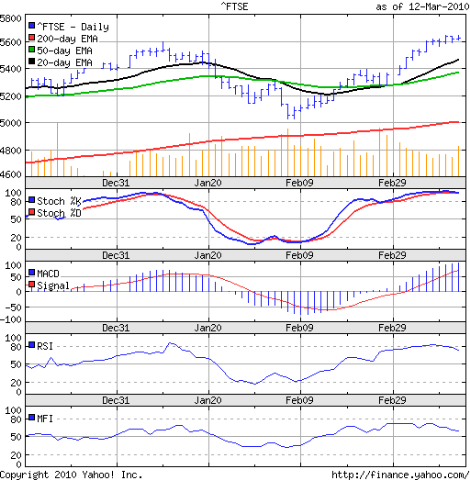

FTSE 100 index chart

In last week's analysis, it was observed that the FTSE 100 index chart had edged above the 5600 mark and closed exactly on this crucial level. The technical indicators were suggesting a continuation of the bull rally, but there were some bearish concerns that led me to conclude: 'The bears may try to stall, if not stop, the bulls.'

The FTSE 100 closed above the 5600 mark on all 5 days of trading but remained within a narrow range of 84 points - trading between the low of 5563 on Mar 9 '10 and the high of 5647 on Mar 12 '10.

The slow stochastic is well inside the overbought zone. The MACD is rising in the positive territory and remains above the signal line. But the RSI has moved down from the overbought zone and is showing negative divergence. So is the MFI, which is dropping towards the 50% level.

The up tick in volume on Friday was encouraging. All three EMAs are moving up with the FTSE 100 index more than 100 points above the 20 day EMA. The distance between the 50 day and 200 day EMAs is widening. A correction could lead to a bearish double-top chart pattern. The economic recovery is a lot slower than the bullish stock market seems to indicate.

DAX index chart

The bullish fervour continued in the DAX index chart, which soared towards the 6000 level and closed just about 150 points below the Jan '10 high of 6094. The 20 day EMA has crossed above the 50 day EMA and all three EMAs are moving up.

The slow stochastic is in the overbought zone. The MACD is rising in positive territory and is above the signal line. But both the RSI and MFI are showing negative divergences while drifting down above the 50% level.

The bears may try to make a stand as the DAX index nears the previous high. But the odds seem to be stacked against them.

CAC 40 index chart

The bulls continued their domination as the CAC 40 index chart remained well above the rising 20 day and 50 day EMAs. There is still hope for the bears as the index remains more than 150 points below its Jan '10 high of 4088.

The slow stochastic is in the overbought zone and the MACD is rising in positive territory - as in the FTSE and CAC indices. But the RSI is showing negative divergence. So is the MFI, which has dropped to the 50% level.

Bottomline? The chart pattern of the European indices are at or near their Jan '10 highs. The bulls are almost in total control once again. However, there is a good possibility of a correction, more so if the earlier highs are not crossed convincingly (i.e. by 3% or more). Buy with strict stop-losses.

No comments:

Post a Comment