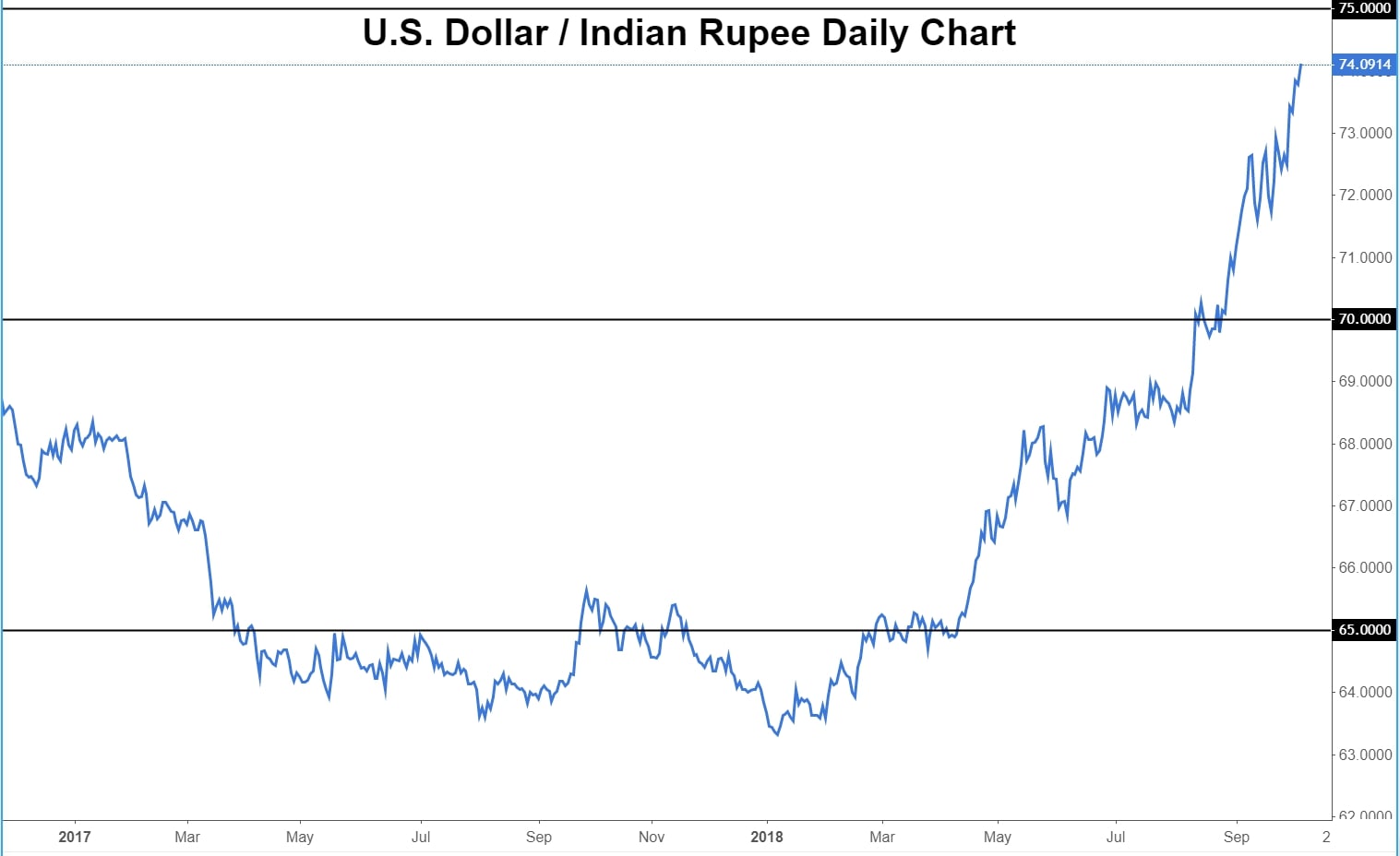

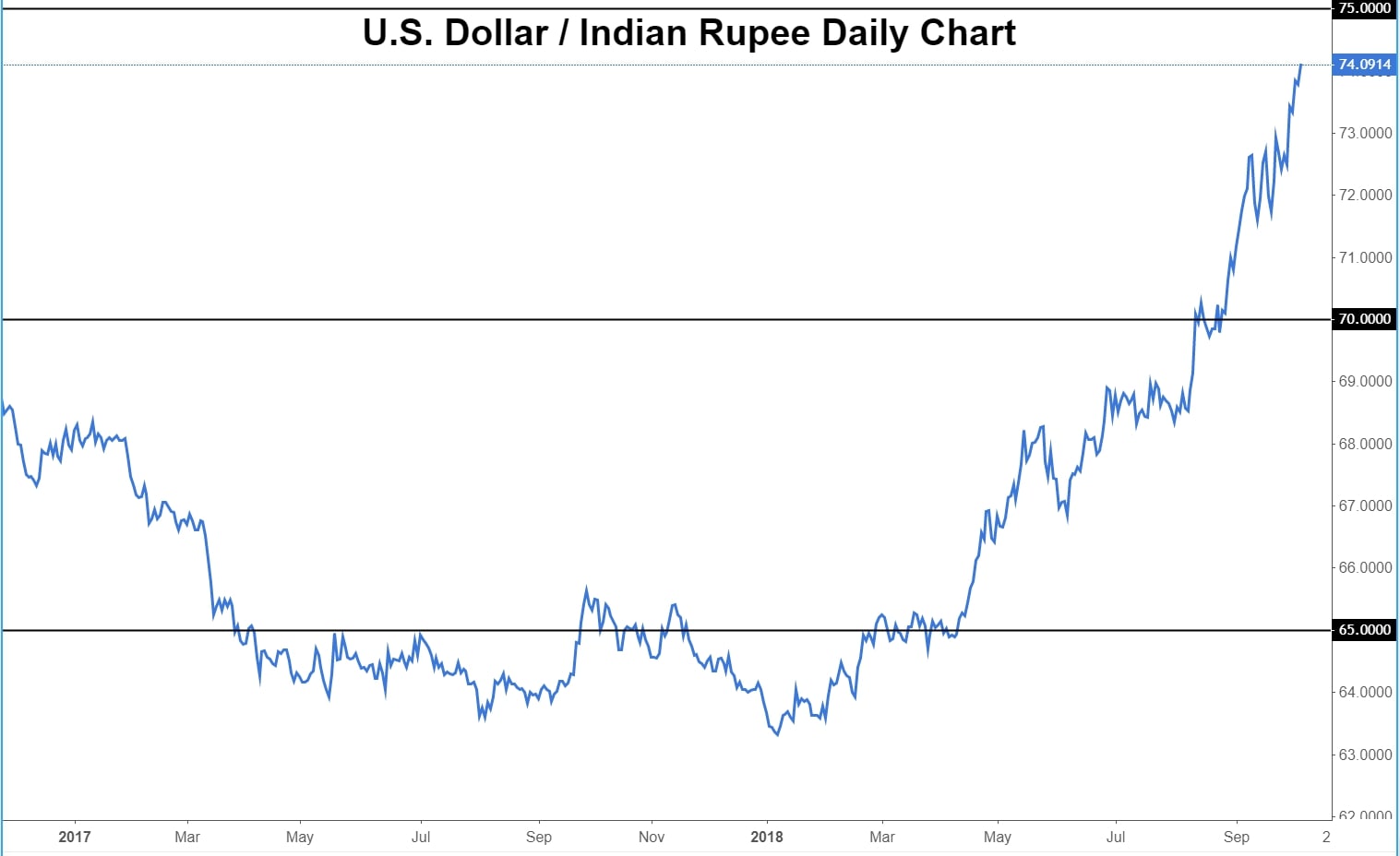

The Indian rupee hit another all-time low against the U.S. dollar on Friday, trading at slightly more than 74 rupees to the dollar. The chart below shows the USD/INR currency pair's price action over the last two years, which displays the U.S. dollar's spectacular strength against the Indian rupee, or conversely, the rupee's extreme weakness against the greenback. The Indian currency's precipitous decline started to accelerate at the beginning of this year, when the exchange rate was only around 63 rupees to the dollar. While many major currencies have been weak against a surging U.S. dollar this year, the rupee's weakness has been exceptional.

Helping to fuel the latest fall for the rupee was a surprise move by the RBI, which had been widely expected to raise the benchmark interest rate on Friday. Instead, the central bank surprised to the dovish side by opting to keep rates unchanged, which led Indian financial markets, including equities and the rupee, to plunge further. The RBI's lack of action to defend its currency and fend off rising inflation was a shock that the rupee did not need, after already having lost nearly 15% of its value, year to date. The rupee's bleeding will almost certainly slow at some point, but if central bank inaction continues to rule the day, India's currency could have significantly further to fall.

By Caleb Silver, Editor in Chief (The Market Sum, Investopedia.com)

Helping to fuel the latest fall for the rupee was a surprise move by the RBI, which had been widely expected to raise the benchmark interest rate on Friday. Instead, the central bank surprised to the dovish side by opting to keep rates unchanged, which led Indian financial markets, including equities and the rupee, to plunge further. The RBI's lack of action to defend its currency and fend off rising inflation was a shock that the rupee did not need, after already having lost nearly 15% of its value, year to date. The rupee's bleeding will almost certainly slow at some point, but if central bank inaction continues to rule the day, India's currency could have significantly further to fall.

By Caleb Silver, Editor in Chief (The Market Sum, Investopedia.com)

No comments:

Post a Comment