Ask any analyst covering the banking sector and you will hear a common refrain: “Buy private sector banks – avoid public sector banks.” I endorse this view.

PSU banks are often forced by the government to extend services to sectors that private banks scrupulously avoid. They run up huge NPAs in the process.

A recent decision by the government to inject Rs 70,000 Crores over the next 4 years into PSU banks have switched the focus back on the banking sector.

Does that make PSU banks better buys? Have a look at the charts of 10 banking sector stocks below and make up your mind.

Punjab National Bank

PNB’s stock started a bull phase in Mar ‘14 that culminated with a closing high of 225.95 in Dec ‘14 (adjusted for 5:1 stock split marked by light blue bell).

As often happens after a stock split, sellers dominated and the stock has dropped into a bear market. The funds infusion news has seen buyers coming to the fore.

Technical indicators are looking bullish, so the stock can rally some more. A convincing move above the sliding 200 day EMA may shake off bears.

Bank of Maharashtra

The stock touched a 2 years closing high of 54.20 in Jun ‘14, but formed a ‘double-top’ reversal pattern and started a 9 months long down trend.

The stock has been consolidating sideways for the past 4 months, but is trading below its 200 day EMA in a bear market.

Daily technical indicators are looking bearish. A convincing move above 42 may change the trend to bullish.

Central Bank

This is the chart of a PSU bank that resembles that of private banks. It is clearly in a bull market.

After closing at a 2 years high of 114.60 in Feb ‘15, the stock price has been consolidating sideways with a slight downward bias.

Technical indicators are showing signs of turning bullish. This can be a good entry point.

Corporation Bank

The stock price closed at a 2 years high of 82.40 in Jun ‘14, but formed a ‘double top’ reversal pattern and started to correct. News of a 5:1 stock split took the stock to a lower top of 77.60 in Jan ‘15.

Bears reasserted themselves, and the stock has been sliding deeper into bear territory. Technical indicators are showing some upward momentum. Any rally should be used to sell.

Indian Overseas Bank

The chart structure of IOB stock is similar to that of Corp. Bank – minus the price spurt in Jan ‘15. After closing at a 2 years high of 88.80, the stock has been on a downhill ride with a break of 4 months (during Oct ‘14 to Jan ‘15) for a sideways consolidation.

Technical indicators are showing signs of upward momentum, but the stock should be avoided.

HDFC Bank

One look at the chart should convince any investor why HDFC Bank’s stock is a favourite of FIIs. After a brief bear phase during Aug-Sep ‘13, the stock price rallied strongly to close at 1094 in Jan ‘15.

A 3 months corrective phase followed. The stock dropped to seek support from its rising 200 day EMA, and then bounced up to touch a 2 years closing high of 1115.60 in Jul ‘15.

Daily technical indicators have corrected from overbought conditions. The stock looks set to resume its up move.

ICICI Bank

After closing at a 2 years low of 156.80 in Sep ‘13, the stock price rose almost one-way to a 2 years closing high of 383.85 (adjusted for the 5:1 stock split in Dec ‘14 marked by light blue bell).

The stock has been in a correction since then, but appears to have formed a ‘double bottom’ reversal pattern. Technical indicators are in the process of correcting oversold conditions.

The bear phase may have come to an end.

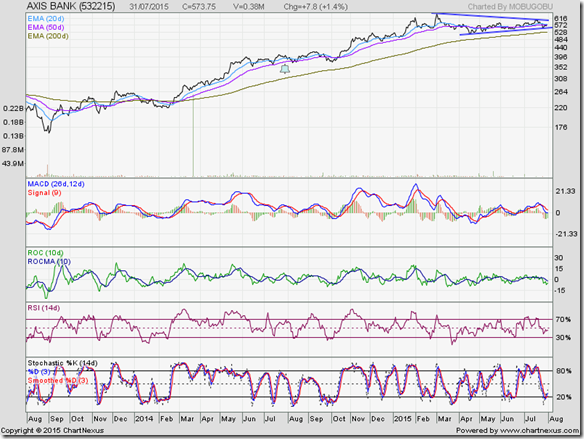

Axis Bank

From a 2 years closing low of 164.70 (touched in Sep ‘13), the stock rose to a 2 years closing high of 649.50 (in Mar ‘15 – adjusted for 5:1 stock split in Jul ‘14) – gaining almost 300% in 18 months.

The stock has been consolidating sideways within a ‘pennant’ pattern for the past 5 months, and is trading above its rising 200 day EMA in a bull market.

Technical indicators are in bearish zones, but trying to turn around. An upward break out from the ‘pennant’ is likely

IndusInd Bank

The stock has given very good returns to investors – rising from a 2 years closing low of 338 (in Aug ‘13) to a 2 years closing high of 977.60 (in Jul ‘15) and gaining almost 190% in 2 years.

In between, a 3 months corrective phase (during Apr-Jun ‘15) ended with a ‘double bottom’ reversal pattern that successfully tested support from the 200 day EMA.

Technical indicators are looking overbought and showing negative divergences. A correction may be around the corner.

Yes Bank

The stock of Yes Bank provided excellent returns to shareholders – gaining 290% from a 2 years closing low of 225.90 (in Aug ‘13) to a 2 years closing high of 883.35 (in Jan ‘15).

Squabbles within the promoter family has prevented the stock from going anywhere since then. The stock has consolidated within a ‘rectangle’ with a 100 points range for the past 6 months.

Technical indicators are showing some upward momentum. A likely upward break out from the ‘rectangle’ can help the stock price touch 4 figures.

No comments:

Post a Comment