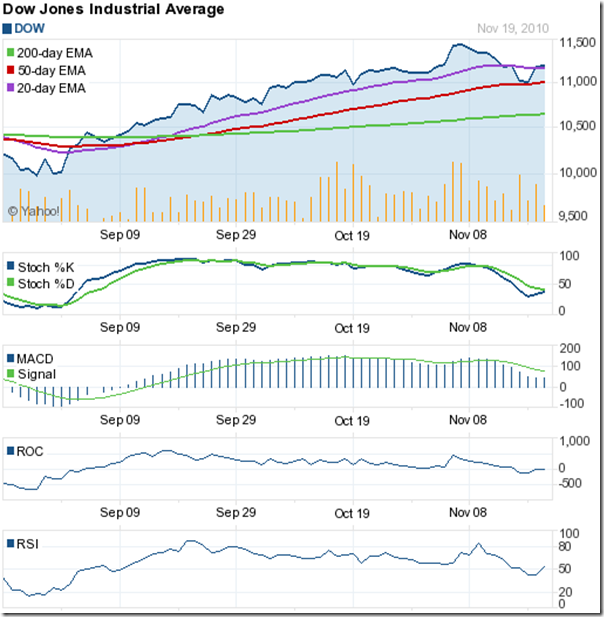

Dow Jones (DJIA) Index Chart

Two weeks back, the Dow Jones (DJIA) index chart had closed at a 2 year high. But negative divergences in the technical indicators had signalled a likely correction. I had advised investors to wait for a dip to the 20 day EMA before buying.

The correction did occur as expected, but deteriorating fundamental news led to a deeper correction down to the 50 day EMA. Fears of Chinese belt tightening and Irish sovereign default proved short-lived - as often happens in bull markets – and the Dow recovered to close above the 20 day EMA by the end of last week.

Such corrections are good for the overall health and sustainability of the bull market, and the bounce up from the 50 day EMA indicates that the bulls are ready to resume control. The technical indicators are also signalling that the correction may be over.

The slow stochastic is below the 50% level, but has started to move up. The MACD is below the signal line, but is in positive territory and has stopped falling. The ROC is at the ‘0’ line after dipping below it. The RSI has climbed back above the 50% level. The volume action is a concern. The highest volumes were on Tue. Nov 16 ‘10 – a ‘down day’. Friday’s higher close was on lower volumes.

The upcoming Thanksgiving holiday weekend could result in the Dow failing to make much headway, as the focus shifts to football and turkey dinner.

FTSE 100 Index Chart

The FTSE 100 index chart has been following the Dow for the past three months, but missed a step last week. The bounce up from the 50 day EMA took the index above the 20 day EMA on Thu. Nov 18 ‘10, only to slip below by the end of last week.

The RSI didn’t drop below the 50% level during the correction and has started to move up. That’s a bullish sign. Not so with the other three indicators. The slow stochastic is falling below the 50% level. The MACD is still in positive zone, but below the signal line and falling. The ROC has dipped below the ‘0’ line.

Some consolidation may be on the cards, before the bulls can gain back control.

Bottomline? The chart patterns of the Dow Jones (DJIA) and FTSE 100 indices are recovering after corrections down to the 50 day EMAs. Both indices are in bull markets, and such dips provide good entry opportunities.

No comments:

Post a Comment