The Advance-Decline (A-D) line (or ratio) is an important technical indicator used to measure market breadth. I had covered the indicator in a post on Mar 23, ‘10 – but wasn’t able to provide a practical example. I propose to ‘fill the gap’. The TRIN (Short-term Trading Index) will also be covered in this post.

The Sensex and Nifty are in firm bear grips with no end to their corrections in sight. The two indices comprise 30 and 50 shares respectively, and are supposed to be representative samples of the entire stock market. Are they?

Thousands of shares are traded at the BSE and NSE every day. Isn’t it possible that the two indices may not be revealing the true picture? Well, mostly they do – however strange it may seem. But there are occasions when the indices may be moving up when the broader markets are heading down, and vice versa.

These are the ‘divergences’ that are of interest to the astute investor. Contrary behaviour can point to likely reversals in the prevailing trend. Market breadth indicators like the A-D Line and TRIN can be of some help in spotting likely reversals. As with any technical indicators, they are not fool-proof. Use them in conjunction with other indicators.

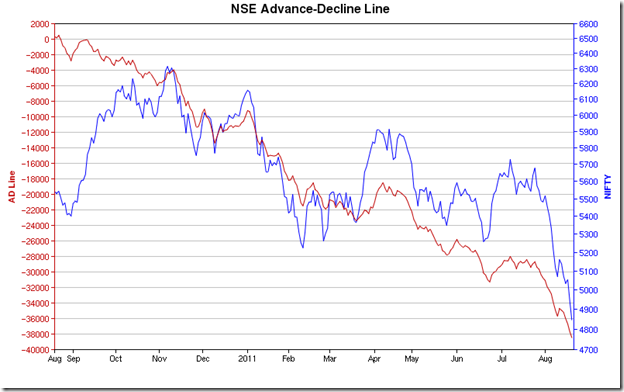

Nifty A-D Line

Note the period between Sep ‘10 to Nov ‘10 (left-most portion of above chart). The Nifty kept rising and reached a new high, while the A-D line was falling. This negative divergence indicated in advance that a correction was likely to follow. What it didn’t indicate was when the correction was going to begin, and how long it was going to last.

Since the Nov ‘10 top on the Nifty chart, the A-D Line has mostly tracked the Nifty’s fall – as it is supposed to do. A couple of interesting negative divergences occurred in Feb ‘11 and Jun ‘11. The Nifty made two bottoms in Feb ‘11 – the second one slightly higher than the first. But the A-D Line touched a lower bottom. Again in Jun ‘11, the Nifty fall stopped at the level of the second (higher) Feb ‘11 bottom, but the A-D line fell to a new lower bottom. The divergences indicated that the subsequent rallies (in Apr ‘11 and Jul ‘11) will be short-lived.

Now, both the Nifty and its A-D Line are falling together and touching new lows. One can look for the A-D line making a higher bottom while the Nifty falls lower. That would be a positive divergence indicating a possible change of trend. But the A-D Line is better at signalling a market top than a market bottom. So, both may start rising together, without giving any advance signal of a trend change.

Nifty TRIN

The TRIN measures the amount of buying and selling pressure in the market. The formula is:

The TRIN can also be used as an overbought/oversold indicator by using its 10 day Moving Average, as has been done in the chart above. A 10 day moving average value of 0.75 or below means the market is in overbought zone, and ready for a correction (note the period between Sep ‘10 and Nov ‘10). A value of 1.2 or higher indicates the market is oversold, and ready for a rally (like in Feb ‘11).

In spite of the Nifty touching a new 52 week low on Fri. Aug 19 ‘11, the 10 day moving average value of TRIN is below 1.0 – not quite in oversold zone yet. Any bounce up from current level is likely to attract selling pressure.

(Note: Charts from www.icharts.in)

3 comments:

Subhankar ji,

The first conclusion says the positive divergence and the market may change the trend to rising. the second conclusion is very tricky that market will rise but the selling pressure again subdue the market. It is like paradox and scary.

No paradox here. Neither the A-D line, nor the TRIN are showing any reversal signs yet. In general, a bounce up is possible after a sharp fall. It may or may not happen.

Even if the Nifty does bounce up, it will probably face selling pressure. Doesn't look like the correction is quite over. Too many uncertainties on the horizon.

As of Fri. Aug 26 '11, the NSE TRIN has reached a value of 1.25 - higher than the Feb '11 value. The oversold conditions can lead to a rally in the coming week.

Post a Comment