the chart patterns of Hang Seng, TSEC and KOSPI indices had rallied above their 200 day EMAs and looked all set to re-enter bull markets. The only hurdles were the gaps that formed on the respective charts back in Aug ‘11. Bears were expected to put up a last-ditch battle to defend the gaps but the bulls appeared to be too strong.

The bears have done a remarkable job in the intervening period – not only in stalling the bull rallies, but in pushing the indices down towards bear markets.

Hang Seng index chart

The Hang Seng index has been in a sideways consolidation pattern with 20000 acting as a good support level. That has changed with a sharp fall and a close below the 20000 level today (May 11 ‘12 – not shown in chart). The 20 day EMA is about to slip below the 50 day EMA. If they fall below the 200 day EMA, a return to a bear market will be technically confirmed.

The technical indicators are bearish. The slow stochastic is about to drop to its oversold zone. Likewise for the RSI. The MACD is negative and below its signal line. The ROC is also negative, but trying to turn around.

The bulls were unable to close the small gap above the 22000 level formed in Aug ‘11, though the larger gap above the 21000 level has been closed. Some more correction can be expected before the bulls fight back.

Taiwan TSEC index chart

The larger of the two gaps on the Taiwan TSEC chart (above 8000 – formed in Aug ‘11) was not completely filled two months back. Bears took full advantage to push the index below the 200 day EMA in Apr ‘12. Despite a couple of attempts by the bulls to cross above the long-term moving average, the bears stood their ground. Now the 20 day and 50 day EMAs have fallen below the 200 day EMA and the TSEC is trading below all three – technically confirming a return to a bear market.

The technical indicators are bearish. The slow stochastic and the RSI are below their 50% levels. The MACD is touching the signal line in negative territory. The ROC is trying to show some positive divergence by gradually climbing up to its ‘0’ line from negative territory. Any rallies will be selling opportunities.

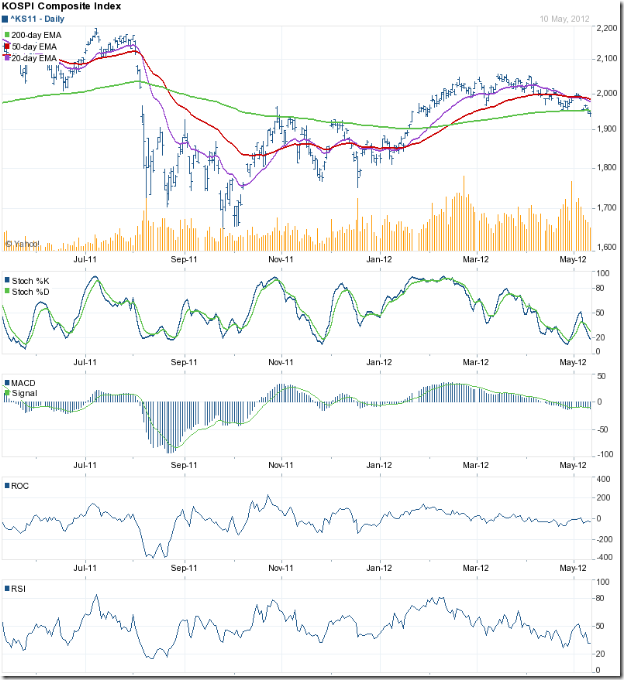

Korea KOSPI index chart

The larger of the two gaps on the Korea KOSPI index chart was completely filled but the smaller gap at the 2100 level remains unfilled. Note the bearish ‘rounding top’ pattern formed by the index (more clearly visible on the 20 day EMA), following which the support from the 200 day EMA was breached.

The 20 day and 50 day EMAs are falling, though they are still above the 200 day EMA. The technical indicators are bearish, which means the correction isn’t over. The slow stochastic is about to enter its oversold zone. The RSI may follow suit. The MACD is touching its signal line in the negative zone. The ROC found resistance at the ‘0’ line and has dropped back into negative territory.

Bottomline? Chart patterns of three Asian indices had brief forays into bull territory, but have been pushed down by the bears. The TSEC index is already in a bear market. Hang Seng and KOSPI are likely to join their neighbouring index into bear country. Economic slowdown in the Eurozone and in USA has cast a pall of gloom over Asian indices. Preserve cash and wait for the situation to improve.

No comments:

Post a Comment