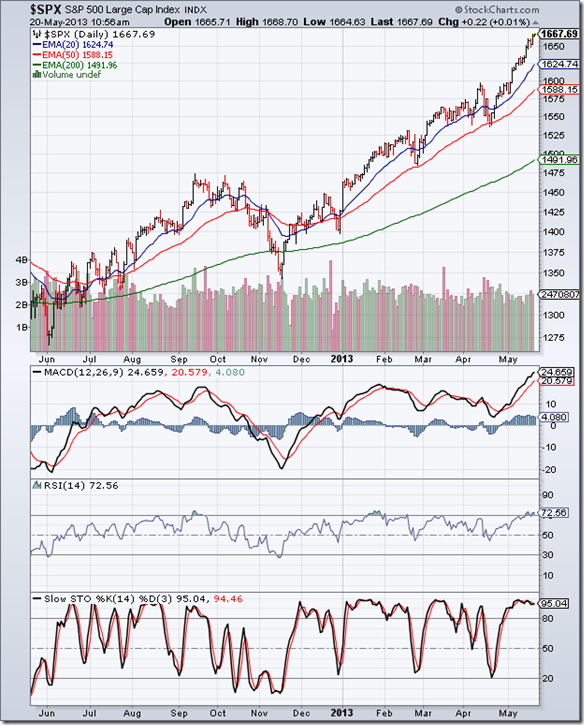

S&P 500 Index Chart

The 1 yr daily bar chart pattern of S&P 500 index keeps rising higher to touch new life-time intra-day and closing highs on a weekly basis. All three EMAs are rising and the index is trading above them. The bulls are in complete control, and are sweeping aside all efforts by bears to stall the runaway rally.

Daily technical indicators are looking quite overbought. MACD is climbing higher into overbought territory. RSI and Slow stochastic are inside their respective overbought zones, and seem happy to stay there. Remember that the index can stay overbought for long periods.

However, during the rally from the Nov ‘12 low, short and sharp corrections have occurred every 6-8 weeks. If the pattern is maintained, a correction may be around the corner. It may be prudent to book partial profits, and redeploy during the next dip.

The US economy continues its painfully slow growth. Initial jobless claims rose higher than expectations. But inflation was lower than the forecast. Univ. of Michigan Consumer Sentiment index rose. Housing starts declined but residential building permits showed growth. Retail sales were strong, but household debt came down.

FTSE 100 Index Chart

The 1 yr daily bar chart pattern of FTSE 100 index sailed past the 6700 level, and closed almost 100 points higher for the week. Volumes picked up as the index rose higher. The bulls seem determined to take the index to a life-time high soon.

Daily technical indicators are bullish, but clearly overbought. MACD is rising above its signal line and entering overbought territory. RSI and Slow stochastic are well inside their overbought zones, and showing no signs of coming down. Stay invested with a trailing stop-loss.

The outlook for UK’s economy during the rest of the year is better. Inflation was lower than expected. GDP growth may touch 1%. However, the economy is far from getting back on track for sustained growth.

Bottomline? The 1 yr daily bar chart patterns of S&P 500 and FTSE 100 indices show that bears have been vanquished, and the bulls are charging ahead. Enjoy the ride, but maintain a trailing stop-loss.

No comments:

Post a Comment